General Election 2015: Tories accused of opposing to abolish non-dom tax statuses because of donors who gain from system

Labour’s pledge to abolish tax status favoured by the super-rich provoked the most bitter exchanges yet in this election campaign

The Conservatives have been accused of opposing moves to abolish non-dom tax status because of their heavy reliance on wealthy donors who gain from the system.

Ed Miliband’s surprise pledge to scrap the tax breaks – which will be a key part of the Labour manifesto – provoked the bitterest exchanges of the election campaign so far.

The Tories leapt on a recent warning by shadow Chancellor Ed Balls that the policy could “cost Britain money”, but Labour insisted the move would attract overwhelming public support. It claimed the Conservatives’ approach was driven by its dependence on donations from a handful of super-rich individuals who have taken advantage of the status to reduce their tax bill.

Non-doms are believed to have contributed up to £16m to Tory coffers in recent years. Lord Laidlaw, who resigned from the Lords to retain his status, has handed £6.9m to the party individually or through his companies.

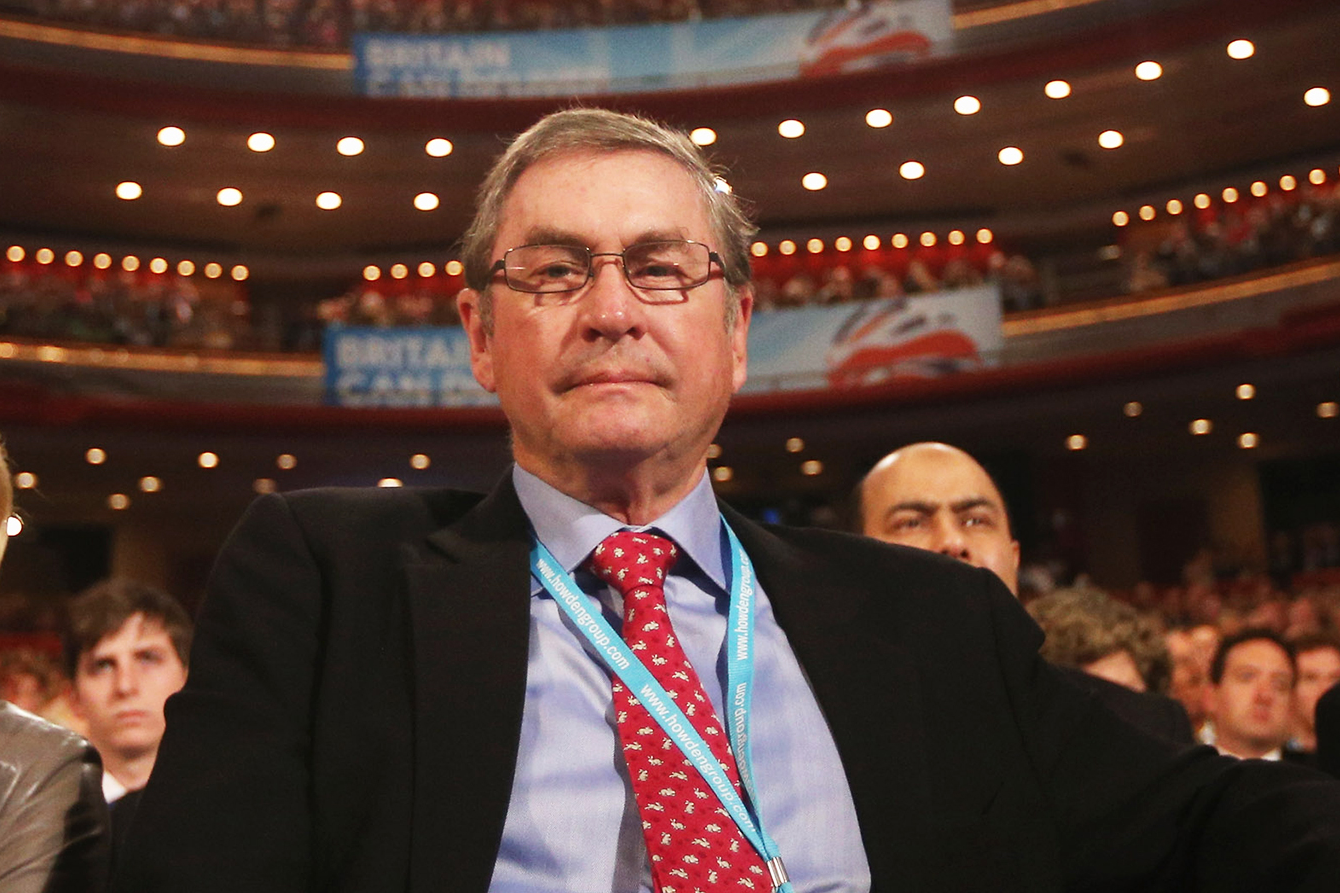

The former Tory deputy chairman Lord Ashcroft gave more than £6.3m before relinquishing his non-dom status to sit in the Lords. His announcement that he has stepped down from the upper house clears the way for him to register again as a non-dom.

Sir Anwar Pervez, founder of Bestway cash-and-carry, has donated about £510,000 to the Tories personally or through his companies.

Lucy Powell, vice-chair of Labour’s election campaign, said: “The Tories are the political wing of the tax-avoidance industry. With non-doms funding their campaign, it’s no wonder the Tories won’t back Labour plans to abolish non-dom status.”

David Cameron claimed Labour was in chaos on the subject. George Osborne added: “This is a complete shambles from Ed Miliband. He has announced a policy on non-doms that has already completely unravelled.” The Chancellor also pointed to his decision to increase the levy that UK residents have to pay to qualify as a non-dom.

The Conservatives were handed ammunition by film of an interview in January in which Mr Balls said: “I think if you abolish the whole status, then it probably ends up costing Britain money because there’ll be some people who will then leave the country, but I think we can be tougher and we should.”

Labour sources insisted Mr Balls was referring to the prospect of non-dom status being swept away in its entirety without special arrangements for foreign nationals who live for short spells in Britain.

Explainer: Non-domicile status

How many “non-doms” are there?

Around 110,700 according to the most recent figures for 2012-13 released by HMRC – that’s up from 83,000 in 1997. Of these around 64,000 choose to pay UK tax on their worldwide income and capital gains. Only 46,700 take advantage of the ability to shield their global income from the UK tax man.

How much income tax do they pay now?

Collectively non-dom taxpayers paid approximately £6.2bn in 2012-13 according to HMRC. Those who took full advantage of the tax loophole paid £4.6bn.

Is that all they pay?

No. Since 2008 to benefit from the loophole, non-doms must pay an annual charge. It’s £30,000 a year payable after seven years as a UK resident, rising to £50,000 after 12 years. This will rise to £60,000 in in 2015-16.

And last year George Osborne announced non-dom UK residents for 17 out of the last 20 years will pay a £90,000 annual charge. These charges raised £223m in 2012-13.

How much extra would closing the loophole raise?

Very difficult to say. The answer depends on the value of their assets abroad and the income they would choose to take from them.

It also depends on how many convert to full UK domicile.

Some may decide to quit the UK altogether and HMRC could theoretically end up losing money as a result.

Is that likely?

The number of registered non-doms and the income tax yield from the group does seem to have declined since the Treasury first imposed a flat-rate fee in 2008.

But it’s impossible to say with certainty that this is due to people leaving Britain. The fall in the income tax yield might be because they are repatriating less income or have earned less on their UK assets.

How much does Labour think the reform will bring in?

Ed Balls quoted a tax lawyer who suggests closing the loophole could raise some £1bn. But the party is being cagey and in truth no one really knows. What we can say is that even under the most optimistic of scenarios the sums raised from closing the loophole are unlikely to be significant in the context of £667bn of expected total tax revenues in 2015-16 and a £90bn deficit. This will not have a transformative impact on the public finances.

But would it hurt jobs, as some are saying?

One of the justifications for Britain’s unusually generous tax regime for non-doms has been that it encourages the super wealthy to come to the UK and to spend and invest here (rather than splashing their cash in Switzerland or Monaco) and that this creates jobs. The Institute of Directors reiterated a version of this argument yesterday, saying Labour’s move would put off entrepreneurs from coming to Britain.

But the effect of the tax regime here is probably exaggerated. What makes the UK attractive to the super wealthy is its secure property rights and the excitements and luxury offered by London. These things will not change.

A more significant drag on the economic dynamism of the UK is probably the Government’s restrictions on non-EU immigration.

Ben Chu

The Independent has got together with May2015.com to produce a poll of polls that produces the most up-to-date data in as close to real time as possible.

Click the buttons below to explore how the main parties' fortunes have changed:

All data, polls and graphics are courtesy of May2015.com. Click through for daily analysis, in-depth features and all the data you need. (All historical data used is provided by UK Polling Report)

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments