Google-style sweetheart tax deals between HMRC and internet giants may never be made public

Rules on confidentiality mean secrecy surrounds vast, retrospective payments to HMRC like Google's of £130m

The public might never be told about Google-style sweetheart tax deals which HM Revenue and Customs (HMRC) reaches with internet giants such as Facebook and LinkedIn, it has emerged as fury grows over the secrecy surrounding the tax affairs of multinational companies.

Both HMRC and George Osborne have come under fire over the agreement allowing Google to pay £130m to cover a decade of back taxes, which critics claim is an effective tax rate of just 3 per cent.

The deal, which was hailed by the Chancellor as a “major success”, is paving the way for similar arrangements with other multinational companies which have previously paid minimal amounts of UK tax despite having substantial British operations.

Potential HMRC targets include Facebook, LinkedIn, Amazon and Microsoft. But details of deals with such companies are not likely to be made public because of the confidentiality surrounding tax matters, Whitehall sources have confirmed.

Google’s agreement with HMRC was only divulged at its own request and the furore over the deal is likely to deter other companies from following suit. A survey found that the vast majority of people support the establishment of a public register showing whether the world’s largest people support the establishment of a public register showing whether the world’s largest firms pay UK taxes. But the move is being ruled out by the Government on the grounds that it would be hugely complex and would breach the principle of tax confidentiality.

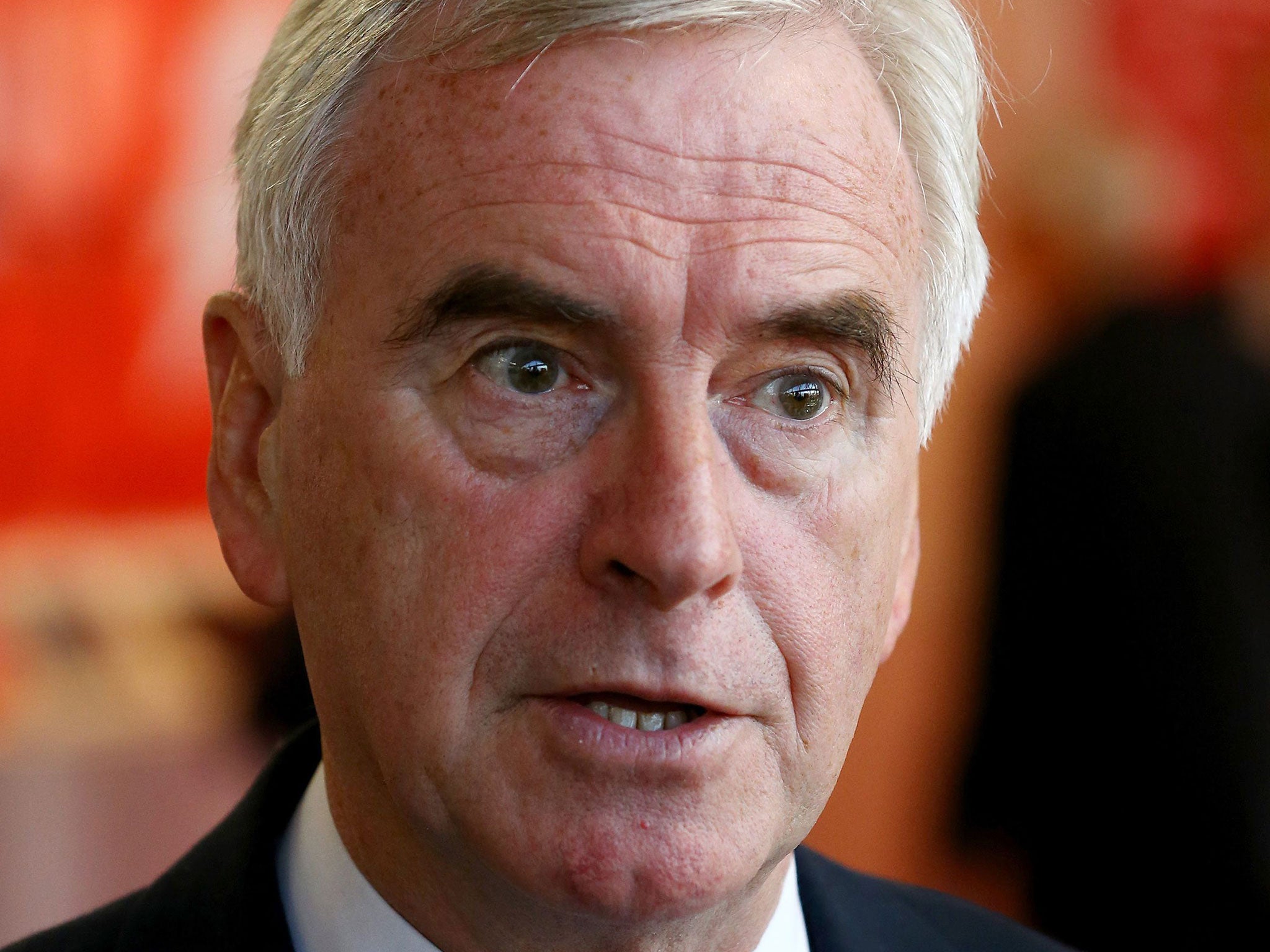

The shadow Chancellor, John McDonnell, has launched a petition urging the Government to come clean on the details of the deal with Google, whose executives have regularly met ministers. He said that “it was important for public trust that HMRC is fair and transparent in its dealings with such companies”.

The tax burden: Who has paid what?

Facebook: paid £4,327 in tax in 2014, after a £28.5m loss in 2014, caused by paying out £35m in a share bonus scheme paid to 362 British staff.

Apple: paid £11.8m in tax in 2014 and channels sales through Ireland, although the company denies this is done to lessen its tax burden. The tech giant also reached a deal with Italian tax authorities to pay €318m in back taxes dating from 2008-13.

Amazon: paid £11.9m in tax in 2014 and previously channelled sales via Luxembourg. In its last financial year the company booked more than £5.3bn of British online sales via its Luxembourg operation. Amazon.co.uk, a British subsidiary, posted a modest profit of £34m.

LinkedIn: the British wing of the professional networking website, which employs 200 people in the UK, paid £532,000 in tax for 2014 and the majority of its UK sales were booked in the group’s Irish subsidiary.

Starbucks: paid £8.1m in tax in 2015. Also paid £20m to HMRC between 2012 and 2014 following a public outcry, when it emerged that the company had paid just £8.6m in UK corporation tax over 14 years previously.

Mr McDonnell told The Independent: “Taxpayers will be appalled at more potential sweetheart deals. MPs were claiming in the Commons that it looks like George Osborne is giving ‘mates’ rates’ to big business, and this won’t stop these allegations.”

The TUC’s general secretary, Frances O’Grady, said: “It is essential that companies are held to account for their tax practices.”

David Cameron looks certain to be challenged in the Commons today over the Google deal after senior Conservatives and charities joined the condemnation of the arrangement.

David Davis, the former minister, said tax deals with tech giants should not be agreed “as though the other guys were carrying a shotgun”. He said: “We need to say: ‘If you earn income in the UK, you pay income in the UK. It’s true for you and me so why is it not true for a corporation?’

“The problem is with successive British governments and with HMRC. If you have a tax regime which allows people to minimise their taxes then that’s what they will do.”

He added that the law should be changed so that confidentiality over tax did not apply to publicly quoted companies.

Boris Johnson, the Mayor of London, said people wanted “clarity on where their profits are being made and an agreement on how much they should be paying”.

Lord Crickhowell, a former Tory cabinet minister, said small businesses regarded action to force international companies to pay more tax to be “inadequate” and called for a “really determined effort” by the Government to sort out an unacceptable situation.

Jim Harra, HMRC’s business tax director general, insisted Google had agreed to pay all the money due. He said: “We only accept the full amount of tax, interest and penalties that is due, otherwise if we can’t reach an agreement on that amount we will go to tribunal. We certainly don’t apply any rate of tax other than the statutory rate that Parliament has published.”

Toby Quantrill, Christian Aid’s principal adviser on economic justice, said: “The UK and other governments should not make such tax deals with multinationals, unless they are prepared publicly to reveal their working: precisely how did they calculate what the company should pay?”

The BMG Research poll for the London Evening Standard found that 84.5 per cent of people wanted the Chancellor to set up a register showing whether multinationals operating in the UK were paying taxes in this country.

Downing Street sought to calm suggestions of a rift with the Treasury over the Google deal. A spokesman for No 10 insisted: “The Prime Minister and the Chancellor are of the same mind on this.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments