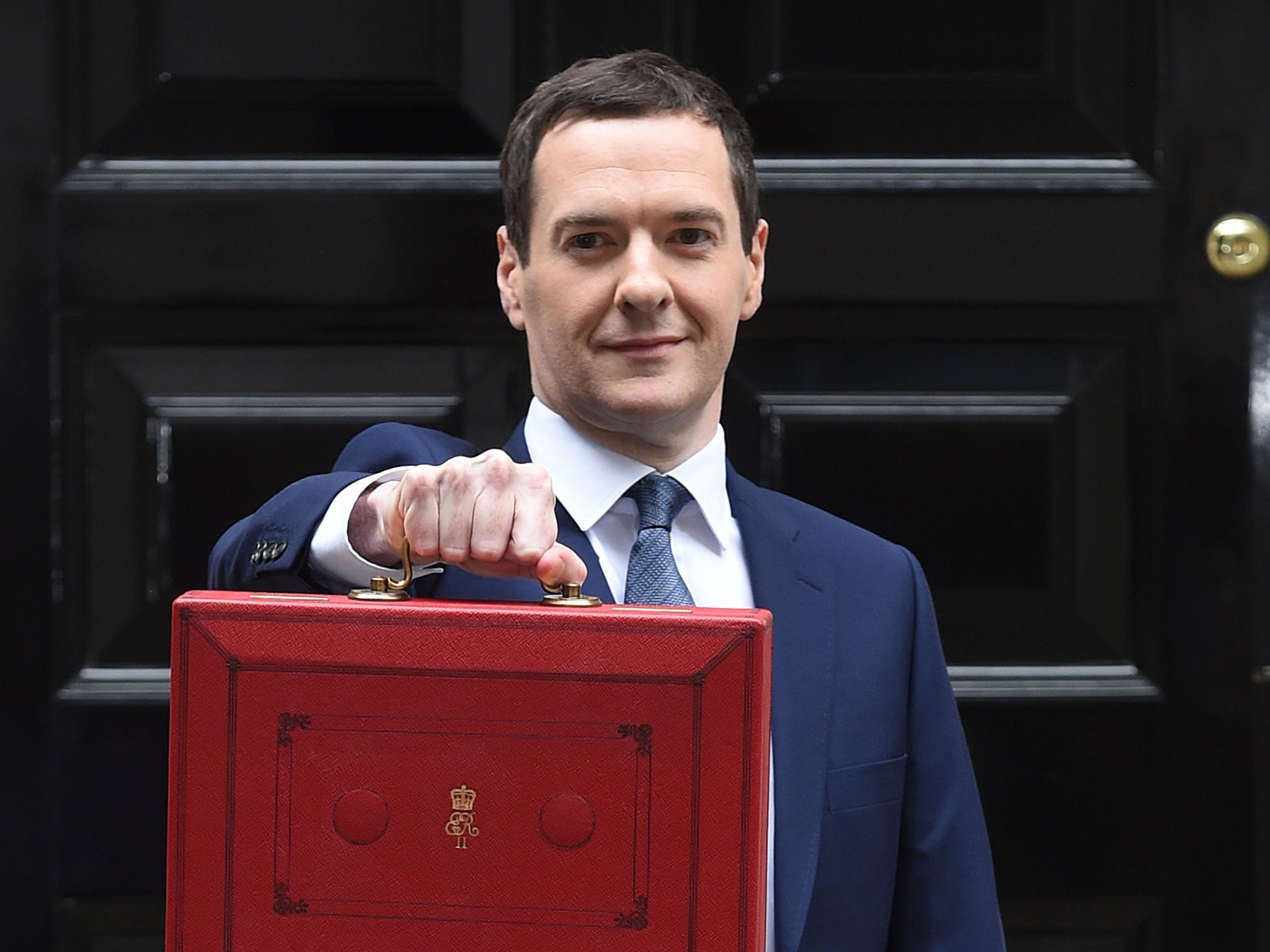

Budget 2016: 85 percent of benefits from new tax cut would go to the richest half of Britain, research suggests

George Osborne is set to deliver the new budget this Wednesday

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The richest half of Britain will enjoy 85 per cent of the benefits of George Osborne’s new tax change, a think tank has warned.

The Chancellor has pledged to raise the income tax threshold from £42,386 to £50,000 by 2020. It order to fulfil his pledge, he will need to find £2 billion to finance the scheme within the next two years. He is expected to announce his first steps towards the measure in his budget statement this Wednesday.

According to research by the Resolution Foundation, the 85 per cent of the benefits of such a move would go to the wealthiest fifth of Britain. In addition, their analysis also suggest that once the tax-free personal allowance income is raised from £10,600 to £12,500, 85 per cent of benefits will still go to the richest half of the country. They claim that this is because Britain’s 4.6 million lowest paid workers earn less than £10,600 and thereby “will gain nothing at all.”

A spokesperson for the Foundation said: “Despite often being described as a tax cut for middle earners, less than one in seven employees would benefit from such a move. As a result, over three quarters of this tax windfall would go to the richest fifth of households.”

They added: “supporting low income families, including overturning cuts to Work Allowances in Universal Credit, should be a higher priority than regressive income tax cuts.”

The government recently confirmed plans to cut benefits for disabled people to make a saving of approximately £1 billion. The Personal Independence Payment is made to people with severe disabilities to help them live more independently. The cut has been condemned by a number of charities as representing a “devastating” impact on the lives of vulnerable people.

Campaigners have criticised the government for cutting disability benefits while also boosting middle earners’ incomes. Shadow Work and Pensions Secretary Owen Smith tweeted yesterday: “Already wicked to take another £1.2 billion from disabled, but truly obscene if switched for tax cuts at the Budget.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments