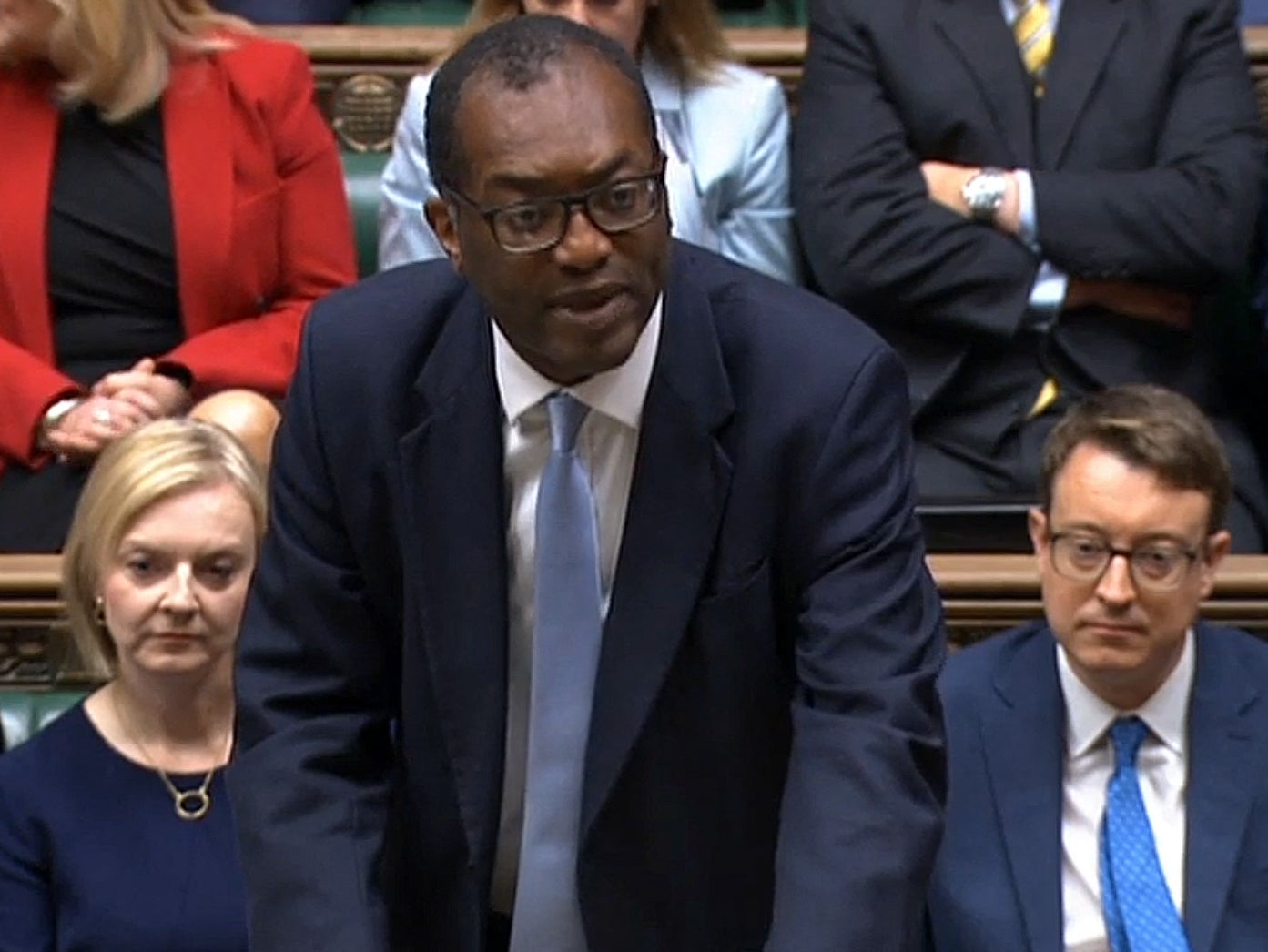

Kwarteng scraps planned duty increase for beer and wine

‘Our drive to modernise also extends to alcohol duties,’ chancellor says

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Kwasi Kwarteng scrapped a planned increase on alcohol duty in his mini-Budget today as he set out plans for billions of pounds worth of tax cuts and more borrowing.

In a statement to parliament on Friday, the chancellor said planned tax rises on beer, cider, wine, and spirits will all be cancelled.

It comes after Rishi Sunak, the former chancellor, announced in February that he would tax beverages based on their alcohol strength. The changes had been due to come into effect from 1 February next year.

But the new chancellor said he had "listened to industry concerns" and vowed to introduce an 18-month transitional measure for wine duty.

"Our drive to modernise also extends to alcohol duties," he said. "I will also extend draught relief to cover smaller kegs of 20 litres and above, to help smaller breweries.

"And, at this difficult time, we are not going to let alcohol duty rates rise in line with RPI (Retail Price Index).”

Alcohol duty usually rises in line with RPI, which sits at 12.3 per cent and is linked to inflation, currently running at 9.9 per cent but expected to rise. The current level of RPI is the highest since the 1980s.

According to Treasury analysis, the move amounts to £600m in tax cuts, with the consumer saving 7p on beer, 4p on a pint of cider, 3p on a bottle of wine and £1.35 on a bottle of spirits.

In his statement, which the government described as a “fiscal event”, Mr Kwarteng also abolished the top rate of income tax for the highest earners as he spent tens of billions of pounds in a bid to drive up growth to ease the cost of living crisis.

He scrapped the 45 per cent top rate of income tax and brought forward the planned cut to the basic rate to 19p in the pound a year early to April.

He also revealed his estimate that the two-year energy bills bailout will cost around £60 billion over its first six months from October.

Friday’s alcohol duty freeze comes at a time when pubs across the country continue to struggle following the Covid pandemic and increasing overheads amid the cost of living crisis.

Many have already been forced to shut down due to the eye-watering cost of gas and electricity.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments