Brexit: £17bn already ripped out of UK public purse due to decision to quit EU, research shows

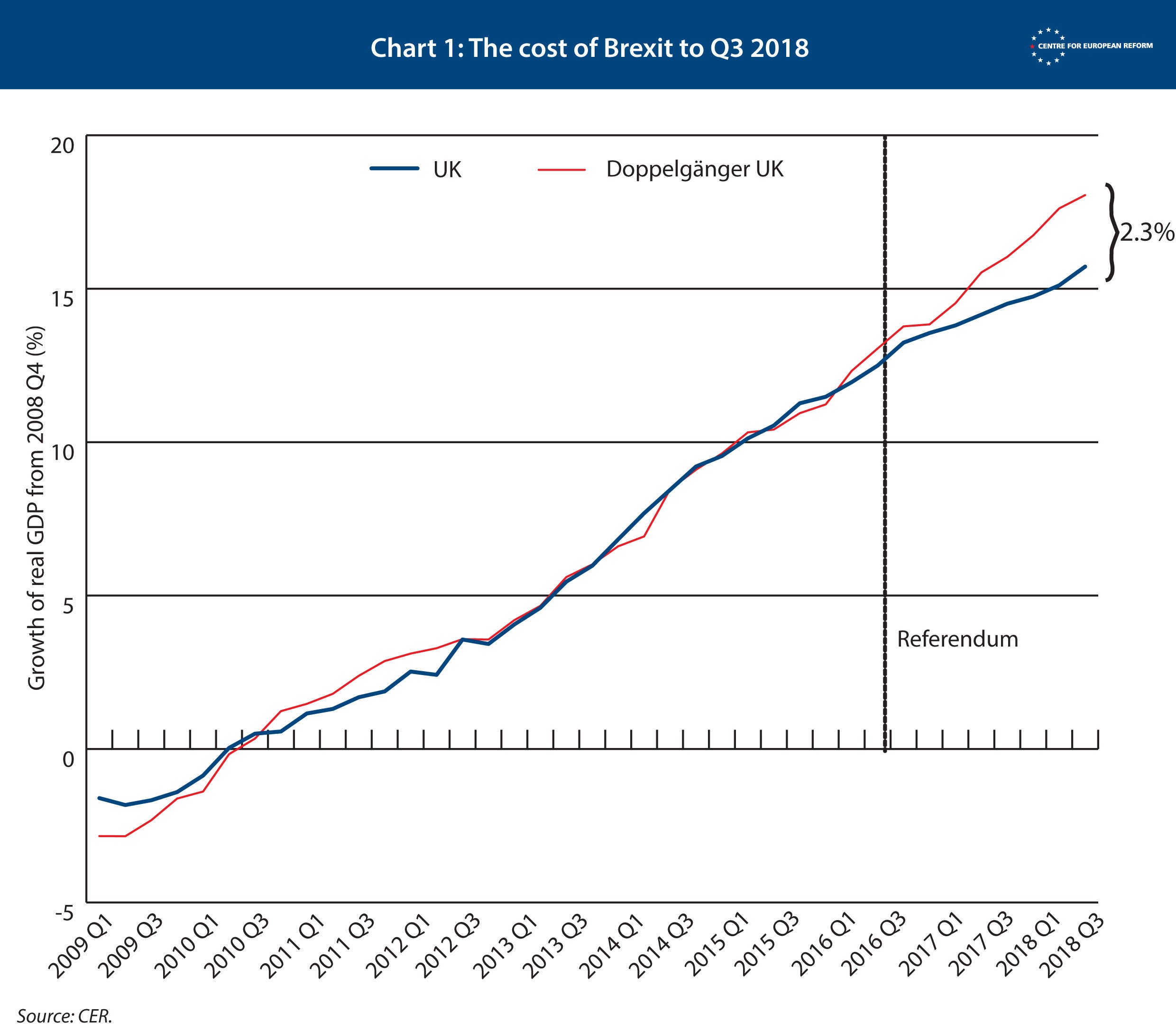

Exclusive: The think tank study indicates GDP would be 2.3 per cent higher had the UK voted to remain in the EU

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Brexit is already costing the UK’s public finances £17bn a year, according to a detailed study released ahead of critical votes in parliament this week.

The amount would be sufficient to pay 10,000 more police to patrol the streets and train nurses to fill every vacancy in England, and still leave enough to cover the UK’s current contribution to the EU’s budget.

The research from the Centre for European Reform estimates the UK economy is 2.3 per cent smaller than it would have been had Britain voted to remain in the EU back in 2016.

The think tank calculated that the reduced GDP would limit the Treasury’s spending power by £17bn a year, or £320m per week – around the amount promised for the NHS by the Leave campaign on the side of its touring bus.

On Tuesday MPs will attempt to break the Brexit deadlock in a series of votes that could hand parliament more power to control the next phase of Brexit, though the signs are that the impasse and uncertainty may go on for weeks.

But the CER’s research indicates that whatever route is chosen, Brexit has already taken a heavy toll on the British economy.

Deputy director John Springford said: “Britain’s decision to leave the EU damaged growth, largely thanks to higher inflation and lower business investment.

“The UK missed out on a broad-based upturn in growth among advanced economies in 2017 and early 2018. And the economic cost of the decision so far is sizeable, if not disastrous.”

The CER’s most up-to-date analysis, passed to The Independent, used a computer programme to create a “doppleganger” UK economy which it then tracked from 2009 until today.

The doppleganger closely matched the real UK economy until the referendum in 2016, when the two countries’ economic performance diverged – with the real UK’s GDP 2.3 per cent lower by the third quarter of 2018.

The analysis found that 1 per cent of lost GDP resulted in £7.6bn of extra borrowing. Given that there is no discernible “Brexit dividend” yet, it means that for the real UK’s 2.3 per cent loss in GDP, there is a hit to the public finances of £17bn a year.

Critically, it also implies that the UK’s fiscal deficit would have largely been eliminated in the 2018-19 financial year if Britain had voted to remain in the EU.

Mr Springford said: “The CER will continue to update our model as new quarterly GDP data comes in – and as a result, we will have a decent basis to test the claims made by Leave and Remain. So far, ‘Project Fear’ continues to be closer to the truth.”

Data released by the Office for National Statistics earlier this week pointed to a need for more resourcing for public services, as it showed violent crime recorded in England and Wales has risen by 19 per cent in a year, amid plummeting police numbers.

An average salary for a new police constable is just under £31,000, add some £12,000 for recruitment and training, and the cost of 10,000 new officers reaches £430m.

With the cost of training one nurse at around £70,000 and a starting salary of some £25,000, it would cost £3.8bn to fill all 40,000 vacancies in England.

Yet even after taking on the substantial costs of restaffing police forces and hospitals, the CER research indicates that had the UK voted Remain there would still be several billion pounds left for the chancellor to play with this year – even after paying off the UK’s £8.9bn net annual contribution to the EU.

The CER’s data could have deep implications for how MPs vote in a series of critical divisions on Tuesday, when parliament will take decisions on several different proposals for what to do next.

Some plans being put forward by MPs would extend the Article 50 negotiating period, others would give more power to parliament to direct the government’s next steps, with the prospect of a second referendum further down the line.

In the meantime Theresa May is planning to return to the European Union in an attempt to secure new concessions on the withdrawal agreement she negotiated with Brussels, to make the deal more palatable to her Conservative MPs.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments