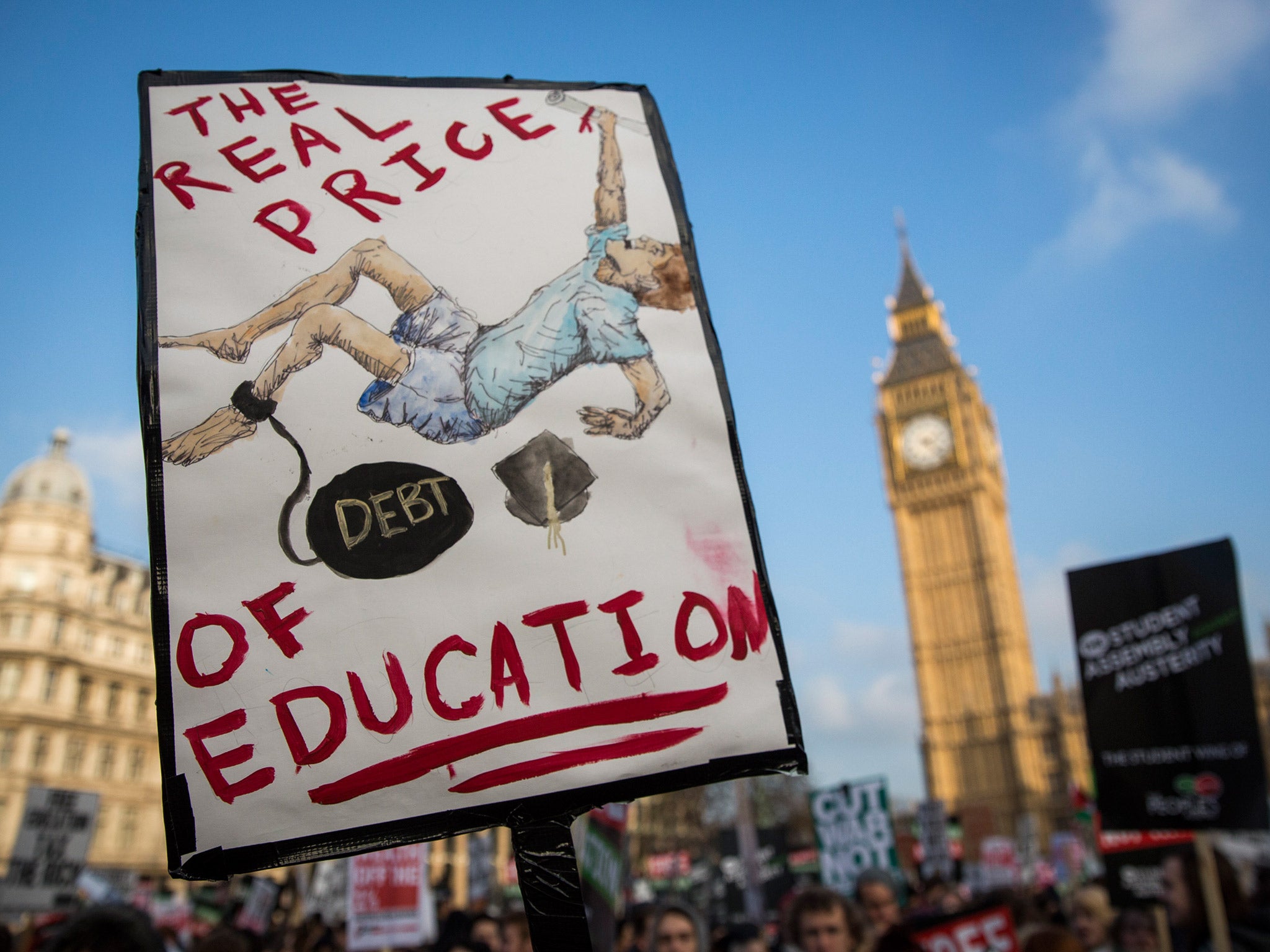

Budget 2015: Maintenance grants for poorer students 'to be scrapped' in next round of cuts

Instead, the current grants of £3,387 a year will be converted into a loan

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Maintenance grants for university students from low-income families will be scrapped and converted into loans in the Government’s next round of spending cuts.

Get all the latest updates in our Budget liveblog here

George Osborne will signal the move when he presents the first all-Conservative Budget since 1996. His landmark Commons statement will set the agenda for the five-year parliament following the Tories’ election victory in May. As he makes the case for more cuts to clear the nation’s deficit, the Chancellor will say: “Our long-term economic plan is working. But the greatest mistake this country could make would be to think all our problems are solved.

“You only have to look at the crisis unfolding in Greece as I speak to realise that if a country is not in control of its borrowing, the borrowing takes control of the country.”

Mr Osborne, who will outline £12bn of welfare cuts, will promise to be “bold in transforming education, bold in reforming welfare, bold in delivering infrastructure, bold in building the Northern Powerhouse, bold in backing the aspirations of working people… it is a Budget that sets the way to secure Britain’s future”.

At present, students in England and Wales from families with annual household incomes of £25,000 or less qualify for maintenance grants of £3,387 a year.

If the family’s income is £30,000, the grant falls to £2,441; at £35,000 to £1,494 and at £40,000 to £547. It is not paid when household income is more than £42,620.

The grants are not repaid –– unlike the loans which cover tuition fees of up to £9,000 a year, which graduates start to pay off when their income reaches £21,000 a year.

Budget 2015: Osborne urged to reverse public health cuts

Banks tell Osborne to rethink the banking levy

Stamp duty unlikely to be changed by Osborne

Ministers may ensure that students from the very poorest families still qualify for grants – for example, by reducing the cut-off point from £42,620 to £25,000. They may also announce new moves to help young people from low-income families go to university. Vince Cable, who was responsible for higher education as Liberal Democrat Business Secretary in the Coalition Government, blocked plans to convert maintenance grants into loans.

But Sajid Javid, his Tory successor and an ally of Mr Osborne, is ready to back the move as he draws up spending cuts in a department that is not protected like health, schools and overseas aid.

The proposal would be controversial with students. But Tory ministers will insist that it would maintain financial support when students most need and want it. Surveys suggest they are more worried about living costs during their studies than about repaying their loans when they find work. Mr Javid has studied closely a report by David Willetts, who was universities minister in the Coalition and left Parliament at the last election.

Mr Willetts said: “The greatest pressure facing students is their living costs. There is a case for an increase in their total maintenance support so they have more cash to live on. Within this there should be a substantial shift from maintenance grant to loans, so that there is also a saving in public spending.”

Budget 2015: Sunday trading hours to go round-the-clock

The deficit will again play central role as Osborne eyes 2020

Tax credit cuts will 'affect more than seven million children'

In his report, Mr Willetts played down fears that the funding system is not sustainable in the long run but said the £9,000 maximum fees – which universities want to see raised – could not be frozen indefinitely.

He proposed that the £21,000 earnings threshold for loan repayments is frozen for the five-year parliament. These questions are expected to be addressed in the government-wide spending review this autumn.

Megan Dunn, the president of the National Union of Students, said: “Cutting maintenance grants would be detrimental to hundreds of thousands of our poorest students who currently rely on it, and could risk putting many people off applying to university.

“We know that our poorest students are the most likely to be deterred by debt, but it could also affect where students choose to live and which courses to take. It will mean staying at home instead of moving into halls or shared accommodation and applying for shorter courses to reduce costs.”

Ms Dunn added: “If grants are cut, it could mean the cost of student loans will go up for everyone or repayment conditions will get tougher than they already are. This is yet another unreasonable barrier to accessing higher education.”

The Budget: Expected measures

Welfare

A total of £12bn cuts including:

- Working age benefits frozen for two years

- Cuts in tax credits

- Cuts in housing benefit, including for those under the age of 25

- Social housing tenants to pay higher rent if on higher incomes (£40,000 London, £30,000 elsewhere)

- Welfare cap (how much one family can draw in benefits in one year) to be reduced from £26,000 to £23,000 in London and £20,000 in rest of UK

Tax

- May speed up rise in personal tax allowance, due to rise to £12,500 by 2020

- Will reaffirm plan for £50,000 threshold for 40p rate by 2020

Tax Avoidance

- £5bn savings by tackling aggressive tax avoidance

- Existing perks may be reduced for those with non-domicile status

Tax relief on pensions

- Will be reduced for people with an income of more than £150,000 a year

Inheritance tax

- New £1m limit for couples with a family home (up from £650,000)

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments