How do prepayment energy meters work and what is being done to stop people being cut off?

Ofgem moves to stop forced installation as penalty for customers falling behind on their bills

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.UK energy regulator Ofgem has ordered energy companies to suspend the forced installation of prepayment meters in the homes of customers who have fallen behind on their bills.

It comes as British Gas is under pressure to explain how it will compensate “vulnerable” customers who faced debt collectors forcibly installing the meters, following damaging allegations about the practice reported by The Times.

The investigation revealed how customers – including disabled and mentally ill people – had been forced by British Gas onto the pay-as-you-go meters or face having their gas switched off.

An undercover reporter for the newspaper worked for debt-collecting contractor Arvato Financial Solutions and accompanied agents on the job, witnessing them use court warrants to gain entry into customers’ homes to force-fit the meters.

Business secretary Grant Shapps branded the revelations “outrageous” while energy minister Graham Stuart has asked Centrica, which owns the energy giant, to urgently outline “redress” for “mistreated customers”.

Ofgem has called for “action, not warm words”.

Last month, a report by Citizens Advice found that an estimated 3.2m people across Britain ran out of credit on their prepayment meter last year, meaning one person every 10 seconds was quite literally left in the dark.

Based on Ofgem figures, the charity estimated that 600,000 people were forced onto a prepayment meter because they could not afford their energy bills in 2022, up from 380,000 in 2021.

Citizens Advice said it feared a further 160,000 people could be switched by the end of this winter if no further action is taken amid the ongoing cost of living crisis.

“All too often the people finding it hardest to pay their bills are being forced on to a prepayment meter they can’t afford to top up,” said Dame Clare Moriarty, the advisory service’s chief executive.

“This puts them at real risk of being left in cold, damp and dark homes. The staggering rise in the cost of living means many simply cannot afford to heat and power their homes to safe levels.

“New protections are needed to stop people being fully cut off from gas and electricity. Until then, there must be a total ban on energy companies forcing those already at breaking point onto prepayment meters. If Ofgem doesn’t act, the government must intervene.”

The regulator has now, belatedly, answered that call.

As it stands, a customer who falls significantly behind on their monthly bills is typically asked by their energy supplier to move to a pay-as-you-go prepayment meter to ensure the provider gets paid.

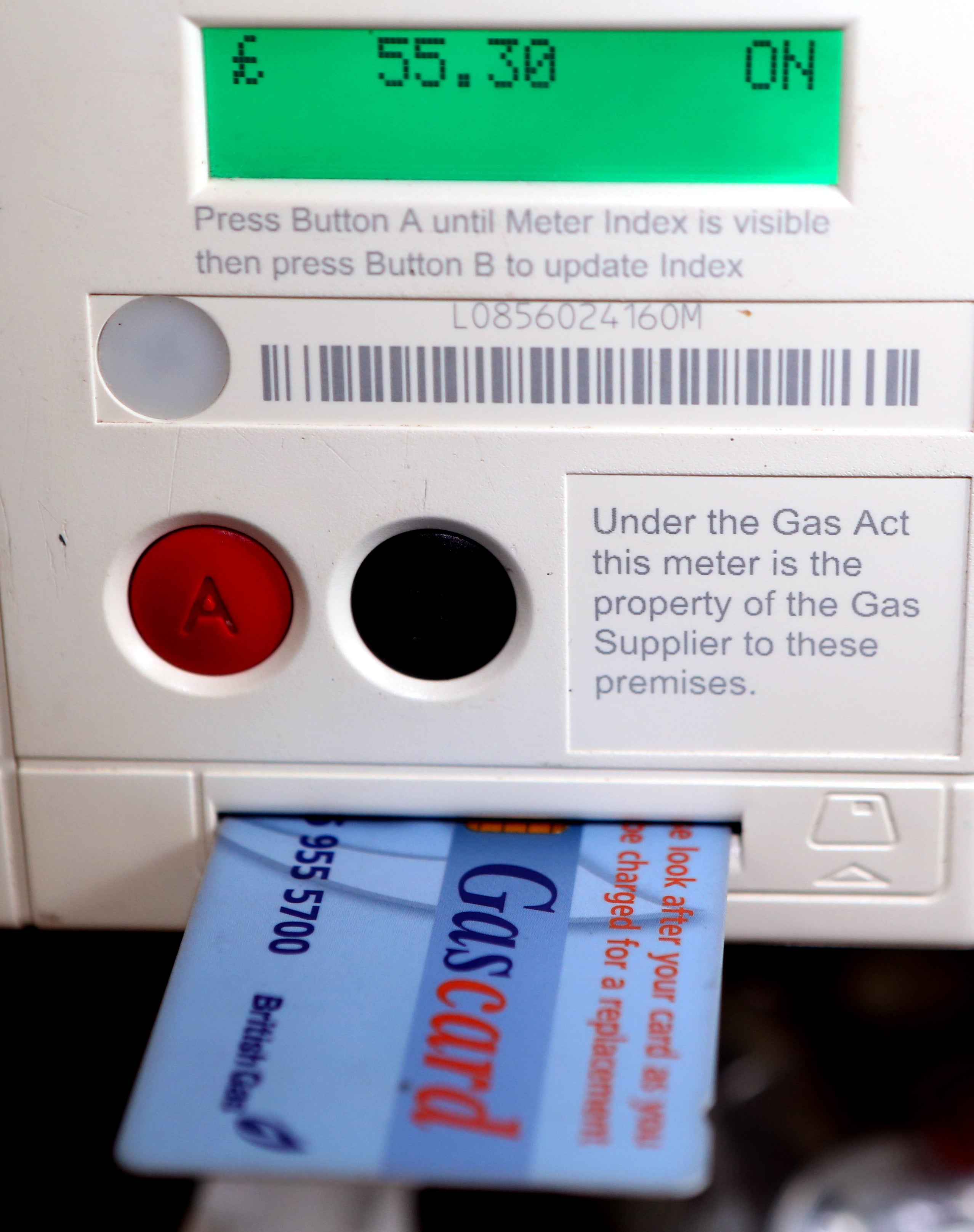

Users effectively pay before using the energy, rather than responding to a bill after the fact, by topping up a smart card with credit. This is then fed into the wall-mounted unit and grants the household power until the credit is used, at which point they will need to load more money onto the card or go without electricity and gas.

The switch to this pay-as-you-go model can be made remotely if the individual in question has a smart meter but, if not, suppliers or debt collection agencies acting on their behalf have been able to obtain warrants to enter homes, with some magistrates reportedly granting hundreds of such requests in one sitting.

Simon Francis, co-ordinator of the End Fuel Poverty Coalition, expressed his support for Citizens Advice’s campaign and commented: “Energy firms and the government should hang their heads in shame.

“Magistrates who approved court warrants in bulk for energy firms to install prepayment meters should also reflect on their role in this injustice.”

What makes the practice doubly contentious is the fact that prepayment meters charge customers for energy at a higher rate than they would be billed on a contract paid monthly or by direct debit. This means people already in debt can be left with no choice but to effectively “self-disconnect” whenever they cannot afford to top up.

For many, Citizens Advice found, this is far from a one-off event, with more than 2m prepayment customers having to go without power at least once a month, with 19 per cent of those cut off then spending at least 24 hours without gas or electricity, leaving them unable to turn the heating on or cook a hot meal.

“Why should those with the least pay more for their energy?” Labour shadow chancellor Rachel Reeves tweeted in response to the report on 12 January. “It’s outrageous, unjustifiable, and Labour will put an end to this penalty.”

A government spokesman responded to the findings by saying: “The government expects energy suppliers to do all they can to help customers who are struggling to pay their bills and suppliers can only install prepayment meters without consent to recover debt as a last resort.

“The regulator Ofgem requires energy suppliers to offer solutions for customers in, or at risk of, debt or disconnection. This includes offering emergency credit to all prepayment meter customers and additional support credit to customers in vulnerable circumstances.”

Citizens Advice said it was particularly concerned about the impact of the practice on disabled people and those living with long-term health conditions, who, according to Ofgem guidelines, are supposed to be protected from being forced onto a prepayment meter to prevent such circumstances arising as them being unable to refrigerate vital medication.

The advisory service previously raised concerns with both Ofgem and the government that it had seen evidence of suppliers forcing people in these groups onto pay-as-you-go meters regardless.

Ofgem duly warned suppliers last October that not enough was being done to identify customers in vulnerable circumstances before installing a prepayment meter.

However, Citizens Advice now reports that, in the month following that intervention, more than a third of prepayment meter households including a disabled person, or someone with a long-term health condition, were cut off from their energy supply at least once, hence its calls for reform.

“Suppliers are required to have exhausted all other options before installing a prepayment meter by warrant – only after repeated unsuccessful attempts to contact the customer to discuss repayment options and checks to ensure they do not go ahead when customers are in the most vulnerable situations,” said Energy UK deputy chief executive Dhara Vyas.

“The energy industry is very aware of the challenges millions of households are facing right now – which means difficult decisions around indebted customers as suppliers are required to try and prevent them falling further into arrears. Any increase in bad debt ultimately ends up costing all consumers more money, as it is recouped from bills.

“Energy suppliers are discussing these concerns with the government and the regulator, including looking at options to reduce the price that prepayment customers pay.”

Additional reporting by agencies

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments