Budget leaves big picture largely unchanged, say experts

Experts from the IFS and Resolution Foundation said taxes were still going up and living standards were falling despite Wednesday’s Budget.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.A “smoke and mirrors” Budget has left the overall economic picture largely unchanged and a “sour” prospect for whoever wins the next election, two leading economic think tanks have said.

The Institute for Fiscal Studies (IFS) and the Resolution Foundation both said Wednesday’s Budget meant taxes were still going up and living standards still falling since 2019 despite the announcement of another 2p cut in national insurance.

Paul Johnson, director of the IFS, said “smoke and mirrors” were to be expected, and the “big picture on tax remains much the same”, with tax revenues being 3.9% of national income higher than they were in 2019.

He said: “This remains a Parliament of record tax rises.

“While the OBR got a little more positive in its projections, the picture on living standards also remains dismal. On average, households will be worse off at the time of the next election than they were at the last, following nugatory real earnings growth.”

Torsten Bell, chief executive of the Resolution Foundation, concurred with Mr Johnson’s assessment, saying: “Britain remains a country where taxes are heading up not down – rising by the equivalent of £3,900 per household – and where incomes are set to remain below their level at the last general election when voters return to the polls.”

The two think tanks did not present a universally negative view of the Budget, with Mr Johnson noting “some bright spots” including the cut in national insurance, scrapping the non-dom tax status – “a big and welcome move” – and changing the system of child benefit for high-income families.

On national insurance, he said it would reduce the “tax wedge” between different sorts of income, benefit those in work and have “marginally more positive work incentive effects”.

Whoever is Chancellor at the time of the next spending review... might wish they’d chosen a different line of work

Mr Bell said the national insurance cut marked a “staggering reversal” of the Conservatives’ approach since 2010, benefiting younger workers while allowing taxes to rise for pensioners.

He said: “It is undoubtedly good economics, even if the politics are a harder sell.”

The move is set to see the average employee gain another £450 on top of a similar amount from the previous national insurance cut, while those earning £50,000 will see the largest tax cuts, gaining around £1,200.

Those earning £19,000 or less will, however, be worse off, according to the Resolution Foundation, while overall it is middle earners – those on salaries between £26,000 and £60,000 – who will see their personal tax bills fall.

Higher and lower earners will see their taxes go up, while pensioners are set to see an average tax increase of £960 by 2028/29 as a result of threshold freezes.

Looking beyond the election, both men warned of bad news to come, with a range of tax rises and spending cuts implied by the Chancellor’s longer-term plans.

Mr Bell said: “The tax cuts announced today to sweeten the Government’s election pitch rely on the prospect of a sour £19 billion of post-election tax rises, and the fiscal fiction that another £19 billion of cuts to public services can be delivered in a spending review that the Treasury today confirmed will not take place until after polling day.”

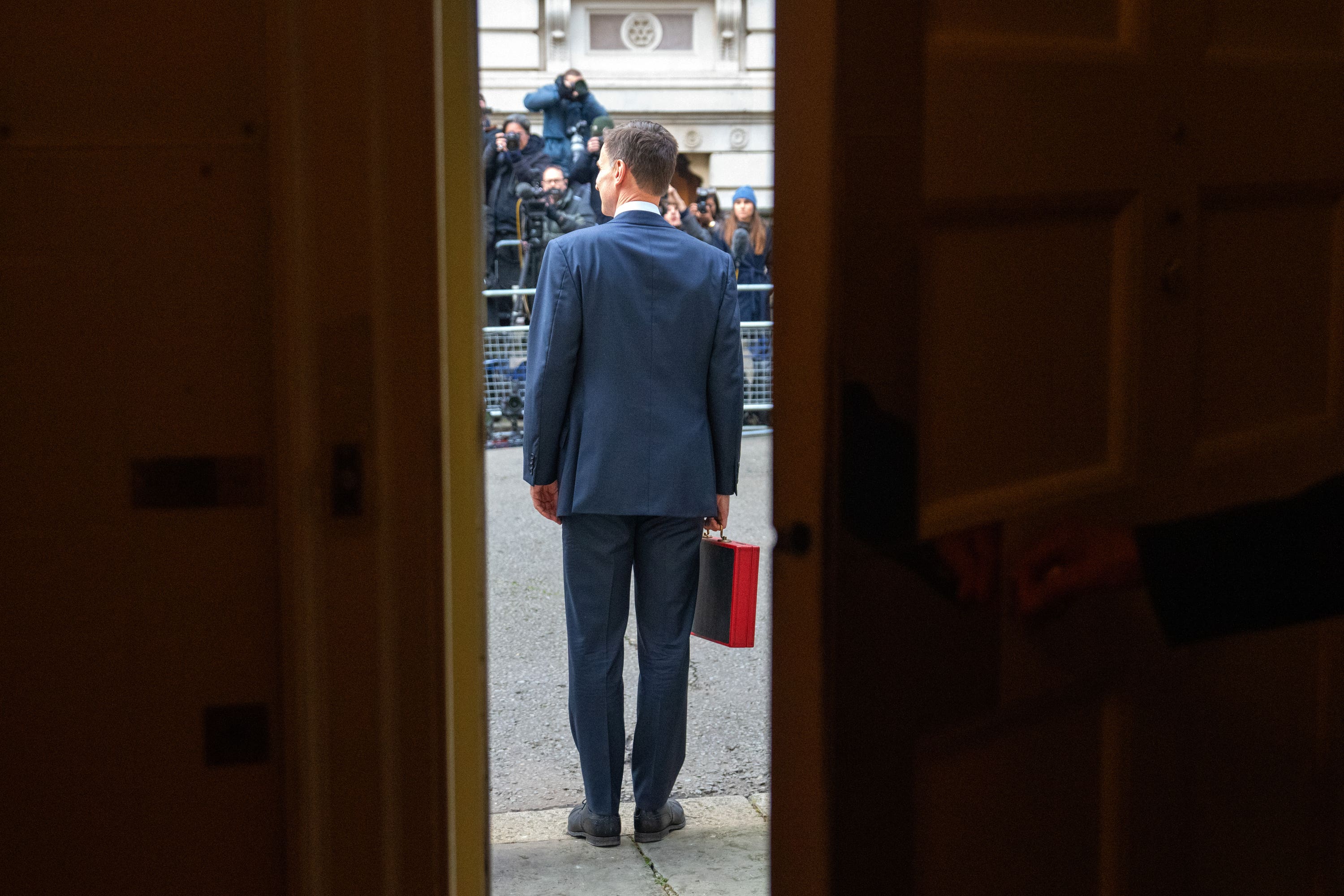

Mr Johnson added that, while Jeremy Hunt did not pencil in even larger cuts from 2025, existing plans already required cutting unprotected services – such as councils, courts and prisons – in a way that may be “within the realms of possibility” but would require “big improvements in public sector productivity”.

He said: “Whoever is Chancellor at the time of the next spending review… might wish they’d chosen a different line of work.”