Hundreds of thousands have tax credit calls unanswered by HMRC

HMRC failed to deal with over 400,000 phone calls in March

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Hundreds of thousands of people who ring HMRC about tax credits don’t have their queries answered because they are left waiting in queues for at least 15 minutes.

Data released by HMRC shows that in March this year staff only managed to deal with 68.3% of the 1.4 million calls about tax credits, according to the Guardian.

Almost 280,000 calls this year were abandoned by the caller, compared to 12,250 in the year before.

Long waiting times are the most likely reason given for calls being terminated.

The large number of queries not being dealt with highlights the extent to which HMRC is struggling to cope with the vast volume of enquiries.

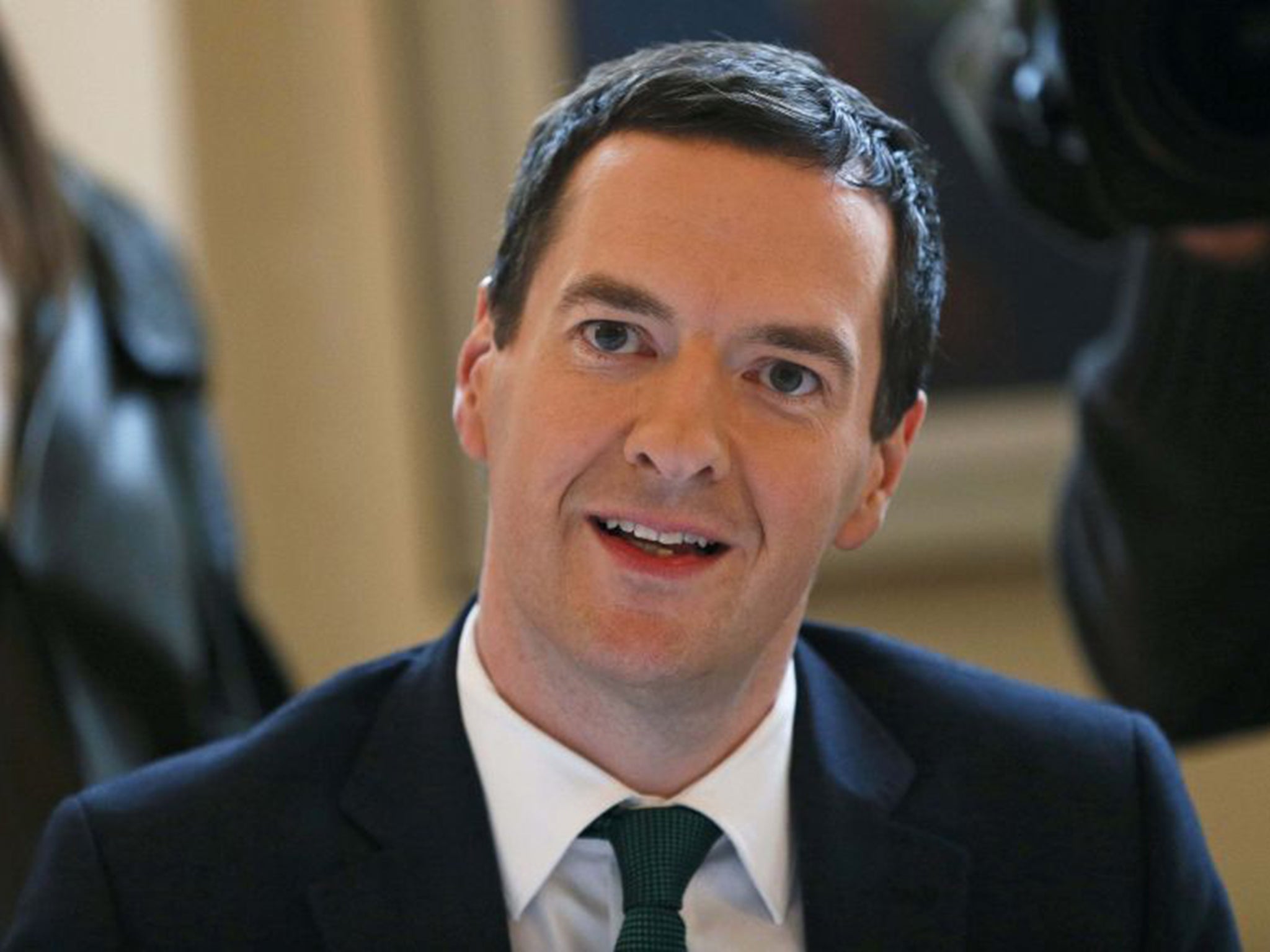

And HMRC's systems are likely to be overwhelmed even more by the increased number of phone calls if George Osborne’s manages to get his tax credit made into law.

Last month, Mr Osborne's plans to reduce tax credits for low-paid workers were delayed by three years in the House of Lords.

In a humiliating rebuff for the Chancellor, his proposals were twice defeated after peers queued up to condemn the measures for hitting the worst-off and attacked the Government for not coming clean in the Tory manifesto about the proposals.

A report last week slammed HMRC for not doing enough to track down aggressive tax avoidance and said it didn't prosecute enough individuals for tax evasion.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments