Zinc: World running out and shortage hits pound in your pocket

Price of the rust-resistant metal is at a three-year high as spent mines close, but demand for it continues to grow

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It’s used in everything from steel-making to sunscreen, but the world is rapidly running out of zinc.

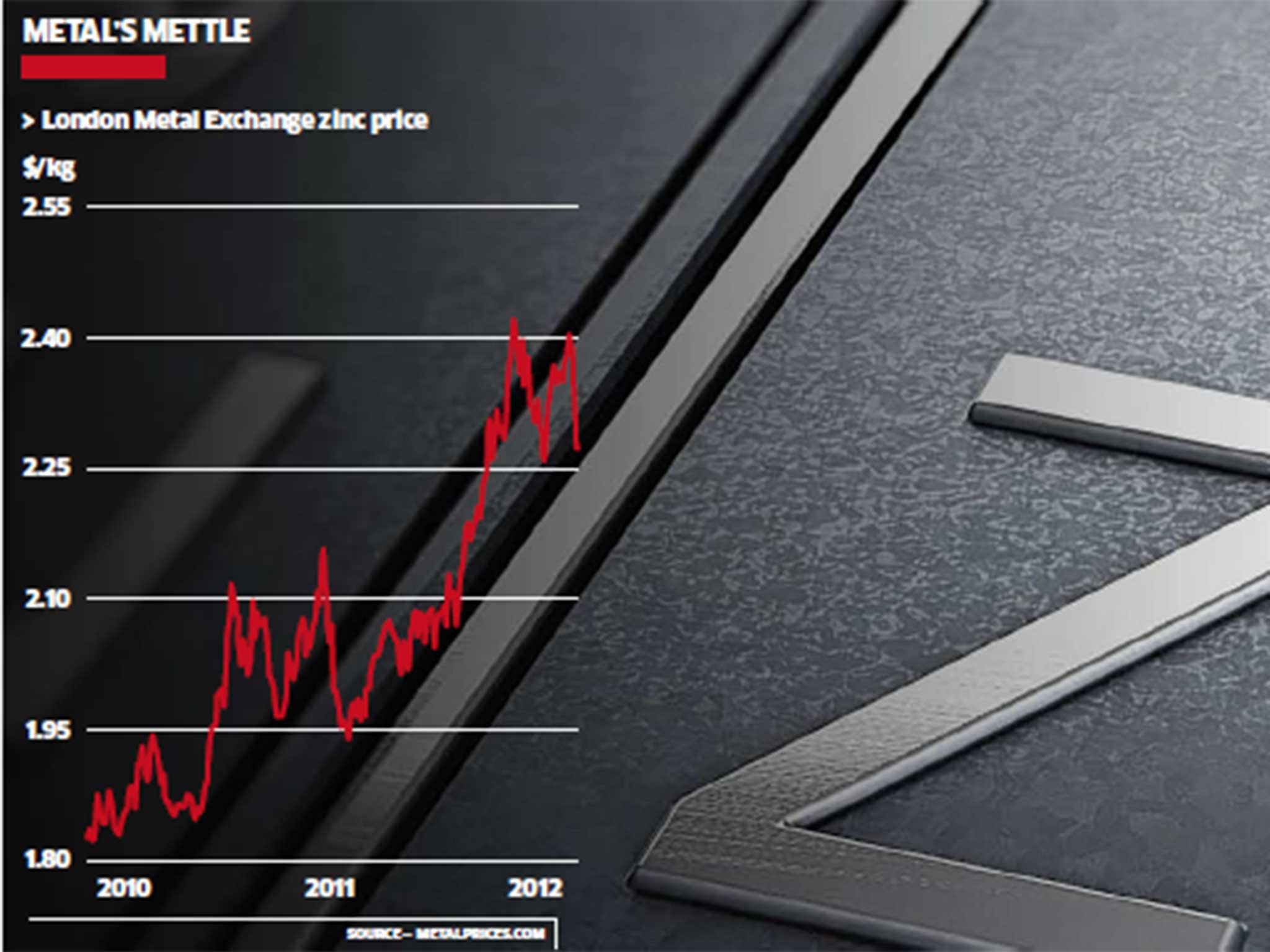

Prices for the rust-resistant metal soared to a three-year high last week as exhausted mines across the world close, but it is with the pound in our pocket that we are likely to feel the soaring cost most acutely.

One and two-pound coins are made up of as much as 25 per cent zinc and analysts are predicting the Royal Mint may have to follow the example of the US Mint and take cost-cutting measures.

The news that zinc prices had spiked on Monday came only days before Chancellor George Osborne launched a competition to create an image that will be emblazoned on the “tails” side of the £1 coin.

He said in this year’s Budget that the Royal Mint would manufacture a new £1 coin to reduce counterfeiting, but some analysts fear that when it enters circulation in 2017 it could be valuable for its metal content rather than its nominal monetary value.

Stephen Briggs, a senior metals analyst at BNP Paribas, said the market for the metal shows no signs of slowing down. He said, “Longer term I see metal prices stabilising higher – much higher – than where they are now. You could actually have a situation where the metal content of the coin is worth more than the value.”

The Royal Mint does not release data on how much each coin costs to manufacture, citing “commercial interests”. The Royal Mint is unlikely to be losing money, according to numismatist Paul Davies.

He said: “This [refusal to comment] may not be because they are losing money. They’re always in competition with other mints from around the world. They don’t like giving other mints an angle on what they make big profits on. They’re unlikely to be losing money.”

Nonetheless zinc prices have risen by 17 per cent so far this year and production is expected to fall short of demand later this year for the first time since 2007, according to Goldman Sachs.

Mr Briggs puts this shortage down to the closure of “two or three larger” zinc mines, including the “huge” Century mine in Australia, which was “almost five times larger than anything new coming online today”. Next year the supply of zinc is set to be reduced further, with predicted falls of up to 7 per cent in production.

Zinc supplies are partly running low due to the soaring global car market, which takes up vast quantities of the metal to produce galvanised steel.

It is a similar story in the rebounding global property development industry.

The US Mint has already been forced to reduce manufacturing costs to counter higher prices for zinc, which makes up 97.5 per cent of each 1 cent coin it produces. The issue is tougher for steelmakers; they use about half the world’s yearly zinc supply.

Zinc isn’t just used for the pound in our pockets or in steel-based products; it is used in everything from tyres to face creams. Major cosmetic brands say there are no plans for price rises, but Amanda McGillivray of the Natural Skincare Company is worried. She said: “This will have an impact on how much zinc manufacturers put into their sunscreens, as the prices are bound to rise. Already zinc oxide is very expensive, and this is why the mainstream suncare brands use chemical sunscreens instead, which we believe are harmful to the body.”

Even without the negative impacts on skincare products, Mr Briggs warned it isn’t time to start collecting pennies just yet. “It is illegal to melt down your coins,” he said.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments