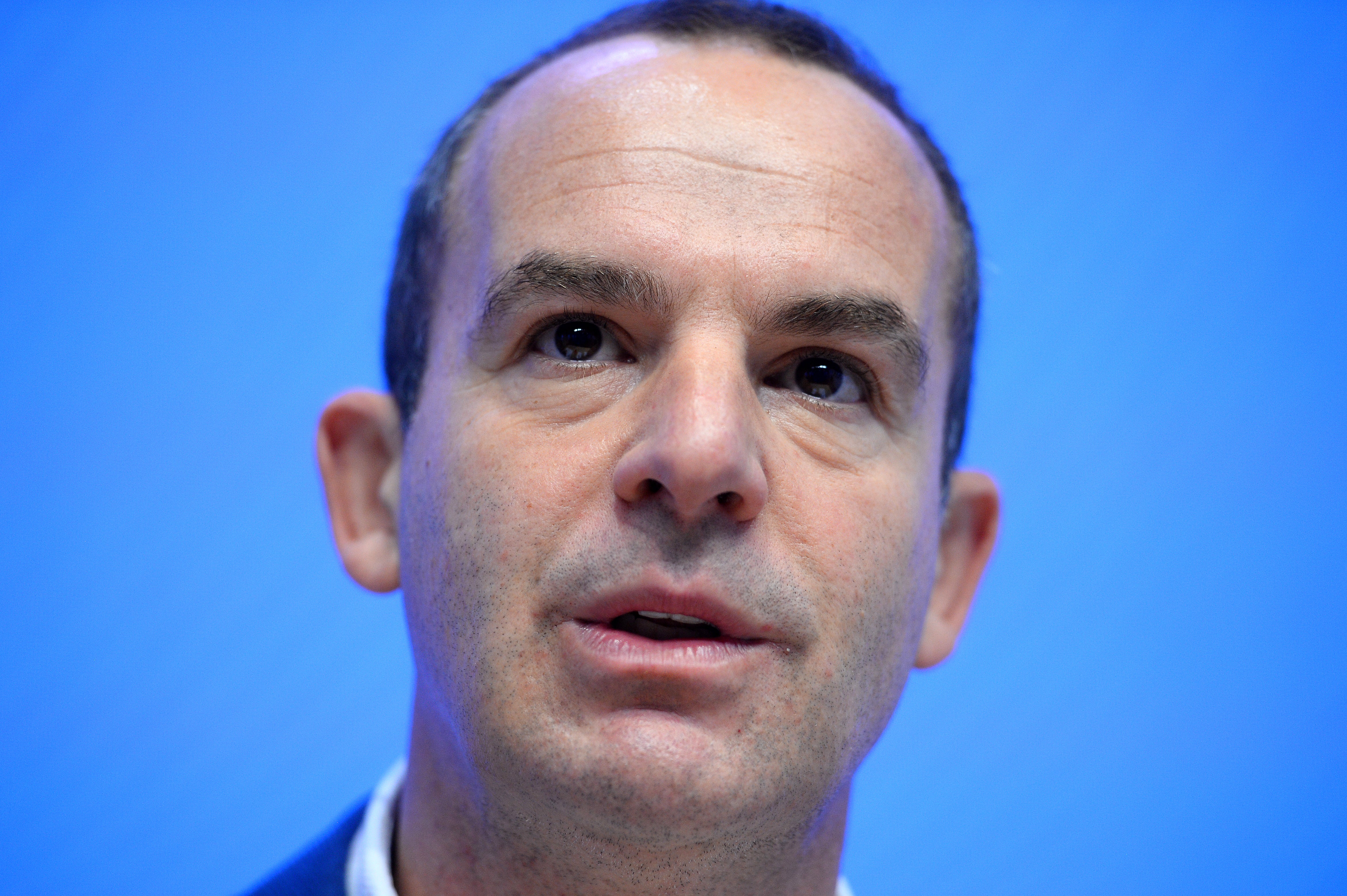

Martin Lewis urges homeowners to make simple check which could save £1,000

Homeowners should check their mortgage after the Bank of England put interest rates up again

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Homeowners have been urged to check their mortgage following an increase in interest rates for the fourth consecutive time last week.

Money saving expert Martin Lewis said those on variable tariffs have around a month to look for other potential deals before their bills go up.

Others on fixed deals due to expire soon might want to think about locking into a new tariff now as well, he said in his Wednesday consumer affairs newsletter.

He said: “The cheapest rates have disappeared - if your fix ends soon-ish or you're on the standard rate, check now if you can save.

“The 0.25% point base rate increase will likely take a month to feed through to most standard variable rates (SVRs), though some tracker rates have already gone up. It will add roughly £12/mth per £100,000 of mortgage.”

There were 50 fixed-rate mortgage deals below 1 per cent last autumn but now the lowest fix is 2.1 per cent, meaning someone with a £200,000, 30-year mortgage, would now be paying £120 a month more than October's cheapest.

"With further rate rises predicted, and many lenders' default standard variable rates heading to 5%, checking if you can save by changing deal is a must-do," Lewis added.

"You may not save as much compared to a few months back, but compared to doing nowt, switching could still help you save £1,000s."

It comes as further rises to base rates are expected, with analysts Capital Economics predicting it to be 1.25 per cent by the end of 2022 and 2 per cent in 2023.

David Hollingworth, associate director at L&C Mortgages, told Mirror Online: “The market is moving at breakneck speed as lenders try to manage their product ranges and lending volume, often resulting in products lasting days rather than weeks.

“That presents a real challenge for borrowers trying to keep on top of market movements but with continuing increases in mortgage rates it’s all the more important for borrowers to keep a tight rein on their mortgage.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments