Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne is set to publish his tax returns as pressure builds on senior politicians to reveal details of their finances in the wake of the Panama Papers leaks.

The Chancellor has been given the green light by Downing Street to reveal his affairs after David Cameron released details of his on Saturday.

“Those in charge of the nation’s finances should show transparency too,” a No 10 spokesperson said.

The Treasury has confirmed Mr Osborne is likely to publish the returns - although some Tory MPs are reportedly concerned that further transparency from the Chancellor could put pressure on other Cabinet ministers and MPs to release details of their affairs.

Last week Channel 4 News asked all 21 Cabinet ministers whether they had any offshore interests and only received answers from three.

the growing clamour for MPs to publish their tax details was given added weight by the Tory MP Jacob Rees-Mogg, who told the BBC it was likely all politicians would have to release their tax returns in the near future.

And he said that while this would amount to a loss of privacy, the move was necessary because politicians had lost public trust in the wake of the expenses scandal.

Mr Osborne has previously been reported to retain a shareholding in his family business Osborne & Little, which has not paid corporation tax for seven years, according to reports dating from February this year.

There is no suggestion that the interior design company, set up by the Chancellor’s father, has avoided tax or done anything wrong.

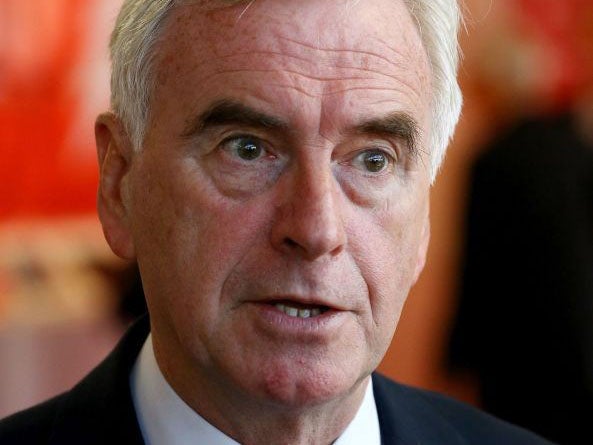

Mr Osborne’s counterpart, shadow chancellor John McDonnell, voluntarily released his tax return in January this year and has urged senior Cabinet ministers to do the same.

Mr McDonnell has suggested all MPs should routinely release their tax returns.

The Labour leader Jeremy Corbyn is also said to be readying the release of his tax returns, having agreed to do so last week.

Mr Corbyn criticised Mr Cameron for not releasing the full documents, rather only a summary prepared by Downing Street.

“I want to see the papers,” Mr Corbyn told the BBC’s Andrew Marr Show.

“We need to know what he's actually returned as a tax return. We need to know why he put this money overseas in the first place, and whether he made anything out of it or not before 2010 when he became prime minister. These are questions that he must answer.”

The surge in interest about senior politicians’ tax affairs comes after dozens of current and former world leaders were implicated in the Panama Papers leak, detailing the use off offshore tax havens.

Mr Cameron last week admitted after days of stalling that he had benefited from an offshore fund set up by his late father in the zero-tax jurisdiction of the Bahamas.

His tax returns also revealed that he had receive a £200,000 gift from his mother which may have resulted in a lower inheritance tax bill. He denies any wrongdoing.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments