Furlough and state-backed loans scheme extended, says Treasury

Furlough to end in April 2021, rather than March, says chancellor

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The furlough scheme will last for another month and hard-pressed businesses will also be able to access state-backed loans until March, the Treasury has announced.

The Coronavirus Job Retention Scheme, under which the state picks up 80 per cent of the furloughed worker’s wages, had been due to finish at the end of March 2021 but will now close at the end of April.

And companies will be able to access state-guaranteed loans until March 2021, rather than January.

The Treasury also said the next Budget will be held on 3 March and that this will “deliver the next phase of the plan to tackle the virus and protect jobs”.

The extension suggests the Treasury wants to dissuade firms from making any decisions on redundancies until after they have seen the Budget.

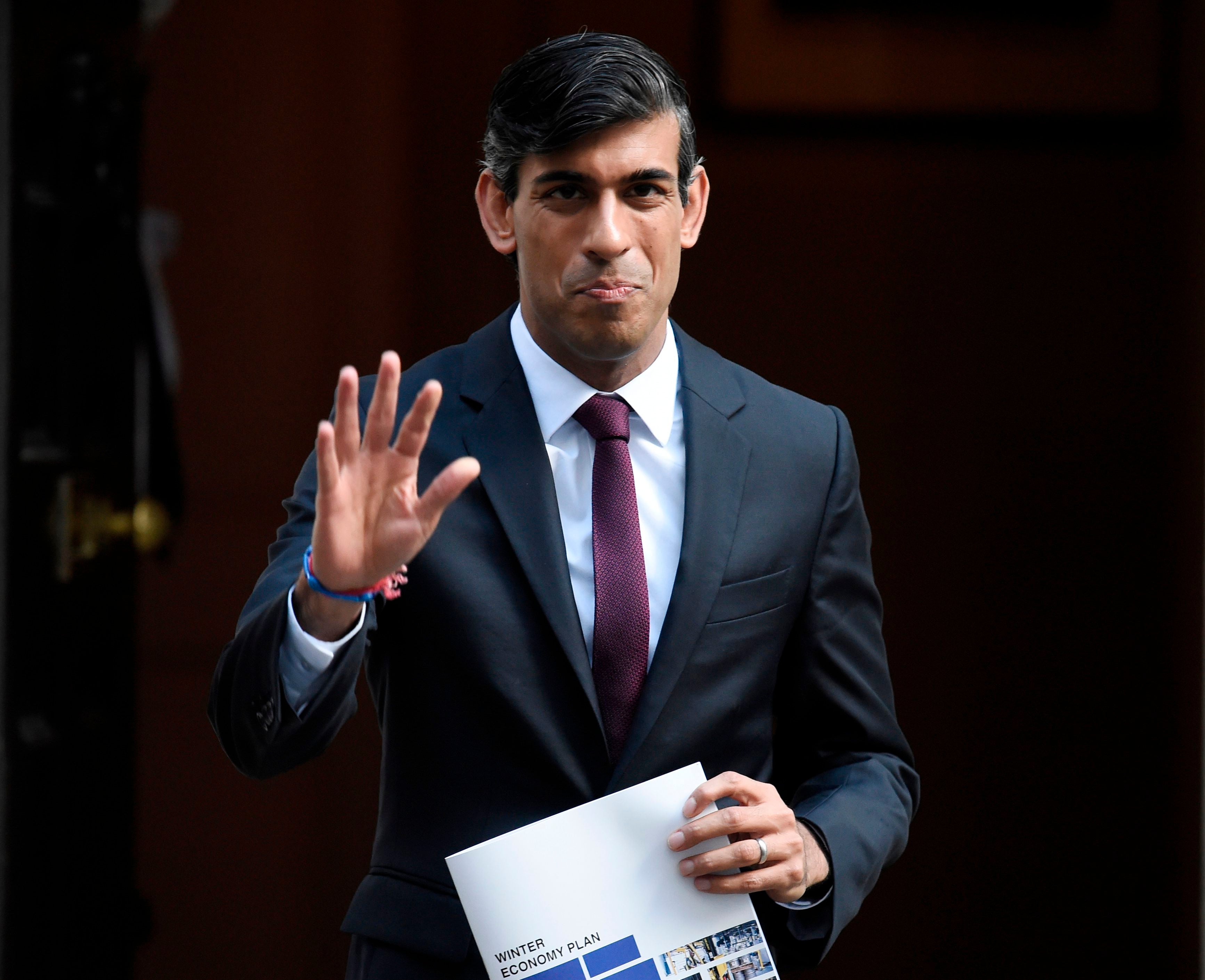

The chancellor, Rishi Sunak, also said he would not, as previously planned, review the employer contribution to the furlough scheme in January, removing the possibility that employers would be required to pay a share of furloughed workers’ wages.

“We know the premium businesses place on certainty, so it is right that we enable them to plan ahead regardless of the path the virus takes, which is why we’re providing certainty and clarity by extending this support, as well as implementing our Plan for Jobs,” said Mr Sunak.

Data released earlier on Thursday showed that at the end of October 2.4 million workers were still furloughed, accounting for around 7.5 per cent of the workforce.

That had been the month that furlough had originally been intended to end. On 5 November Mr Sunak announced, in the face of new restrictions and lockdowns, that the scheme would be extended to March.

Despite the extension of the furlough scheme, the Office for Budget Responsibility (OBR) has projected nationwide unemployment to spike to 7.5 per cent next year.

The Trades Union Congress (TUC) welcomed the extension but warned that the danger of soaring unemployment still remained.

“The government must provide additional support for the industries hit hardest by this crisis like retail and hospitality,” said the TUC’s general secretary Frances O’Grady.

James Smith, research director of the Resolution Foundation, also welcomed the extension, but said it raised questions about the reasons.

“Is this telling us that the vaccine rollout is going to be slower than expected [or] restrictions in place for longer?” he asked.

This year UK firms have, collectively, borrowed some £65bn from the Bounce Back Loan Scheme, the Coronavirus Business Interruption Loan Scheme, and the Coronavirus Large Business Interruption Loan Scheme.

This has enabled many firms to survive the biggest shock to the economy in three centuries.

But analysts have warned of a severe cash shortage facing many smaller firms in 2021, creating the need for additional state support to stop a wave of insolvencies.

The Treasury is working on a longer-term successor scheme to this year’s state-backed loans, but there have been some suggestions that the terms of access will be much tougher.

The extension of the furlough scheme will add to its cost to the taxpayer, with the estimated gross cost of the scheme for the month of March 2021 put by the OBR at £3.3bn.

In December the OBR estimated that total payments under the furlough would amount to £62.5bn in 2020-21.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments