Credit rating agencies warn against Brexit after Sterling sees worst fall in six years

'Traders and investors have been waiting for an opportunity to give sterling a smack and the Mayor of London has handed them a big old bat with which to do it'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Sterling endured its most brutal day since the global financial crisis on 22 February, as two major credit ratings agencies warned again of the economic damage a Brexit would inflict and senior figures from the world of industry made a plea for the Britain to remain part of the European Union.

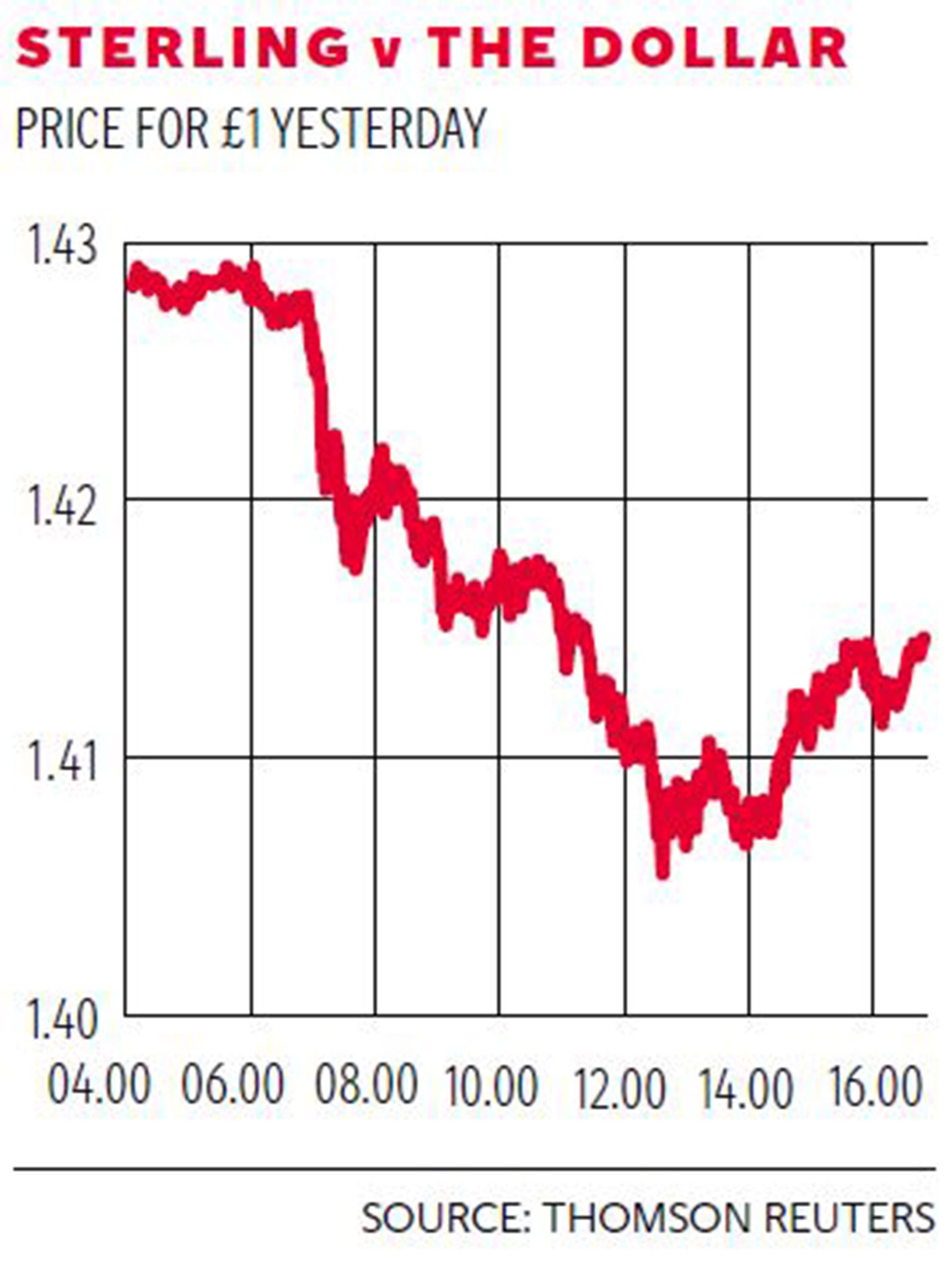

The pound fell 1.8 per cent against the dollar, the currency’s biggest single-day slippage in six years, with financial traders reporting the decision of Boris Johnson to campaign for Out as the primary driver of the negative market sentiment.

“Boris pounds sterling,” said Joshua Mahony of the spread-betting firm IG. “Traders and investors have been waiting for an opportunity to give sterling a smack and the Mayor of London has handed them a big old bat with which to do it,” said Jeremy Cook of currency exchange firm World First.

Citi, the world’s largest bank, told its clients that the risk of Brexit had jumped from 30-40 per cent, up from 20-30 per cent before the weekend.

Fitch, which rates sovereign bonds for investors, repeated its long-standing view that Brexit would result in a short-term economic costs and “significant” long-term risk for the UK. Another of the three main credit agencies, Moody’s, said it would consider a negative outlook to the UK’s credit rating if Britons voted Out.

A letter due to be published today from scores of bosses of FTSE 100 companies, which employ hundreds of thousands of Britons, reportedly warned that the UK leaving the 28 member bloc would “put the economy at risk”.

“Businesses like ours need unrestricted access to the European market of 500 million people in order to continue to grow, invest and create jobs,” it said. “We believe that leaving the EU would deter investment and threaten jobs. It would put the economy at risk”.

The last time sterling got such a single-day pounding in the foreign exchange markets was in October 2009 when the UK was still in the grip of the turmoil that followed the global financial crisis. During the Scottish referendum in 2014 the biggest single day fall was only 1.16 per cent.

Traders said the fall in the pound, which touched a seven-year low against the dollar of $1.4056, reflected the prospect of large sums of investment capital being withdrawn from the UK by international firms and shareholders in the wake of a Brexit vote.

Some analysts said Brexit would also make it less likely that the Bank of England would raise interest rates, which would also push down on the value of the currency. But others said that, on the contrary, the Bank might need to put up interest rates rapidly to support the value of the currency. “The currency is the main barometer of uncertainty,” said analysts at the Swiss bank UBS.

The cost of hedging against falls in the value of the UK dollar exchange rate rose to the highest level in four years, reflecting a sudden move by many firms to offset their exposure. Against the euro, sterling fell around 0.5 per cent to €1.2839, dipping as much as 0.9 per cent at one point.

However, despite the currency turmoil, the FTSE 100 index of blue chip shares rose by 1.47 per cent to its strongest level in three weeks yesterday, with traders pointing to the possibility of a weaker currency giving firms’ exports a fillip.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments