Trump administration threatens UK with tariffs if Boris Johnson imposes taxes on tech giants

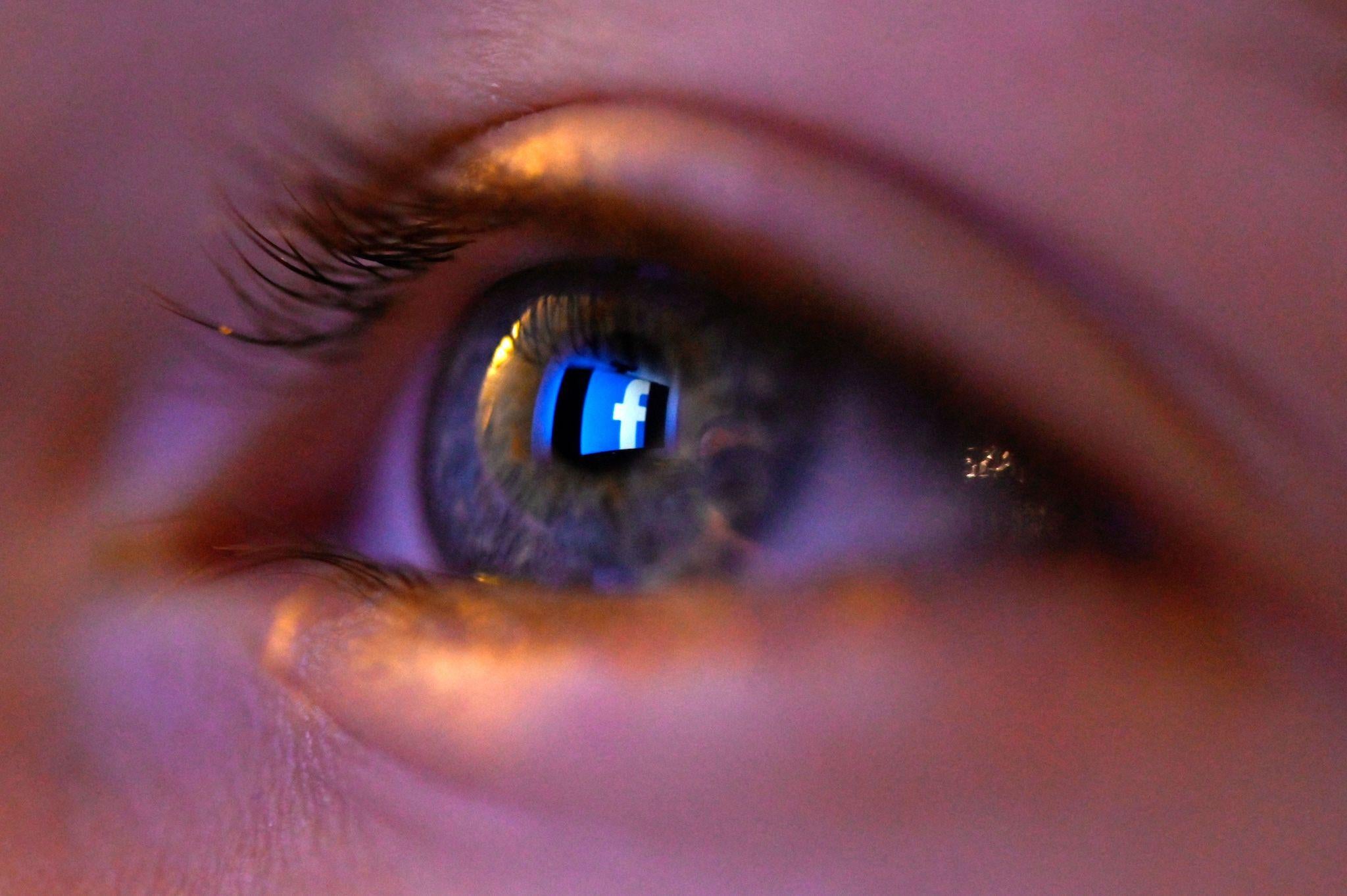

Digital services levy due to be imposed on web-based firms like Facebook and Amazon from April

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Steven Mnuchin, the US treasury secretary, has threatened the UK with tariffs if Boris Johnson presses ahead with plans for a new tax on American tech giants.

The threat escalates an ongoing row between Mr Johnson and Donald Trump just weeks before London hopes to open talks on a post-Brexit free trade deal with the US.

It comes after Emmanuel Macron, the French president, backed down at the weekend on plans for a levy of up to 3 per cent of revenue in a bid to resolve the issue of global technology companies paying little tax in countries where they earn large amounts but are not physically present.

In a phone call with Mr Trump on Sunday, Mr Macron agreed to extend negotiations until the end of this year, averting threatened US duties of up to 100 per cent on about £2bn worth of imports of totemic French products such as champagne and camembert cheese.

Now Mr Mnuchin has warned that UK exporters can expect similar treatment if Johnson persists with the digital services tax, which Washington believes unfairly penalises firms like Google, Amazon and Facebook.

The tax is due to come into force in April, at a rate of 2 per cent of revenues of search engines, social media platforms and online marketplaces that derive value from British users.

Speaking to The Wall Street Journal at the World Economic Forum in Davos, Switzerland, the US treasury secretary said that Mr Macron’s truce was “the beginning of a solution” and called on Britain and Italy to suspend similar plans.

“If not, they’ll find themselves faced with President Trump’s tariffs,” said Mr Mnuchin. “We’ll be having similar conversations with them.”

Downing Street made clear that it viewed an international agreement on the tax treatment of incomes from web-based technologies as the long-term solution to the issue.

But Mr Johnson’s official spokesperson gave no indication that the UK is preparing to back down on the introduction of the tax in the face of US pressure.

“We are fully engaged in international discussions to address the challenges digitalisation poses for tax,” said the PM’s spokesperson.

“Our strong preference is for an appropriate global solution and to repeal our digital services tax once this is in place.

“We have consulted extensively on our digital services tax and sought to design it in a proportionate way.”

Speaking about the digital services tax ahead of Mr Trump’s visit to London last month, Mr Johnson warned against a “trade war”, but said he believed a way needed to be found of ensuring tech giants make a “fairer contribution” in tax.

“I do think we need to look at the operations of the big digital companies and the huge revenues they make in the UK and the amount of tax they pay,” the PM said in December.

“We need to sort that out. They need to make a fairer contribution.”

The row risks scuppering Mr Johnson’s hopes for a swift and ambitious trade deal with the US as a means of mitigating the hit to UK exports expected as a result of Brexit. The PM has already limited the scope of such a deal by ruling out the inclusion of NHS services.

The digital services tax was announced in the 2018 Budget by then chancellor Philip Hammond as a way of levelling the playing field between global tech giants who exploit the international system to minimise their tax liabilities and bricks-and-mortar businesses that are tied to local tax rates.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments