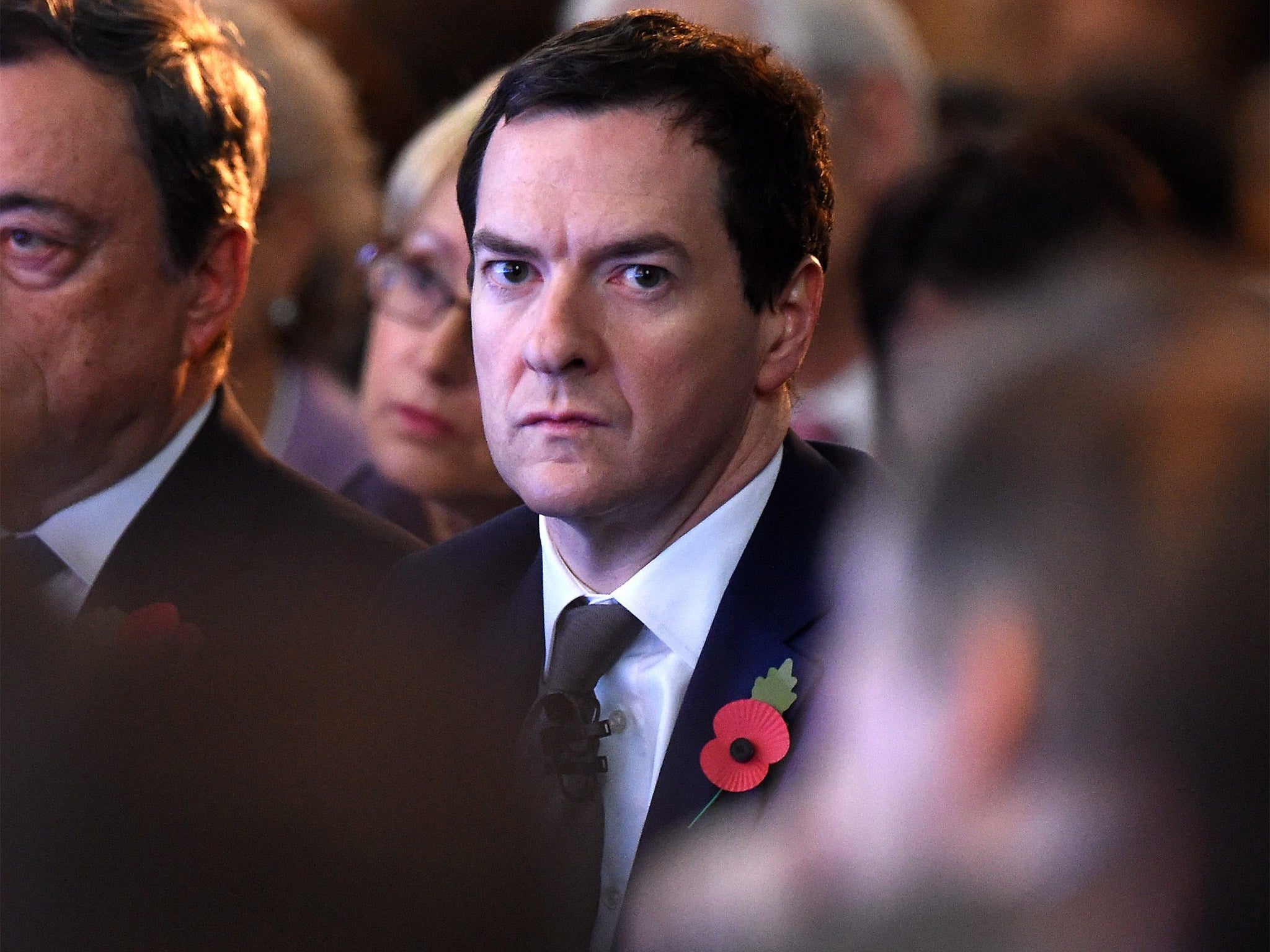

George Osborne pressured to increase social care funding or risk crisis

New study warns Chancellor's new £9 minimum wage will cost the social care sector £2.3bn

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne is under pressure to provide more money for social care to head off a funding crisis that will be deepened by his decision to raise the minimum wage.

In a new study, the Resolution Foundation think tank found that the Chancellor’s decision to bring in a national living wage worth £9 an hour by 2020 will cost the social care sector £2.3bn. Some £1.4bn of it will fall on the public purse because two-thirds of provision is funded through local government.

It warned that, without extra government money and productivity gains, the “pay crunch” could result in more rationing of care, with shorter home visits and further limits on eligibility for publicly-funded care.

The report will add to the pressure on Mr Osborne to pump more money into social care in his government-wide spending review to be announced on November 25. But he is already struggling to make his sums add up after the House of Lords rejected his plans to cut tax credits by £4.4bn.

According to the foundation, the good news is that between 850,000 and one million frontline care workers will benefit from the national living wage, which starts at £7.20 an hour next April. Their earnings will rise by an average of £1,250 a year by 2020. The think tank said this long overdue pay rise should help to recruit and retain staff, and pointed out that the Treasury will benefit from higher tax revenues.

The report said it is vital that any extra public money reaches care workers’ pay packets. It warned that there is a risk of illegal underpayment in a sector already blighted by widespread non-payment of the £6.70 an hour national minimum wage, which costs care workers an estimated £130m a year.

Laura Gardiner, senior research and policy analyst at the foundation, said: “The introduction of the national living wage will make a huge difference to up to a million low paid care workers who look after some of the most vulnerable people in our society. But the new higher wage floor will also raise costs in a sector already facing a funding shortfall.”

She added: “The consequences of not funding the national living wage could be severe, with increasing non-payment of the minimum wage for staff, and reduction in the quality of care for patients. It is imperative that the Chancellor announces the necessary funding in the autumn statement.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments