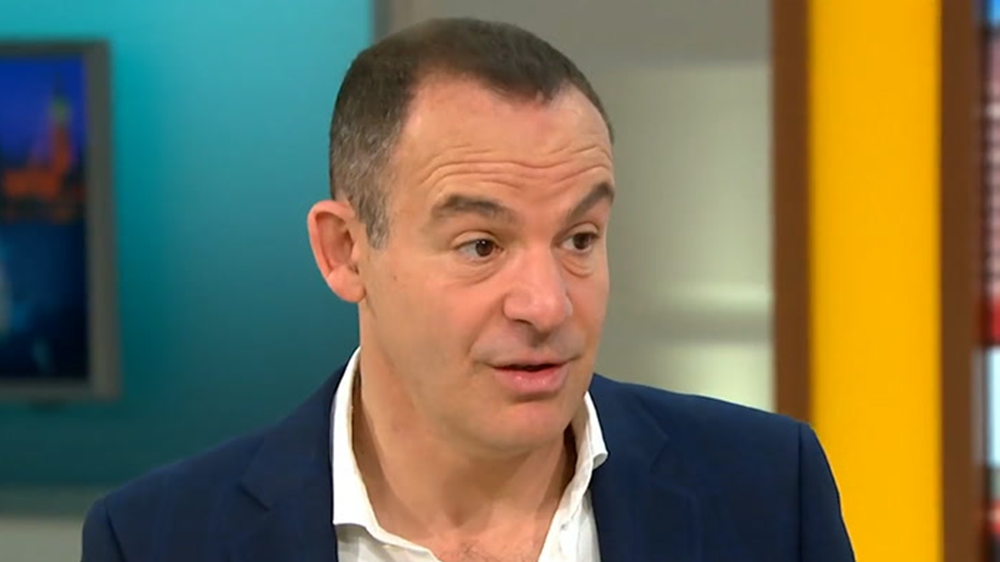

Martin Lewis reveals how you can get £200 in free cash

Money Saving Expert shares best incentives currently offered by banks when you switch

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Martin Lewis has issued advice to people seeking to switch their bank accounts, which could see them earn up to £200.

The Money Saving Expert has encouraged people to take advantage of introductory sweetener deals offered by banks when they change. He also urged caution, however, that this could impact a person’s credit rating.

Answering audience questions on Good Morning Britain today, Mr Lewis was quizzed by a woman named Sarah over whether she should close her account and take advantage of the cash incentive offered by an alternative bank.

She also asked Mr Lewis whether this might affect her credit rating, to which he replied: “You don’t have a credit rating. You are credit scored individually by each firm. But evidence of longevity of a bank account tends to be good for your credit scoring.

“What I would say is, it’s very trivial switching bank, and the benefits are good, so do it. But if you’re within three months from a major credit application such as re-mortgaging, that’s bad timing, right? Don’t do it in the three months in a run up to or a big balance transfer, but otherwise get on and do it.”

Mr Lewis then went on to run through some of the best incentives currently offered by banks when you switch.

He said HSBC has just launched a free £200 offer, as well as a five per cent linked regular savings account.

He added: “You’ve got NatWest and RBS Rewards sister banks that also give you a free £200 for switches you need to use their switching services. There will be a credit check for this and check the eligibility terms.

“There are various different ones. I haven’t got time to run through them all. It also gives you £3 a month cash back. What it actually does is it charges you £2 a month, and it gives you £5 a month. So that’s a net £3 a month, £36 a year as long as you’re using its app and you’ve got enough direct debits going out and a six per cent linked regular saver, and then you’ve got First Direct.

“The other one that pays pays slightly less than 175 quid. But that has come top or near top of every customer service poll I’ve ever done. Rated 90 per cent great in the last one.

“It’s got a seven per cent linked regular saver and a zero per cent overdraft, up to 250 quid. So if service is what counts for you, that is probably the winner. If money is what counts for you, it’s one of the other two.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments