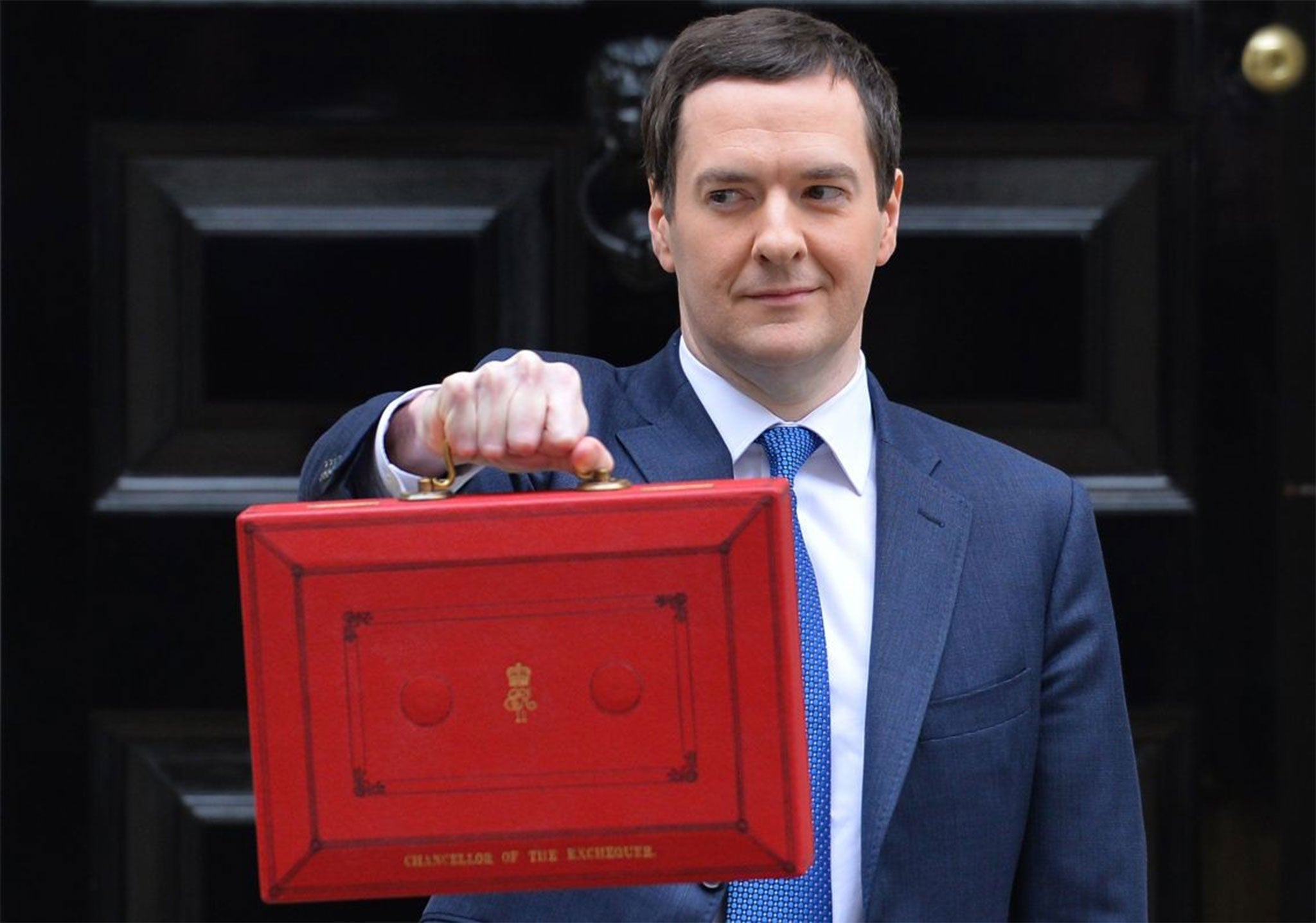

Budget 2014: George Osborne warns of hard choices ahead despite higher growth

OBR raises growth forecasts for 2014 once again

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne warned today that the country still has a long haul in front of it to close the deficit despite higher growth and lower borrowing this year.

The Office for Budget Responsibility raised growth forecasts for 2014 the second time in four months, from 2.4 per cent to 2.7 per cent - albeit lower than the Bank of England’s 3.4 per cent forecast - and cut borrowing estimates to £108 billion from the £111 billion expected in December’s autumn statement.

The recovery is feeding into the public finances as borrowing falls by £24 billion over the OBR’s forecast horizon compared with December’s forecasts, moving into a £5 billion surplus by 2018/19.

The upgrade to forecasts means the economy will be £16 billion bigger than previously thought. But the Chancellor stressed little progress had been made in cutting back the country’s structural deficit, which is impervious to the ups and downs of the economy. Osborne said: “Faster growth alone will not balance the books... there will have to be more hard decisions, more cuts.”

The Bank of England also warned of the hard yards to come. Minutes of the Monetary Policy Committee’s latest meeting noted signs that the UK’s recent growth spurt may not have been as reliant on a consumer spending spree and resurgent housing market as first appeared, but said “there remained some way to go to ensure that the recovery was both balanced and sustainable”.

The comments came as the UK’s unemployment rate remained steady at 7.2 per cent for the quarter to January, meaning that the Bank’s forward guidance framework — which rules out rate rises until the proportion of jobless falls to 7 per cent — is still in place. Rate-setters say expectations of a first interest rate rise next spring are “reasonable”.

Policymakers noted “initial signs that the anticipated broadening from household to business spending might have already begun” after recent official figures showed business investment spending rising at an annual pace of 8.5 per cent at the end of last year. But trade figures show the UK’s goods trade gap with the rest of the world widening to £9.8 billion with little sign of rebalancing seen in the longer term. In the quarter to January, export volumes were 0.9 per cent ahead of a year earlier, but imports up 4.6 per cent.

Threadneedle Street is still concerned over the rise in the pound — up 1.5 per cent over the last month - hampering an export recovery and keeping a close eye on wages, which rose 1.4 per cent on last year. Single-month figures stripping out bonuses showed relief for squeezed households coming into view with salaries up 1.8 per cent compared to January last year — almost catching up with the Bank’s Consumer Prices Index inflation benchmark, which stands at 1.9 per cent.

But wages are still sluggish by historical standards. Markit chief economist Chris Williamson said: “It still looks a long while off before pay will be rising at a sufficiently strong pace to worry policymakers into raising interest rates.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments