George Osborne: UK could be richer than America by 2030

The Chancellor claims his plans for the economy could see the UK become ‘the richest major economy in the world’

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Britain is set to have the largest economy in Europe in the next 15 years and be richer than America, Chancellor George Osborne has said, should voters stick with his plan.

The Chancellor claimed “the case for optimism is strengthening”, stating that significant progress had been made over the past five years, and that “there is no reason why Britain cannot be the richest major economy in the world” by the 2030s.

In a highly political pre-election speech, Mr Osborne said that when the Coalition took power, the budget deficit had been running at 10 per cent of GDP, while unemployment was at eight per cent.

He claimed that alongside tackling the long-term issues of banking weaknesses, housing market excesses and skills shortages, ministers had reduced the budget deficit to five per cent.

“The net result is that since 2010 fiscal consolidation has been accompanied by the third fastest GDP growth in the G7, and the fastest employment growth of any major advanced economy in the world,” Mr Osborne told the Royal Economic Society.

“In the early years of this Parliament a lot of focus was placed on whether fiscal consolidation was compatible with recovery; it is now clear that credible fiscal policy is a precondition for recovery, underpinning confidence and an activist monetary policy.”

But the Chancellor warned that there were still “huge challenges” ahead, and proposed tough new measures to ensure that UK plc stayed on track – including a rule that the Government’s books should be in surplus in most “normal years”.

In a challenge to party leaders, Mr Osborne said that all parties were under an “obligation” to explain how they would find the £30 billion needed to balance the books in the first two years of the next parliament, while he spelled out the details of the Tory policy on how it would run a Government surplus after that.

He set out plans for introducing a “fundamental and simple principle” for fiscal politic in the UK, claiming that in “normal” times the Government should aim to run an overall budget surplus “each and every year”.

Under the “good housekeeping” blueprint, the Office for Budget Responsibility would be given a trigger to define when the country was outside of normal times – such as a recession.

“So in the good times we stay in surplus - raising more money than we spend and using that to pay down our debts,” Mr Osborne said.

“And when the bad times come, the Government will have to set out a clear plan to get back to health.

”Fixing the roof while the sun is shining and a plan for repair when the storm hits.“

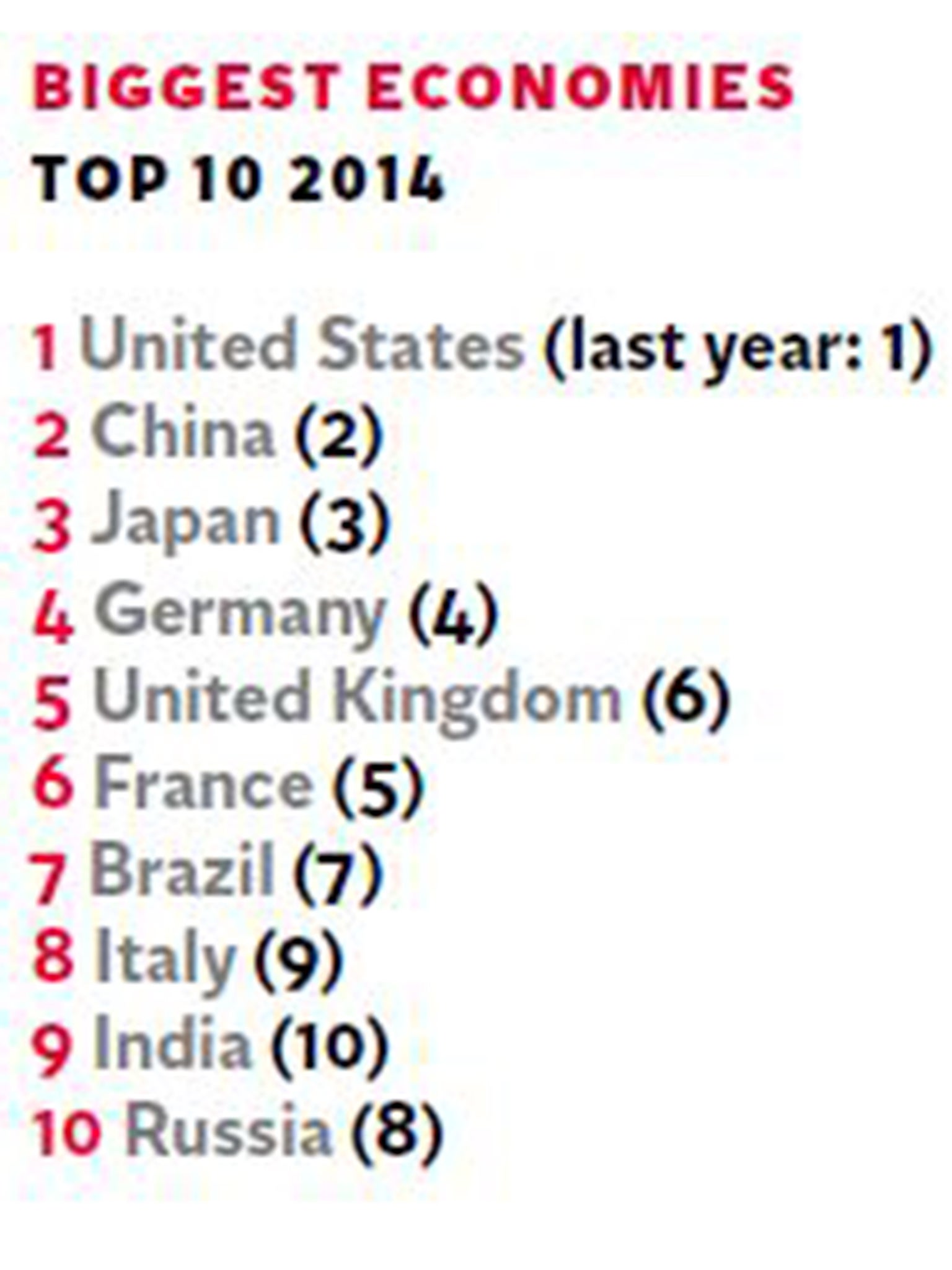

Mr Osborne indicated that his wider aim was to overhaul countries such as the US, Canada and Germany to become the wealthiest G7 member by GDP per capita in the 2030s, hailing the UK’s competitive tax rates, tax cuts for the low paid, welfare reforms, the raising of the minimum wage, the UK’s high performing universities and high levels of investment from China.

He said: ”Pessimism has been fashionable in recent years, whether it's predictions of secular stagnation or claims that the proceeds of growth would only go to the richest.

“The problem for the pessimists is that the evidence and experience of the last few years increasingly don't support their claims.

”Instead the case for optimism is strengthening.

“If we are willing to take on the vested interests and pursue the right policies with consistency and discipline then there are no limits to what Britain can achieve.

”There is no reason why Britain cannot be the richest major economy in the world."

Additional reporting by PA

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments