More than a billion pounds a year 'lost to Government due to wealthy Britons avoiding tax'

'You can choose how much you want to pay, it’s pretty much down to your moral barometer'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.More than a billion pounds a year is being lost to the Government due to wealthy Britons avoiding paying the taxes that they should, according to a tax industry insider.

And a former tax inspector who runs a company helping people minimise the amount they pay to HM Revenue and Customs (HMRC) hints that former Prime Ministers are among his clients.

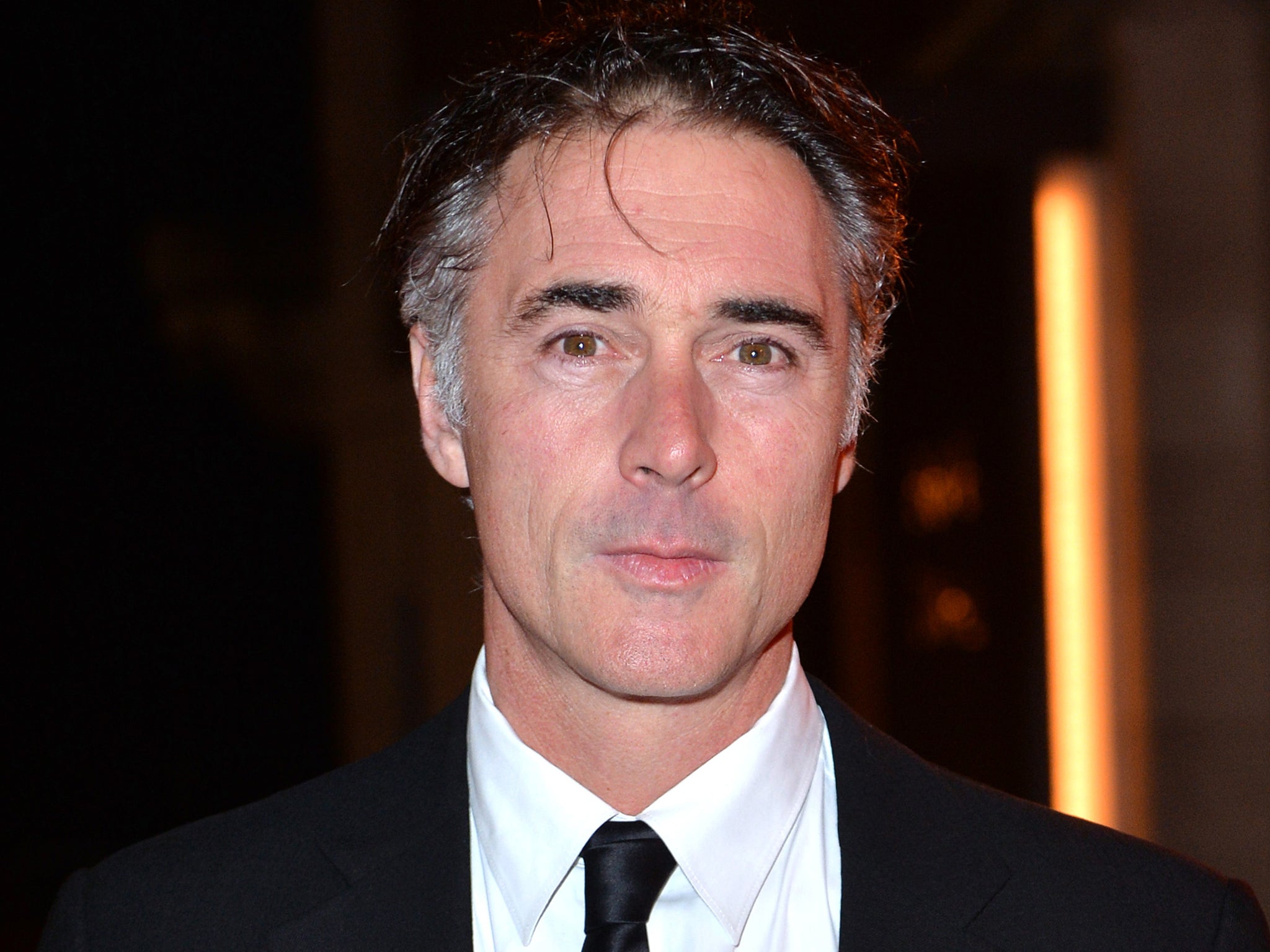

The claims have been made to actor Greg Wise, during an undercover investigation into how the rich avoid tax.

He described how he played the part of “morally ambiguous greedy actor Greg Wise seeking to zero his tax bill,” and arranged a series of meetings with financial consultants which were secretly filmed.

The actor, who is married to Emma Thompson, commented: “Between us we make a fair pile of money so it’s only right that we hand over a chunk of that to the government in the form of taxes. But a lot of rich people try and avoid paying their dues, that makes me angry.”

Britain’s tax code is more than 22,000 pages long, and its “enormous size and complexity means it’s got more holes in it than a Swiss cheese and is ripe for aggressive exploitation,” commented the actor.

His investigation into how easy it is not to pay the tax you should will be broadcast on Channel 4 on 8 February.

In a telephone call, Tony Ashbolt, who runs a company called Connaught Corporate Solutions, tells Mr Wise: “Tax, as I say to all clients, is voluntary. You can choose how much you want to pay, it’s pretty much down to your moral barometer.”

When the two meet, Mr Ashbolt suggests a scheme whereby the actor would set up an offshore trust in Belize to avoid tax. “Money never goes to Belize, only paper, we use Belize because they are cheap, because they will let you do this structure, they will let you then in effect manage your own money.”

He adds: “I pay a little bit of tax because I just play the game with them so what I do is I declare to them 40,000 pounds a year in income, so from me I pay around about two to three thousand pounds a year in tax. That’s it. The rest of my money goes through the trust.”

Mr Ashbolt subsequently claimed the tax planning he was suggesting was a remuneration trust - something which the HMRC says is entirely legitimate. Connaught Corporate Services did respond to requests for comment from the IoS.

Another company featured in the film, Valhalla Private Client Services, promotes a scheme which revolves around exploiting tax credits people can get from putting money into the Government’s Enterprise Investment Scheme (EIS).

Mr Wise meets Peter Nichols, a partner in the firm, and says he’s looking for ways to stop paying tax. “That’s very simple for me because that’s what we do,” replies Mr Nichols, a former tax inspector. “When a client comes to us we ask whether it’s all your tax or some of your tax because you are actually capable of zeroing your tax bills... you can remove your tax bill in its utter entirety if that’s what you want to do.”

He adds: “I’ve got people who were in number 10 in some of my schemes, it would be dynamite for the newspapers to be honest but it never comes to light, it’s very very confidential.”

Mr Nichols founded Chancery UK, a film finance and tax planning firm which went into liquidation last year, and is also director of the Aegis Film Fund, which funded Oscar-winning film The King’s Speech.

In a statement, Valhalla Private Client Services said it “promotes EIS schemes for genuine commercial reasons.” The company “does not condone tax evasion,” it added.

The documentary also features an industry insider who admits the sole purpose of their former company, which sold tax avoidance products, was to “make people’s tax liabilities disappear.”

The individual, speaking in the film under condition of anonymity, claimed their company alone ensured that more than £100m did not go to HMRC.

The scale of the problem is far bigger, they argue: “It’s reasonable to assume that hundreds of millions, if not more than a billion, is being lost to the revenue every year.”

People should do the right thing and not get involved in complicated schemes designed to reduce tax, said Conservative MP Stephen Phillips QC, a member of the Public Accounts Committee. “When you’re engaged in that sort of behaviour you know you’re doing wrong. It may not be a criminal offence but it’s just not right morally.”

He added: “We live in a society which is based upon cohesion and it’s just not right that some people are paying their taxes and some people are either avoiding them or indeed just not paying them at all and are criminals, and that has to change.”

In a statement, an HMRC spokesperson said: “Tax avoidance schemes like those shown in this programme simply do not work. We shut them down quickly and make sure we track down money due to the Exchequer.” They added: “People tempted by these schemes will be left facing a potentially life changing bill that can include the tax, interest and penalties.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments