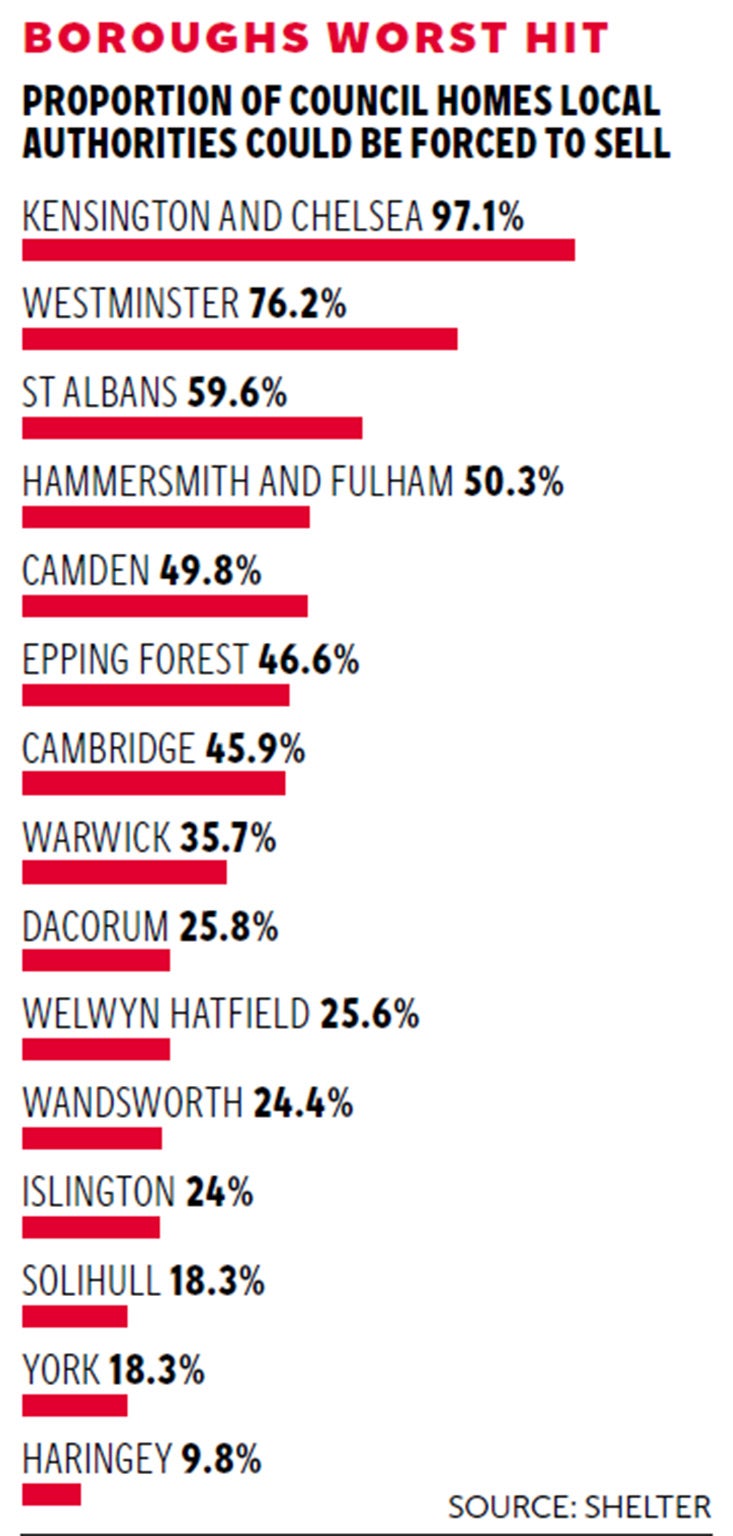

Right to Buy: Kensington and Chelsea council may lose 97% of its homes under new plans

Council house sell-off will be forced by controversial plans to extend scheme

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Local authorities could be forced to sell off 113,000 council homes under Government plans, a move that would mean Kensington and Chelsea in London being forced to dispose of a staggering 97 per cent of their housing stock.

The council house sell-off will be forced by the Government’s controversial plans to extend the Right to Buy scheme, according to analysis from housing charity Shelter.

The extension of the scheme to housing association tenants was a key commitment in the Conservative’s election manifesto. Under the plans, it will be extended to England’s 1.3 million housing association tenants, giving them the same opportunities as council housing tenants to buy their homes at a discount.

The scheme will force council homes worth more than a set threshold to be sold once they become vacant. The money raised would be used to fund new discounts of up to £100,000 for housing association tenants taking up the Right to Buy.

“The government needs to scrap this proposal and start helping the millions of ordinary families struggling with sky-high housing costs,” said Campbell Robb, Shelter’s chief executive. “If George Osborne is serious about turning around the housing crisis, the autumn spending review is his last chance to invest in the genuinely affordable homes this country desperately needs.”

The trigger threshold varies according to region, but starts as low as £80,000 for a one-bedroom property in the North-east of England and climbs to £1,205,000 for a five-bedroom home in London.

Even at that higher level, Kensington and Chelsea council would be forced to sell more than 6,600 homes once they become vacant, almost its entire remaining council house stock.

Meanwhile Camden in north London would be forced to sell 11,700 homes, almost half their total remaining stock.

For a standard two-bedroom home the threshold figure that would trigger a sale when a property becomes empty starts at £125,000 in the North east, rising to £400,000 in London. The threshold for three-bed homes starts at £155,000 and rises to £490,000.

Cambridge could lose almost 46 per cent of its total, or more than 3,200 homes, and York more than 1,400 homes – or nearly a fifth of total council housing stock.

“At a time when millions of families are struggling to find somewhere affordable to live, plans to sell off large swathes of the few genuinely affordable homes we have left is only going to make things worse,” warned Mr Robb. “More and more families with barely a hope of ever affording a home of their own and who no longer have the option of social housing, will be forced into unstable and expensive private renting.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments