Windrush pensioner, 92, among overseas NatWest customers to have accounts axed by bank

Exclusive: Philip Cato had thousands of pounds withheld by the bank after it shut his account in clampdown on overseas account holders

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.A 92-year-old Windrush pensioner is among “hundreds” of NatWest bank account holders living overseas to have their accounts axed, The Independent can reveal.

Philip Cato, who lived in Britain for over 50 years but has since retired to Jamaica, was not able to access his UK state pension for seven months due to the closure in January this year.

Mr Cato’s daughter Judy said the “stressful” situation had impacted him, his 82-year-old wife and their family, who found it impossible to get help from the bank to access the thousands of pounds it had withheld.

But following intervention from a solicitor, NatWest was forced to hand over his backdated pension two weeks ago.

It comes after former Brexit Party Nigel Farage said his bank account was unfairly shut down by private bank Coutts, owned by NatWest Group, because it did not agree with his political views. The row sparked an outcry and led to the resignation of NatWest boss Dame Alison Rose.

Are you an overseas resident who’s been affected by UK bank account closures? If so, please email nadine.white@independent.co.uk

NatWest said it had pulled the plug on some overseas personal accounts in favour of a “UK-centric” approach to business.

But customers told The Independent they had been left without sufficient warning of the closures or inadequate support on how to access their money, with Mr Cato’s lawyer saying she believed hundreds of customers had been affected.

A spokesperson for NatWest said: “We have taken the decision to stop offering banking services to a number of personal customers in some countries of residence outside the UK. We’re doing so as we focus on investing in and providing great services for those customers in our core market.

“We will always get in touch directly with impacted customers if any changes are made to their account-servicing arrangements. We will always treat customers fairly by giving them clear information and timelines about next steps.”

Having migrated from Jamaica to Britain in the 1960s, Mr Cato lived and worked here for 50 years prior to his retirement, holding a NatWest account throughout that time.

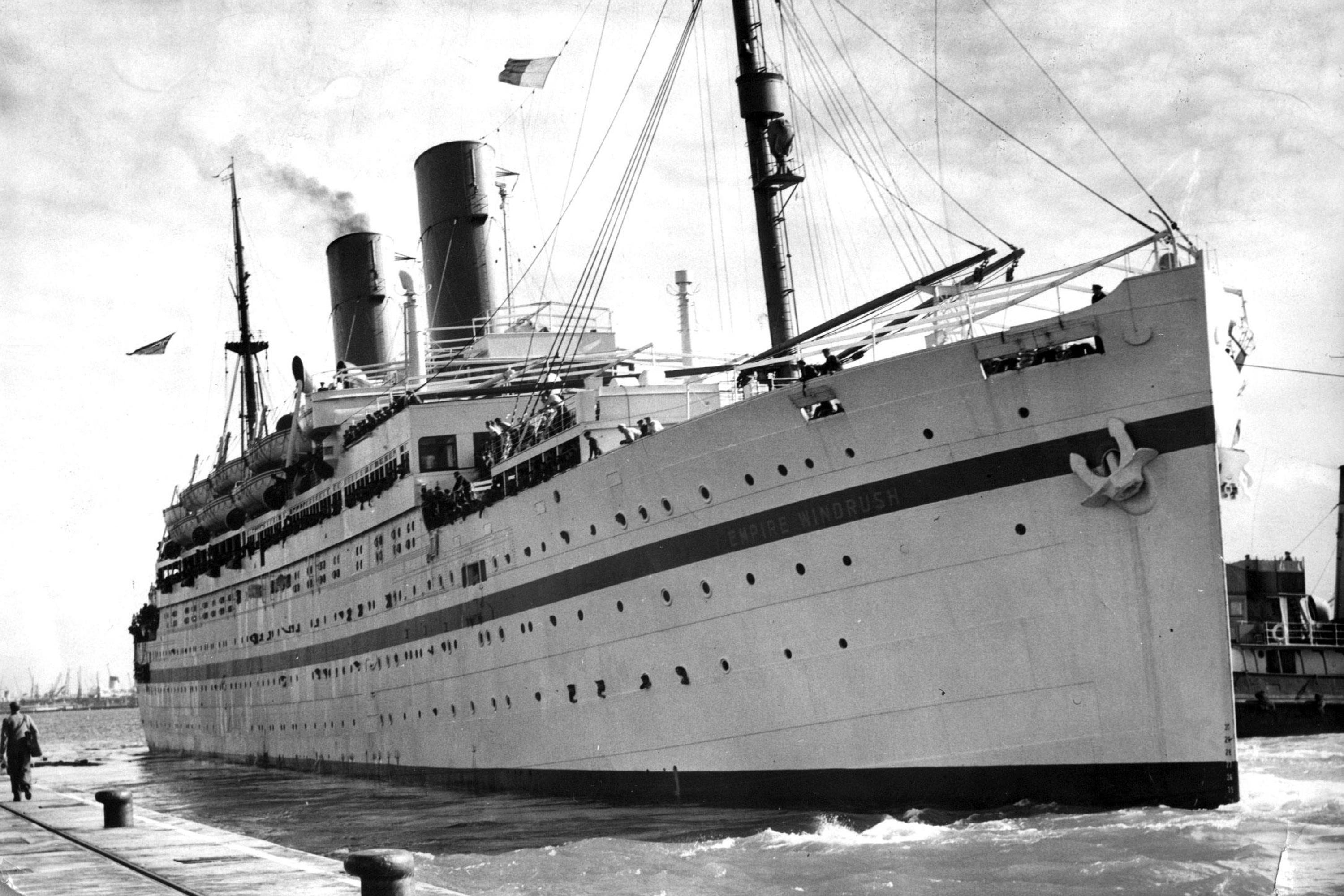

Mr Cato came to Britain along with more than half a million Caribbean migrants between 1948 and 1972 to rebuild the country after the Second World War.

NatWest claimed it had given him six months’ notice of its intention to close his account having written to his Jamaican address in July 2022. However, due to various delays, the pensioner didn’t receive the correspondence until December 2022 and the account was closed the following month.

The letter, seen by The Independent, says: “As a business we have taken the difficult decision to reduce the number of countries in which we service our customers.”

NatWest declined to say how many customers were affected, which countries were being targeted and how it made the decisions but confirmed it did not apply to all countries where customers live abroad.

The Independent is aware of several cases of overseas pensioners being affected by “abrupt” closures, including in Jamaica and Barbados.

Pauline Campbell, the lawyer representing Mr Cato, said his banking records would have clearly shown he was a 91-year-old man when NatWest threatened the closure, yet “no consideration” was made for how difficult it would be for him to navigate the closure of an account into which his state and private pension was paid.

She added: “Although this has now been rectified, the pain and suffering he and his elderly wife have faced over the past seven months starts with NatWest’s decision.”

Ms Campbell, a pro-bono lawyer for Windrush victims and author of Rice & Peas & Fish & Chips, added: “In the past two weeks we have witnessed people in high positions resigning due to the Nigel Farage issue, yet no one has taken account of the unnamed ordinary men and women impacted by such a mammoth and inequitable decision. Jamaica is just one country affected, but the question that has to be asked is why Jamaica?

“Once again, as with the hostile environment, a number of those affected are of the Windrush Generation, making it clear that it is not the vulnerable that are heard it is the ones with political clout that NatWest have apologised to.”

Meanwhile, the Muslim Council for Britain has called for an impartial review that not only addresses the mechanisms behind bank account closures but also examines why British Muslims are disproportionately affected by the issue.

The Financial Conduct Authority (FCA), which regulates UK banks, said financial institutions should have due regard for the interests of their customers and treat consumers fairly.

An FCA spokesperson said: “Banks may set their own requirements on country of residence for account holders and must comply with local law and regulation when serving customers outside the UK.

“Whether or not banks decide to extend services to customers outside of UK is a commercial decision for them, but we expect them to treat their customers fairly, comply with equalities legislation, and provide adequate notice to the customer if they decide to close their account.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments