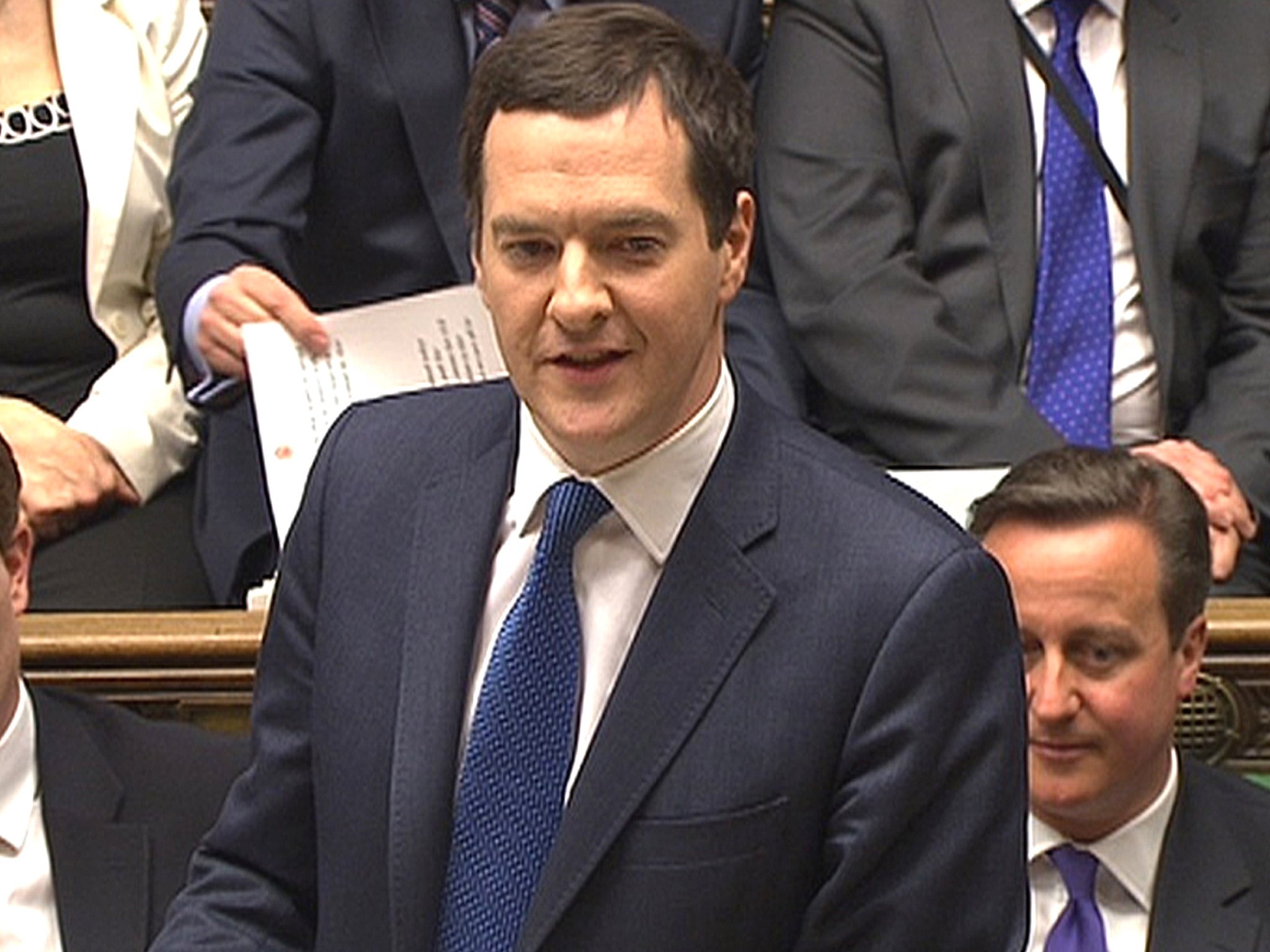

Experts warn of hidden downsides to George Osborne's pension reforms

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Councils could face huge extra bills to pay for social care if George Osborne’s sweeping pension reforms encourage newly retired people to spend most of the money they have set aside for old age, the Government was warned last night.

It follows claims that pensioners could rush to invest in buy-to-let properties, further stoking up house prices, when they gain the right to cash in their pension pots as a lump sum.

Town halls said they were examining the Budget’s fine print to ensure already stretched budgets did not come under strain as a byproduct of the liberalisation of pensions.

James Lloyd, of the Strategic Society Centre policy think-tank, said people who opt to cash in their pension pots rather than purchase annuities are likely to have a lower income if they ask their councils for help with social care costs.

It will also be easier to divest of flexible pension pots before they require care putting them beyond the scope of means-testing, he said.

Mr Lloyd warned: “Together, this will reduce people’s private means to purchase social care, thereby boosting their entitlement to local authority financial support and increasing pressure on council budgets.”

Currently councils only have to pick up the costs of looking after people who move into a care home if they have assets, including their property, of less than £23,250.

However, all parties are committed to reform of the system, with the Government setting out moves that will mean no one has to meet the full cost of care if their assets are less than £123,000.

The Association of Directors of Adult Social Services, which argues councils are already significantly underfunded, said it needed further detail on the “options and consequences” of the new pension rules.

Its president, Sandie Keene, said: “Any encouragement to divest personal finances in order to avoid payments for care may well have a detrimental effect on tight local government finances.”

A Local Government Association spokeswoman said: “Councils will be working through the detail of planned changes to understand the implications these will have on the financial contribution people make for care and the potential impact this could have on council budgets in the longer term.”

The Chancellor also faced fresh warnings over the impact of the reforms on house prices. Campbell Robb, the chief executive of the housing charity Shelter, welcomed moves to boost house-building.

But he added: “Ministers need to consider the unintended consequences of millions of pounds in pension funds being poured into a property market that’s already spinning out of control.”

The insurance industry has criticised the Treasury for failing to consult in advance on the overhaul, which some analysts expect to reduce the size of the annuities market by two thirds from next year when the reform takes effect.

Mr Osborne’s announcement came just a month after the Financial Conduct Authority (FCA) found in February that parts of the annuities market were “not working well” for some consumers. That prompted the regulator to launch a full-blown market study into the commercial providers of retirement incomes, which is due to report next February.

That exercise has now been complicated by the Chancellor’s surprise decision to liberalise the pensions market. However, Martin Wheatley, the FCA’s head, said yesterday he welcomed the Government’s efforts to improve competition in the annuities sector.

The FCA found last month that eight out of 10 buyers could get a better income if they shopped around. Currently around 420,000 annuities worth £14 billion are sold every year.

Analysts at Barclays have estimated the market will shrink to £4 billion over the next 18 months as pensioners take the opportunity to use their pension pots in other ways. The Institute for Fiscal Studies has predicted that those who remain in the annuities market are likely to receive lower incomes.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments