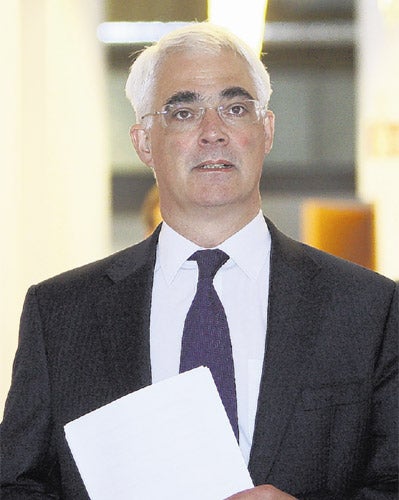

Confidence returning – but Darling gets no credit in poll

Increasing number of business leaders seeing green shoots of recovery

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The number of bosses who can see green shoots appearing in the economy has doubled since February, according to a ComRes survey for The Independent.

Some 37 per cent of business leaders now detect signs of recovery in their company's sector – up from 32 per cent last month, 29 per cent in April and 18 per cent in February. But the survey of 203 businessmen and women suggests that the Government is getting little political credit. The ratings of both Gordon Brown and Alistair Darling have dropped in the past month.

Only 14 per cent of them have confidence in the Chancellor, his lowest rating since last September when the financial crisis broke out. The figure may reflect the widespread belief that the Prime Minister intended to move him from the Treasury in this month's cabinet reshuffle but backed down amid the attempt by Labour MPs to topple him. Some 77 per cent of businessmen believe Mr Darling is out of his depth, only 24 per cent think he understands business and only 26 per cent believe he is handling the economy responsibly.

Confidence in Mr Brown among businessmen has fallen from 20 to 16 per cent in the past month, also its lowest level since last autumn. They trail senior Tories Kenneth Clarke (65 per cent), David Cameron (62 per cent), George Osborne (39 per cent), the Liberal Democrats' Vince Cable (61 per cent) and Nick Clegg (27 per cent) and the Business Secretary Lord Mandelson (31 per cent).

Tonight the Chancellor will strike a "cautious but confident" tone about the economy in his annual Mansion House speech, insisting that his Budget forecast of growth resuming by the end of this year is on track.

Mr Darling will warn the City that sweeping changes are needed to build a stronger, more efficient and more resilient financial sector following the crisis. "Anyone who thinks that we can carry on as if nothing has happened should think again," he will say.

The Chancellor will argue that the process of learning lessons must start in boardrooms, whose focus "must be long-term wealth creation, not short-term profits". A review by the former City regulator Sir David Walker will produce proposals to ensure that bank boards get access to information they need to manage more effectively.

Opposing plans for the EU to take on a bigger supervisory role, Mr Darling will say: "We need to ensure that progress at a European and international level does not allow national regulators off the hook and must retain the vital link between home regulators and national governments."

He will say that restricting the size of banks is not the solution. "The right approach is to ensure that we, as well as the banks themselves, have plans for tackling failure."

The Chancellor will call for a stronger focus on system-wide risks by regulators and central banks. But he will react coolly to demands for new institutions, defending the three-way split between the Treasury, Bank of England and the Financial Services Authority. "To concentrate only on institutions is to miss the point. At its heart, this is about judgements – making the right call at the right time," he will argue. Mr Darling will say: "We also need to ensure that innovation and the complexity it sometimes involves is not an excuse for a lack of transparency or for avoiding regulation."

Safe hands? Who business leaders rate

Ken Clarke 65%

David Cameron 62%

Vince Cable 61%

George Osborne 39%

Lord Mandelson 31%

Nick Clegg 27%

Gordon Brown 16%

Alistair Darling 14%

Source: ComRes/The Independent

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments