Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

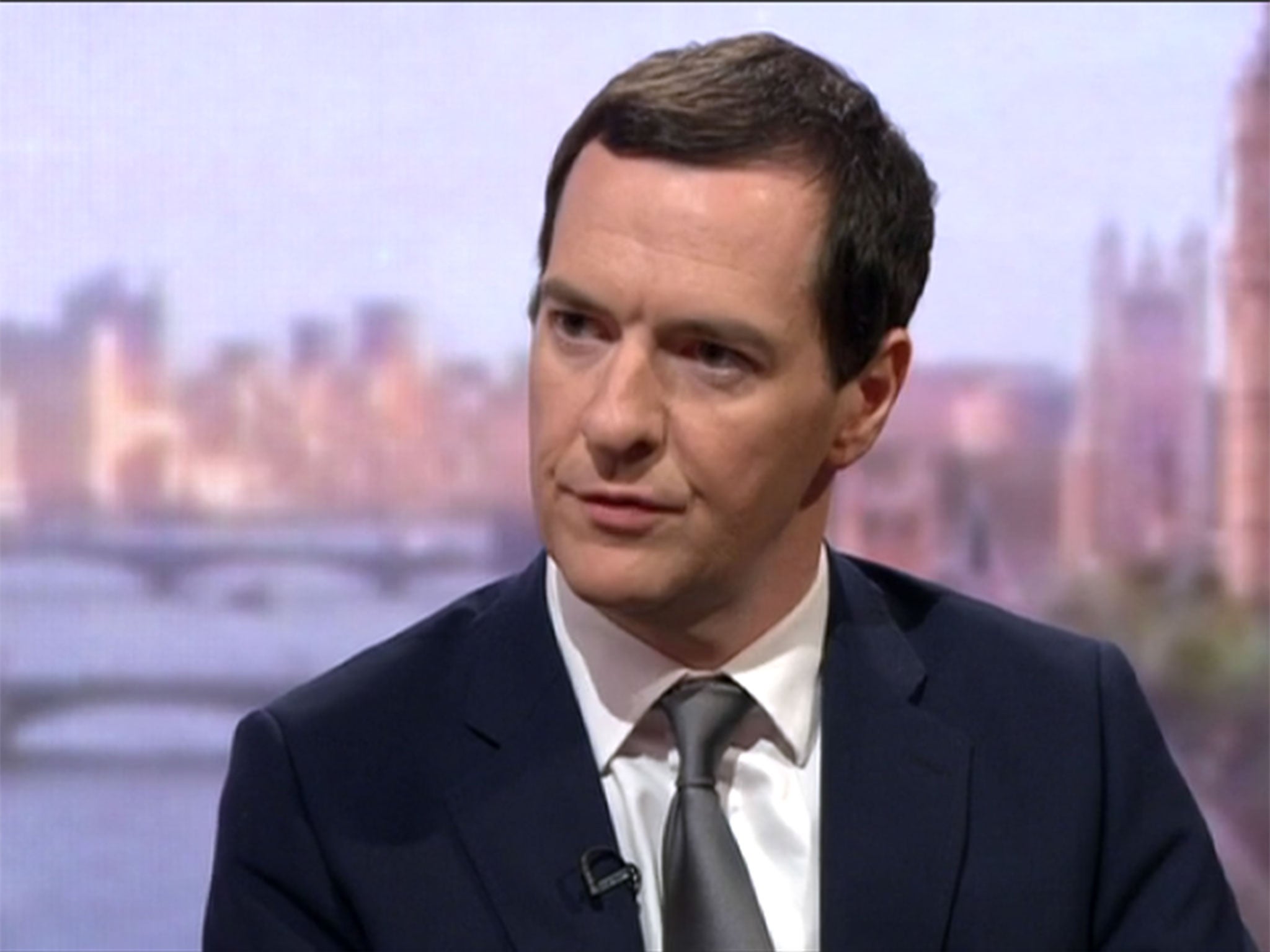

Your support makes all the difference.George Osborne’s deepest cuts to tax credits and benefits are aimed at people who have jobs, the respected Institute for Fiscal Studies think-tank has said.

The Institute’s director Paul Johnson said George Osborne’s higher minimum wage would come “nowhere near” to compensating for the Chancellor’s planned cuts to tax credits.

“There’s quite a set of cuts both for those in work and for those out of work. The Government’s said some people will be compensated by the introduction of the higher minimum wage for the over-25s – the so-called National Living Wage – and that will help some people somewhat but the scale of it is nowhere near enough to compensate for the cut in benefits,” he told BBC Radio 4’s Today programme this morning.

Mr Johnson said that amongst the cuts, which will also affect people with children, the most significant was for people who went out to work.

“Actually the biggest cut will be for those in work and in particular the amount you can earn before you start losing tax credits has been pulled back a great deal,” he explained.

An analysis published last week by the Institute found that even people who took a significant wage rise because of the new ‘National Living Wage’ would be significantly worse off after Mr Osborne’s budget.

Mr Osborne renamed the National Minimum Wage the “National Living Wage” and raised it to £7.20, a figure actually below the independently calculated Living Wage rate.

But the higher minimum wage would only cover about a quarter of the cash cut from in-work tax credits, leaving low income households worse off in work.

“Among the 8.4 million working age households who are currently eligible for benefits or tax credits who do contain someone in paid work the average loss from the cuts to benefits and tax credits is £750 per year,” the IFS said in a research publication.

“Among this same group the average gain from the new NLW, is estimated at £200 per year (in a “better case” scenario). This suggests that those in paid work and eligible for benefits or tax credits are, on average, being compensated for 26 per cent of their losses from changes to taxes, tax credits and benefits through the new NLW.”

In a rare qualitative assessment, the IFS warned that the higher wage could not replace tax credits and benefits as a way of alleviating poverty.

“There may be strong arguments for introducing the new NLW, but it should not be considered a direct substitute for benefits and tax credits aimed at lower income households,” it explained.

Mr Osborne said at the time of the wage’s announcement that it would provide people with “financial security”.

The cuts to tax credits and other benefits are part of a drive to make £12bn welfare cuts.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments