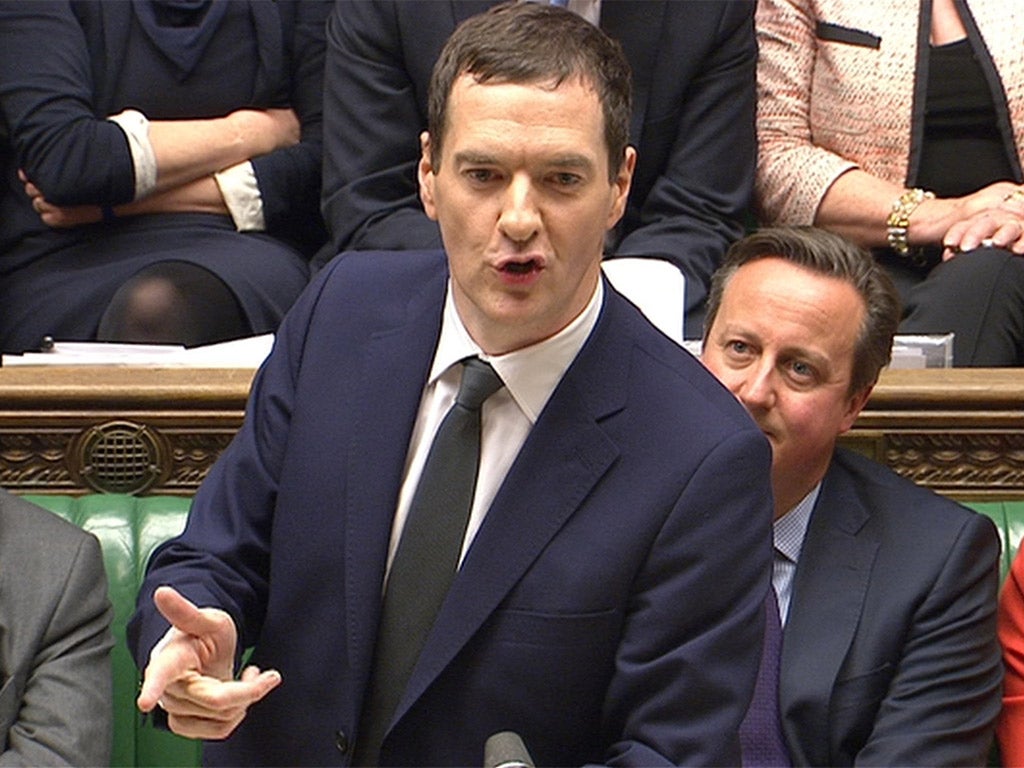

Autumn Statement: Are George Osborne's anticipated savings realistic, optimistic... or just plain bull?

The Office of Budget Responsibility examines all Treasury policies and assesses how realistic they are. Here's what they said after the Chancellor's statement...

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Chancellor and his Treasury mandarins are renowned for being overly optimistic about the savings the country will make through their brilliant policies.

Sadly for them, but luckily for us, the independent Office of Budget Responsibility goes through all of their clever wheezes and scores them on whether the anticipated savings are realistic, optimistic or just plain bull.

The OBR prefers to use more measured language – talking in terms of low, medium or high levels of uncertainty. We prefer our own categories:

The Apprenticeship levy

The biggest moneyspinner for the Exchequer will see big businesses pay extra National Insurance on their workforces to fund the UK wide drive to increase the numbers of apprentices.

The Exchequer says it will raise over five years: £11.64bn

OBR says: Optimistic

Stamp Duty Land Tax

Increase by 3% the rate of stamp duty on second homes.

The Exchequer says it will raise over five years: £4.09 bn

OBR says: Bull

Diesel levy on company cars

The extra tax paid by companies on diesel engines will be extended.

The Exchequer reckons it will raise over five years: £1.4bn

OBR says: Optimistic

Tax avoidance

Perhaps the most famously over-stated savings by Chancellors since the financial crisis, every Budget and mini-Budget comes up with tough sounding new clampdowns on rich tax avoiders. History shows they never come up with the promised savings.

The Exchequer reckons it will raise over five years: £1bn

OBR says: Bull

Moving people’s tax forms online

The taxman is going digital, making people update their details quarterly. Bizarrely, the Exchequer reckons fewer errors will be made, helping it raise more tax.

The Exchequer reckons it will raise over five years: £920m

OBR says: Bull

Tax credits

Scrapping plans to cut in-work benefits after uproar.

Exchequer says it will cost: £9bn

OBR says: Realistic

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments