Number of women in work in Britain hits record high - but figures show the gender pay gap is growing too

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

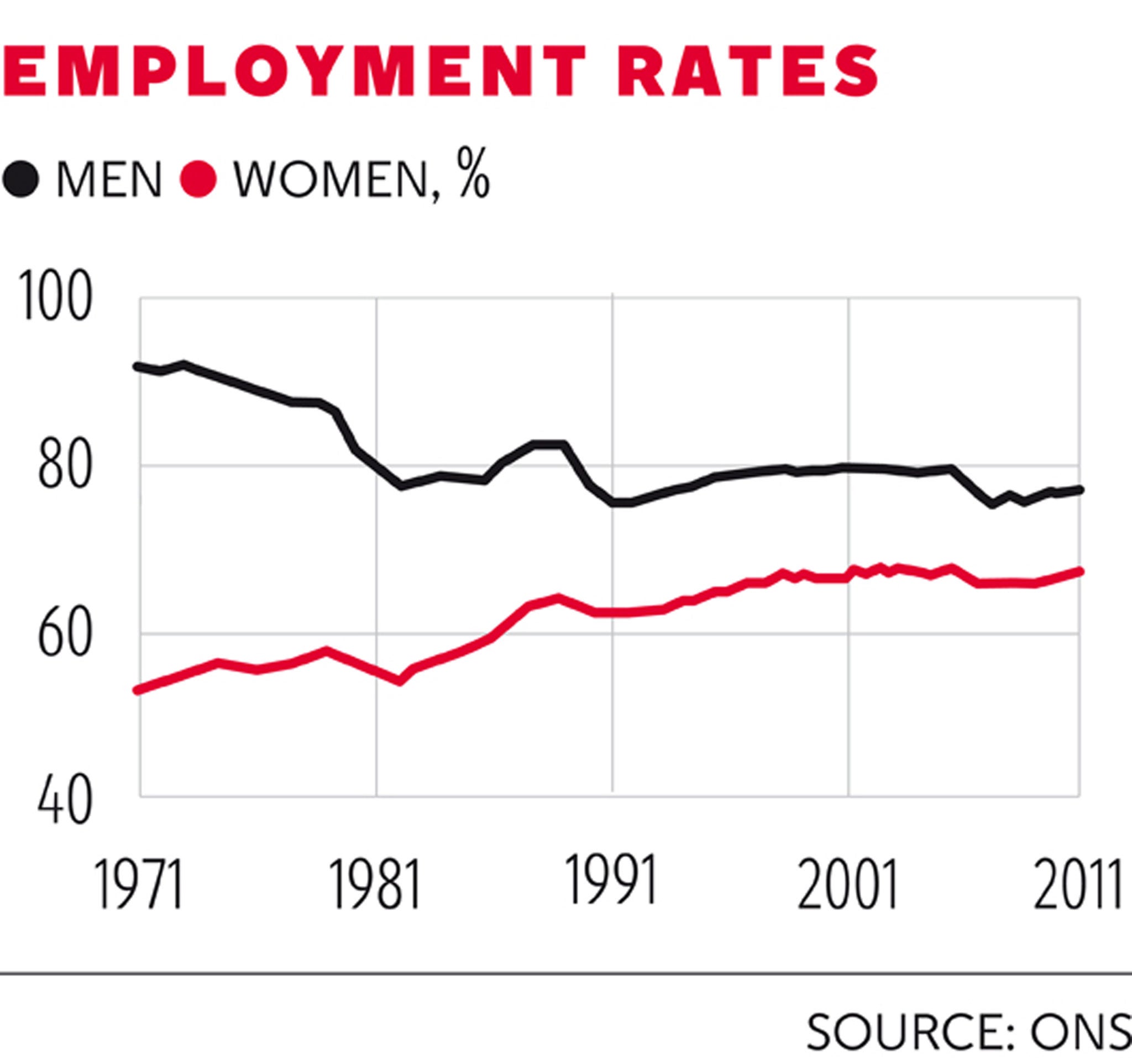

Your support makes all the difference.More women are in work than ever before as official figures show a record-breaking 14 million now have jobs. The female employment rate reached 67.2 per cent last year, the highest since the Office for National Statistics’ records began.

However, experts cautioned today that this rise had coincided with an increase in the gender pay gap, as median wages for women fell. The increase was also largely created by more women declaring themselves self-employed, which could mean many pocketing paltry sums far below the minimum wage.

Overall, 193,000 more men and women got jobs between October and December 2013, taking the total number in work to 30.15 million people. British workers made up almost nine tenths of the employment rise.

Diane Elson, Chair of the UK Women’s Budget Group, which analyses how women fare in the labour market, told The Independent: “While it’s good to see women’s employment rate increasing, we have to look at the quality of employment. There are two things in the latest statistics that the Government is not highlighting: median wages and self-employment.”

The median weekly earnings for men rose from £502 to £508 over the last year, but for women they fell from £413 to £411. This means the gender pay gap has now risen from £89 to £97 pounds a week.

Much of the rise in employment amongst women was down to more declaring themselves self-employed. Professor Elson believes that this category could hide large numbers putting in very long hours for little financial return.

The number of women registered as self-employed went up 5.3 per cent between the last quarter of 2012 and the same period last year, to 1.357 million. Amongst men, self-employment rose by only 2.8 per cent.

Long-term unemployment, which often stays stubbornly high, fell by 45,000 in the three months to December 2013. Job vacancies were also up, increasing by 28,000 to 580,000 in the last quarter.

Employment Minister Esther McVey said: “With employment continuing to increase, it’s clear that the Government’s long-term plan to build a stronger, more secure economy is helping businesses create jobs and get people into work.

“Record numbers of women are in work and youth unemployment continues to fall, which means more people have the security of a regular wage and can plan for their future.”

The number of young people in work increased by 49,000, with those claiming Jobseeker’s Allowance falling for the last 20 months. However Rachel Reeves MP, the shadow Work and Pensions Secretary, said unemployment amongst young people was still worryingly high.

“While today’s fall in overall unemployment is welcome, the Government must not be complacent”, she said. “More than 900,000 young people are still unemployed and over 250,000 young people have been unemployed for over a year. Today‘s figures also show working people facing a cost-of-living crisis are over £1,600-a-year worse off since David Cameron’s became Prime Minister.”

Although unemployment fell by 125,000 in the last quarter, there were indications that improvements to the labour market were slowing. The unemployment rate increased from 7.1 to 7.2 per cent between the penultimate and last quarter of the year.

TUC General Secretary Frances O’Grady said: “These are encouraging figures for the millions of people desperate for work...But people already in work have less to cheer about with prices still rising twice as fast as wages. While we have a record proportion of women in employment the widening gender pay gap means many women are not getting the fair pay they deserve.”

Case study: The graduate, back on track

Chloë Wright, 27, from Ironbridge Gorge in Shropshire, said:

“After graduating from university [Aberystwyth] in 2008 I had a string of part-time jobs to make up a full-time wage. One of my employers, a champagne company, then took me on full time.

But after about 18 months the company closed and I was made redundant. I wasn’t entitled to jobseeker’s allowance because I was living with my partner, who had also just been made redundant. I started cleaning houses for friends to earn enough money to pay my rent.

I was unemployed for about four months when I managed to get a part-time job doing marketing for a hotel that had seen some of my previous work.

I finally got a full-time job as a marketing executive at an IT company through an agency. It felt great to get back into full-time work. It was a huge relief and it’s brilliant to have my career back on track.”

Case study: The breadwinner - ‘I treat him quite a lot’

Helen Cox, 39, is a programme manager at the BBC. She lives in Clacton-On-Sea with her partner.

“My partner works ad hoc as a landlord, but mostly he’s renovating the house that we bought. I earn about £45,000 a year more than he does. We’ve been together just over three years.

I was earning more than him when we first met. He was happy we had the opportunity to pool our resources: his skills and my income, so it hasn’t really been an issue, apart from when I want to spend a lot of money on a holiday!

We’ve kind of adjusted to the difference in earnings. He knows what my means are and I know what his expectations are. I will buy all the theatre tickets, for example, and that’s just kind of accepted. I treat him quite a lot. If I make a decision like having organic vegetables, I will buy them.

I don’t really see myself as supporting him. He’s working hard on the house and he has enough money to support himself. We do have a joint bank account but we just put money for the bills and the mortgage in that, it’s not where the shopping or going out money goes. We both have separate bank accounts too. I think it’s important to keep those things separate.

I think more women are becoming the breadwinners and I’ve also got several friends whose partners are taking on the opposite role of homemaker. They’re staying at home and raising the children because the women are earning more so it makes more financial sense for them to return to work.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments