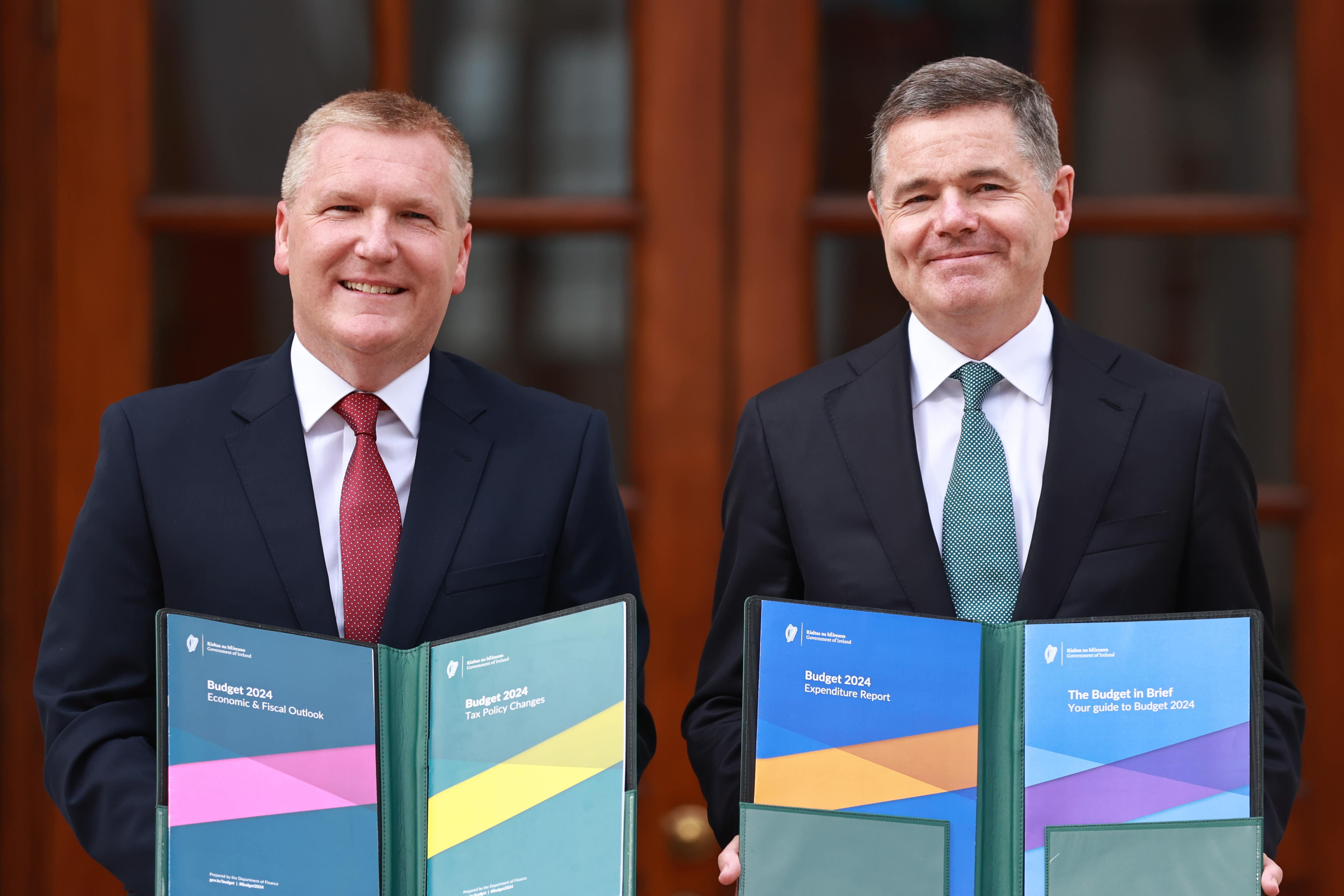

Irish ministers say 14bn euro budget prioritises challenges of today and future

Budget 2024 was unveiled on Tuesday.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Irish Government has unveiled a 14 billion euro budget package it insists balances the needs of today with the future wellbeing of the economy.

Finance minister Michael McGrath said Budget 2024 was framed against a backdrop of “global uncertainty”.

The package agreed by the Fianna Fail, Fine Gael and Green Party coalition in Dublin includes a 5.27 billion euro increase in public spending.

The budget also includes 4.76 billion euro of non-core funding to respond to exceptional circumstances, including the humanitarian response to the war in Ukraine; 1.16 billion euro on tax measures; a further 444 million euro in temporary tax measures; 1.4 billion euro for one-off cost-of-living supports; and 900 million on energy credits for households.

Mr McGrath also announced two new funds that will use Ireland’s multi-billion euro windfall from corporation tax receipts, mostly derived from multinational companies, to invest in future priorities, including support for the response to climate change.

“The annual budget is about setting out how we can help with the needs of today, but it also has to be about planning for the next 10, 20, 30 years,” the minister told the Dail.

The budget includes a one-year, tax relief on mortgage interest payments. The relief for those affected by soaring rates in the last 12 months will be capped at 1,250 euro per property.

The Government estimates that the measure will benefit 165,000 mortgage holders at a cost of 125 million euro.

This budget continues that approach. Not spending every cent today; leaving some aside for tomorrow. Helping with the cost of living, but changing that help as inflation slows

Among the one-off, cost-of-living supports are three electricity credits worth 450 euro; a winter fuel allowance lump sum of 300 euro; a 200 euro winter living alone allowance; a Christmas bonus for welfare recipients; and 250 million euro in one-off business supports.

There will be a 12 euro increase in the weekly social welfare rate for working age recipients and a 12 euro increase in weekly payments for pensioners.

In tax policy, the standard rate cut-off point for income tax has increased by 2,000 euro, meaning people will start paying the highest tax rate at 42,000 euro.

The rent tax credit has been increased to 750 euro.

Mr McGrath said a temporary tax relief to benefit small landlords would also be introduced.

This would see rental income of 3,000 euro for 2024, 4,000 euro for 2025, and 5,000 euro for 2026 and 2027 disregarded at the standard rate – as long as landlords stay in the market for that full, four-year period.

There is also a reduction in the middle rate of the Universal Social Charge (USC), a controversial tax introduced after the financial crisis, from 4.5% to 4%.

The budget included a 0.1% increase in PRSI (Pay Related Social Insurance) contribution rates from October 1 next year.

There was a 75 cent increase in excise duty and VAT on a pack of 20 cigarettes.

In expenditure, the Government announced funding to recruit 1,000 more gardai into the Irish policing service and 250 civilian staff.

A scheme which provides for free school books has been extended into the first thee years of secondary school.

Child benefit will be extended for 18-year-olds who are still in full-time, secondary education.

There will be one billion euro provided for the development and renewal of the Irish road network, and “one million euro per day” invested in cycling and walking infrastructure.

The 4.76 billion euro for “exceptional challenges” includes 2.5 billion euro for measures like the education, welfare payments and accommodation for Ukrainian refugees; 1.3 billion euro for the ongoing Covid-19 response in Ireland; and 700 million euro for other responsive provisions under by the National Recovery and Resilience Plan.

Public Expenditure Minister Paschal Donohoe said recent budgets had been defined by global challenges, including climate change and the threat of violence around the world.

He said those challenges could have caused “long-lasting harm” to the Irish economy.

He said the reason they had not was because Ireland’s public finances had gradually been returned to health, from deficit to balance to surplus.

“This budget continues that approach,” he said. “Not spending every cent today; leaving some aside for tomorrow. Helping with the cost of living, but changing that help as inflation slows.”

He said the Government was spending more on public services and building more homes, more schools and better public transport.

But he said that was not based on spending money “we may not always have”, referencing the windfall corporation tax receipts.

“This is why this budget well help with the cost of living, will help with better public services and will give more children a better start to life,” he said.

Opposition politicians immediately criticised the Government’s planning around housing, healthcare and tax policy.

You’ve just decided to forget about health

Sinn Fein finance spokesman Pearse Doherty said the budget was a “squandered opportunity” to deal with inequality.

Delivering his party’s budget response, Mr Doherty said the housing crisis should have been the number one priority in the budget.

He said: “We needed a budget for renters, instead we got a budget for landlords.”

The opposition TD said the budget had done “next to nothing” for the health service.

“No urgency, no vision, no compassion, and that’s the reality. You’ve just decided to forget about health.”

Labour TD Ged Nash described Budget 2024 as a “lazy rerun of all that was wrong with Budget 2023”.

“Tax cuts that favour the better-off again. Failure to properly fund the public services on which we all rely, and which the citizens of this rich Republic should expect,” he said.

“Again, a wall of once-off payments, but no permanent change and once those once-off payments are gone, they’re gone.

“The budget that will yet again be found to be regressive once lump sum payments melt away like snow on a ditch.”

Social Democrats finance spokeswoman Roisin Shortall said the Government’s housing policy is a “litany of failure”.

“There was an opportunity with this budget, given the resources, to do some transformative things to tackle the big problems facing the country and ensure that we are not again pulling up the ladder and passing on problems to the next generation to solve.

“But instead we have a budget that is desperately short of ambition.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.