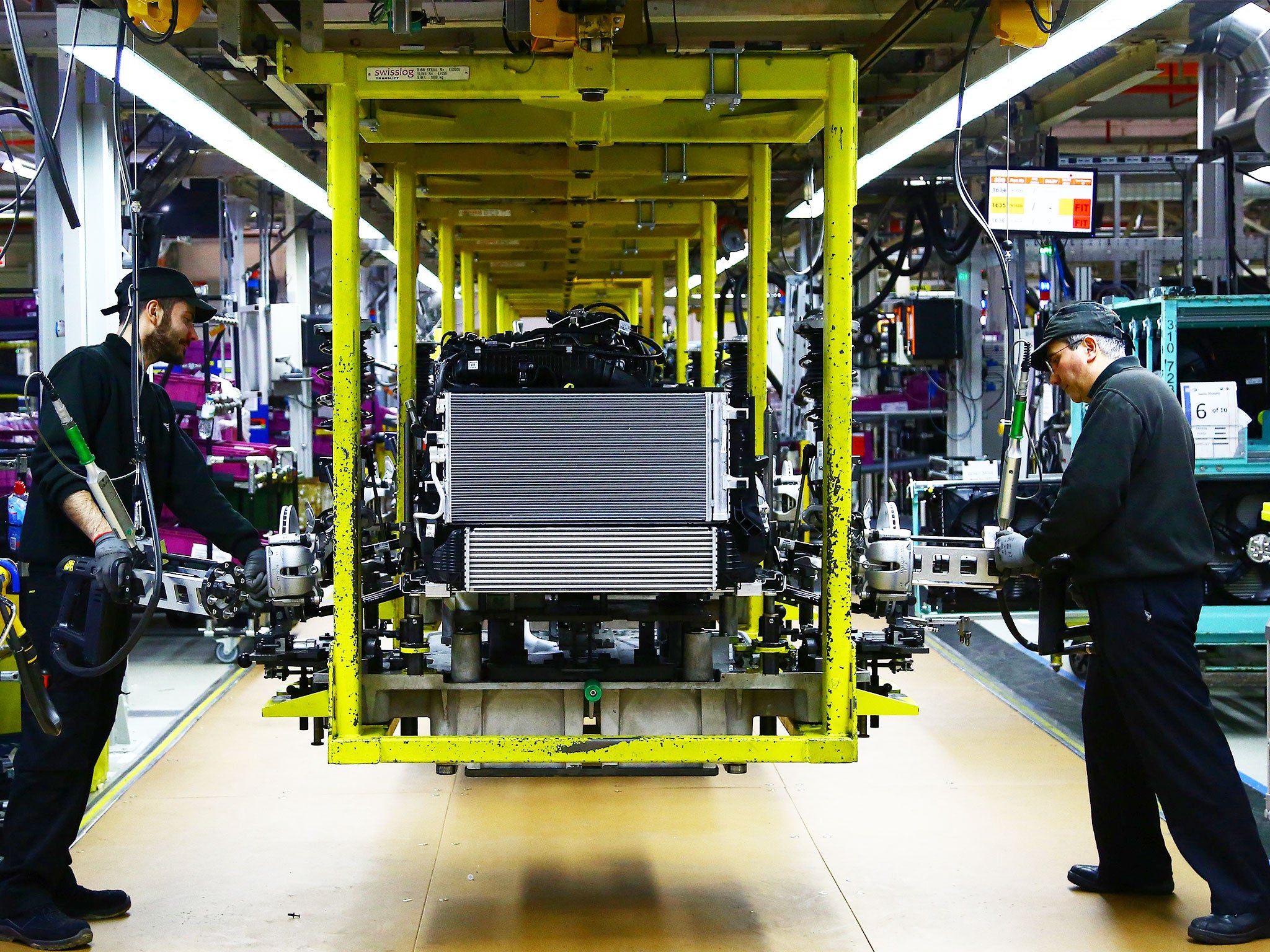

Third of manufacturing firms want to move some operations out of UK after Brexit, report warns

Leaving EU is a 'game-changer' for UK manufacturing with two-thirds of companies believing the instability will be bad for the economy

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Deep uncertainty caused by Theresa May's drive to Brexit has left one in three manufacturing firms planning to shift some operations out of the UK, a damning report reveals today.

The study from consultancy firm KPMG found that China and India - two countries Ms May is desperate to secure greater trade with - are set to be the main beneficiaries from the potential exodus.

The risk of the UK failing to secure any sort of future trade deal with Europe - something Ms May has threatened if Parliament does not approve the deal she agrees with Brussels - was cited as a key potential fear.

It comes just weeks before Philip Hammond gives his Budget, with the Government under pressure to help struggling companies and amid reports of big firms like HSBC and PWC potentially shifting hundreds of jobs out of the UK.

The report said that Brexit had become a "game-changer" for UK manufacturing with two thirds of firms believing the instability from Brexit would be bad for the economy generally.

The report reads: "Our research finds that companies are considering a number of measures to plan for this potentially radical change. For example, a third are considering relocating aspects of their plant or operations to another country in order to boost productivity or reduce costs, with China and India the most attractive destinations for relocation.

"There is also a slight but notable increase in consideration of moving elements of the supply chain away from the UK."

It went on: "While this might seem counter-intuitive at a time when the low pound value is encouraging greater investment into the UK, businesses with interconnected pan-European supply chains may be planning for the possibility that the UK exits the EU Customs Union without an EU-UK Free Trade Agreement in place."

Ms May angered politicians both in Europe and abroad when she gave her historic Lancaster House speech on Brexit, in which she said "no deal is better than a bad deal".

The report then predicted rising prices for consumers, highlighting that firms will deal with increasing costs by passing increased prices onto the customer.

Karen Briggs, the KPMG's head of Brexit, said: "Although some are concerned about exchange rates, labour pressures and higher indirect taxation, they are also taking a range of practical measures to prepare.

“These include partial relocation, supply chain management, increased business development, and new sources of financing."

The document did give the Government some credit for having promised a more joined-up industrial strategy to help meet new challenges, posed by Brexit, digitisation and the need for skills, but added that it is unclear if it will translate into "longer-term, concrete action”.

It also found two out of five firms were undeterred by the referendum vote and did not believe that Brexit will make it harder to recruit staff.

But political opponents slammed the Government's approach to Brexit. Shadow international trade secretary Barry Gardiner said: "The Government keeps telling us that leaving the EU is good for the UK. So it is difficult for them to explain why so many of our key businesses appear to be leaving.

"These are British jobs that are being exported and UK economic growth that is being lost.

"People are keen to understand what are the alternative facts that Theresa May knows, but British business is so unaware of."

Tim Farron, the Liberal Democrat leader, called the research a “hammerblow” to Theresa May, urging her to “wake up” to the threat to the British economy.

“More businesses are admitting they are looking overseas. This, I believe, is because businesses want to keep their access to the Single Market,” he said.

“The Government's ‘hard Brexit’ is now threatening jobs and investment in Britain. The Government needs to wake up and act before it is too late.”

Economists remain gloomy about the prospects for Brexit, despite the robust performance of the British economy since last June.

Growth will slow markedly in 2017, household incomes will be squeezed by higher inflation and businesses will hold back on investment decisions, according to the majority of economists in an annual Financial Times survey.

The UK is thought to have been one of the fastest-growing advanced economies in 2016.

But most of the 122 economists who responded now expected growth to slow - from about 2.1 per cent in 2016 to no more than 1.5 per cent in 2017.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments