Benefit cap should be reconsidered - according to Tory architect behind the scheme

Tens of thousands to miss out as welfare payments soar by up to 10 per cent from April

The benefit cap should be reconsidered to prevent some of the UK’s poorest families missing out on a huge boost to their incomes, one of its Tory architects has suggested.

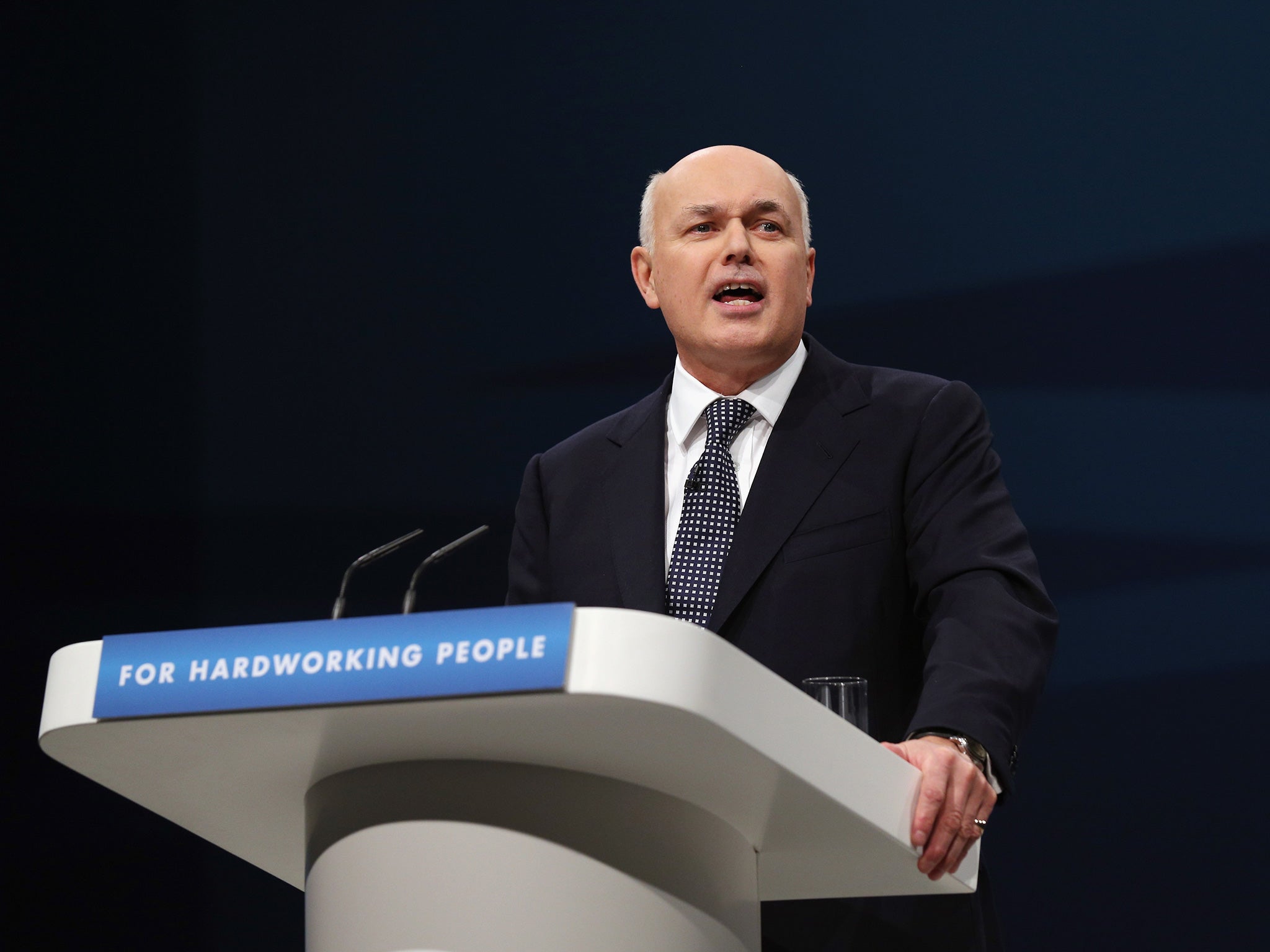

Iain Duncan Smith, the former Conservative Party leader who was the work and pensions secretary when it was introduced, said he would be in favour of looking again at the limit.

Benefits payments are set to soar by up to 10 per cent from next April to keep up with the rate of inflation, the chancellor has confirmed.

But more than 120,000 households will not see a penny extra, despite the cost of living crisis, because of the cap, which acts as a ceiling on how much they can receieve from the state.

Asked if the cap should now rise, Mr Duncan Smith said: “I would certainly be in favour of looking at it.”

He added: “Not everyone is caught under the benefit cap, and there are some quite significant exemptions. But I would certainly look at it”.

Earlier this week Carl Emmerson, the deputy director of the highly respected Institute for Fiscal Studies (IFS) think tank, told The Independent that if ministers planned to make benefits more generous, “the benefit cap should almost certainly increase to reflect that”.

In his £15bn giveaway to ease the cost of living last week, Rishi Sunak announced that a one-off £650 payment would still go to families that are affected by the cap. The move was widely welcomed by poverty campaigners. But the same households stand to lose much more if the cap does not rise in line with inflation next year.

Experts warn that a combination of rapidly rising prices and stagnant incomes is leaving them trapped in an “impossible situation”.

Famously, ministers did not raise the cap, which is a limit on the total amount most adults under pension age can receive, two years ago in response to the Covid pandemic.

They did increase one benefit, universal credit, by £20 a week. But critics warned that for many households much of that money was clawed back because of the cap.

The limit was first introduced by the then chancellor George Osborne as part of the Tory-Lib Dem government’s austerity measures.

It currently stands at £20,000 a year, or £13,400 for single adults with no children. In Greater London a slightly higher limit of £23,000 a year applies.

Mr Emmerson said that because of the way the limit works the cap effectively “says ‘we are OK with people who have a few more children in cheap parts of the country and we are OK with people having a bit more expensive housing costs as long as they don’t happen to be children’. What we don’t like is people having lots of children in expensive parts of the country.”

The Child Poverty Action Group charity has warned that most families hit by the cap also have children under five.

A government spokesperson said: “The benefit cap, up to the equivalent salary of £24k, balances fairness for taxpayers with providing a vital safety net.

“We keep the cap under review and any revision would align with the timing of decisions on uprating benefits, with changes taking effect the following April.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments