The Big Question: Is it time the benefits system was subject to a complete overhaul?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Why are we asking this now?

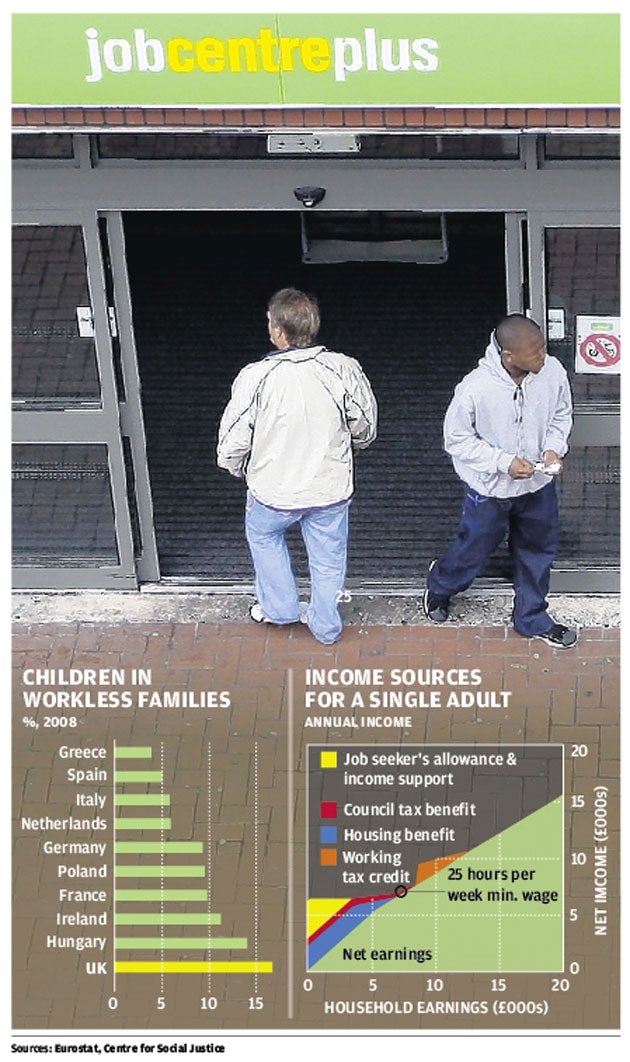

Iain Duncan Smith yesterday made a provocative call for the welfare state to be subjected to its biggest reform since its creation after the Second World War. According to a report by the Centre for Social Justice, the think-tank headed by the former Tory leader, the extent and urgency of the financial crisis facing the country means that the time has come to stop tinkering around the edges of the system and take radical action.

What does he propose?

The report, "Dynamic Benefits", calls for a dramatic simplification of the system under which the current 51 benefits paid to the sick, low-paid and unemployed would be reduced to just two. The payments go to almost six million people of working age.

Its two proposed replacements would be a "work credit", instead of jobseekers' allowance, income support and incapacity benefit, and a "life credit", instead of working tax credit, child tax credit and housing benefit.

What would such radical action achieve?

Mr Duncan Smith argues that it would help tackle a dependency culture that deters people from moving off benefits and into work. The report sets out a series of examples of when the unemployed are hardly any better off from accepting a job. The centre proposes tackling that problem by withdrawing benefits gradually to ensure that people in new jobs notice a significant rise in income.

Do benefits deter job-seekers?

According to the thinktank, a 25-year-old moving into a low-paid job can be less than £1 an hour better off after they leave benefits, with out-of-work couples facing similar disincentives. Ministers counter that policies such as the national minimum wage (currently £5.73 for employees aged 22 and over) and tax credits were designed to beat the benefits dependency trap. They also point to schemes to ease the transition back to work, including job grant payments and continued payments of some housing benefit or mortgage interest to the newly employed.

Just how big is the bill for benefits?

The cost of hand-outs swallows up more than one-quarter of Whitehall spending. In 2008-09 it reached £170bn and is likely to approach £200bn within three years. The Department for Work and Pensions (DWP) spent more than £135bn on benefits in 2008-09, a rise of £40bn in a decade. By far the largest chunk – £62.7bn – went on pensions, which is an accelerating cost for the taxpayer because of the steadily increasing life expectancy of the British population.

Housing benefit accounted for £17.2bn, disability benefit for £16.2bn and income support for £8.7bn. jobseekers' allowance only represented £2.9bn, but the government acknowledges that spending on this benefit will soar as dole queues reach three million. HM Revenue and Customs, meanwhile, spent a further £34.1bn on benefits this year – £23.7bn for Gordon Brown's cherished system of tax credits (an increase of £10bn in five years) and £11.2bn for child benefit.

Can the numbers be reduced?

Slashing the benefits bill is the top priority for any politician committed to tackling government budgets – not least because the public usually singles out trimming benefits as its preferred way of saving taxpayers' money. In practice there are two serious problems for a minister preparing to wield the axe.

First, the cost of benefits is likely to rise during economic downturns, just at the time when governments are under pressure to cut costs. For instance, the number of people out of work yesterday rose to a 14-year high of 2.47 million – one million more than six years ago.

Second, ministers tend to run into trouble when they specify which benefits they want to be cut. An assault on incapacity payments would outrage disability groups, a reduction of unemployment benefits attract charges of hard-heartedness, and any attempt to remove benefits paid to pensioners (by cutting winter fuel payments, for example) provoke rebellion among the group most likely to vote. It would be a brave Chancellor who taxed the child benefit paid to middle-class homes.

Would Mr Duncan Smith's blueprint bring down the benefits bill?

Yes and no. The Centre for Social Justice says it would cost £3.6bn to set up the system it proposes. But it argues that the cash would soon be recouped as the newly employed start paying tax and as employers (rather than civil servants) administer the payments. There would be a longer-term benefit too, it argues, because the benefits culture is being tackled.

How have the three main parties reacted to the report?

With a mixture of caution, suspicion and outright hostility. David Cameron described the Duncan Smith report yesterday as "very interesting" and promised to study it "very carefully" – apparent code for "don't expect anything in the near future". A Tory spokesman added: "Any changes to the system need intense and careful scrutiny." A Conservative government would also be likely to baulk at the £3.6bn upfront costs of the proposals, notwithstanding the potential long-term savings.

Meanwhile Jim Knight, the Employment Minister, said: "Iain Duncan Smith provides an exaggerated political analysis that paints the picture – wrongly – of a failing benefits and tax system. The truth is that the vast majority of people are better off in work, thanks to the reforms we have made."

Steve Webb, the Liberal Democrat work and pensions spokesman, labelled the plan "absurd". He said: "A one-size-fits-all approach won't work because different groups of people need tailored support. It is just nonsense to suggest that hundreds of thousands of people would suddenly walk into new jobs if the incentives were tweaked."

So what would they do instead?

A Conservative government is expected to streamline tax credits so that they are targeted on worst-off families and no longer paid to the middle class. They have promised to cut the bill for incapacity benefits by subjecting all claimants to tests of their fitness for work, and to strip jobseekers' allowance from people who turn down a "reasonable" offer of work.

Labour hopes to save money by issuing contracts to private companies to find jobs for the unemployed and has announced plans to reform the incapacity benefits system. Mr Brown has already announced that plans to extend paternity leave are being put on hold – although this saving will benefit the Department for Business rather than the DWP.

The Liberal Democrats agree with Mr Duncan Smith that the benefits system is too complicated, although stop far short of his dramatic solution by proposing a single "working-age benefit". They also want to refocus tax credits on lower income homes and have suggested that the child benefit system could be reformed.

Additional research by Peter Campbell

Is the benefits system just too complicated?

Yes...

* The intricate network of 51 benefits is hard to navigate – and easy to fiddle

* Any system that takes nearly 8,700 pages of guidance from Whitehall to summarise is flawed

* The more complicated the rules are on benefits, the more elaborate the bureaucracy to administer them

No...

* A nation of 61 million requires a flexible benefits system

* Some benefits are already being streamlined, with claimants able to apply for several benefits in one visit to the job centre

* There is no guarantee that Mr Duncan Smith's proposals would eventually cut the benefits bill

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments