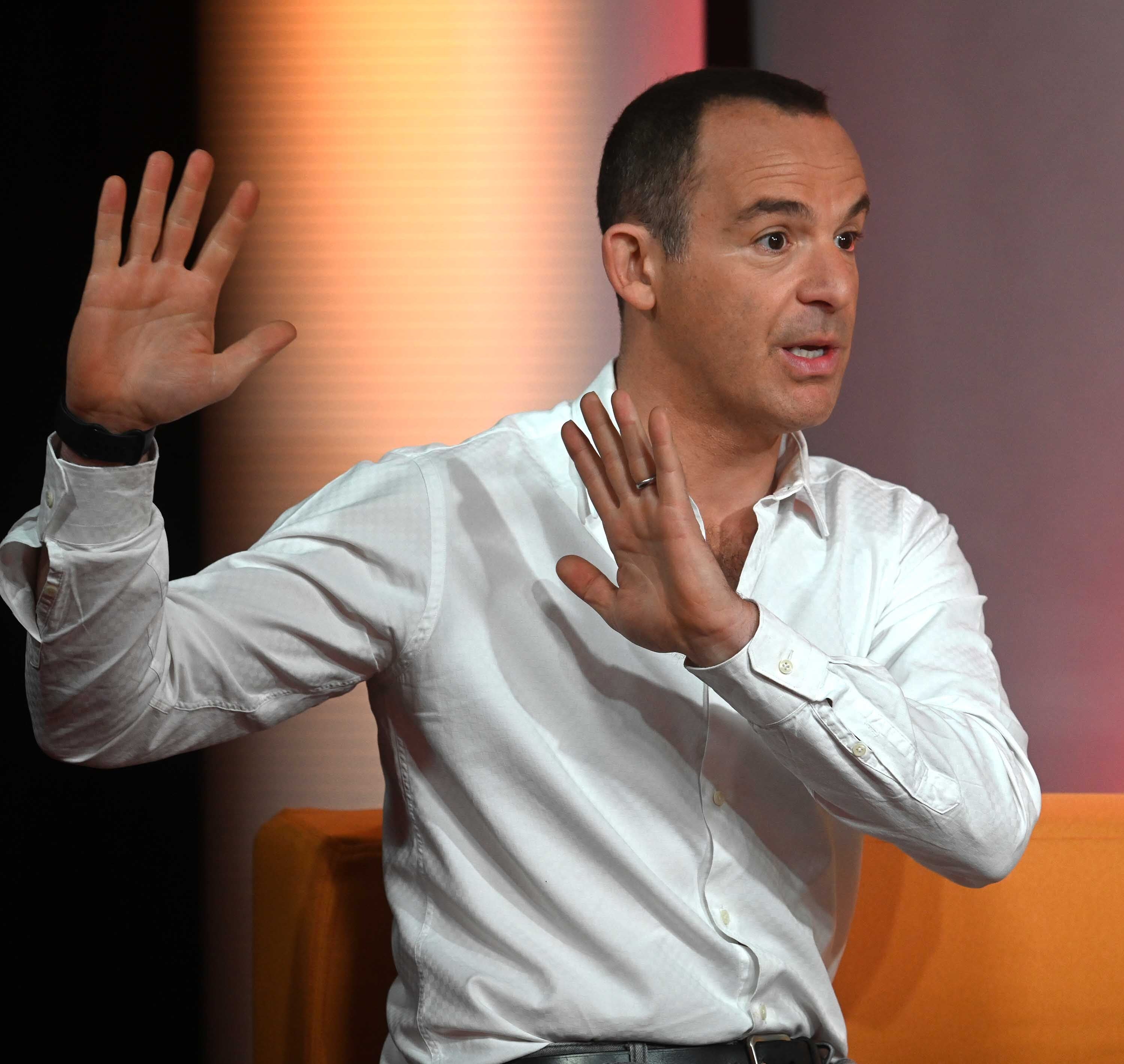

Martin Lewis issues mortgage ‘ticking time bomb’ warning to homeowners

Money Saving Expert urges homeowners to ‘lock in’ cheap rates before payments become too expenive

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Martin Lewis has warned of a "ticking time bomb" for homeowners, as he urged them to act quickly to lock in cheap rates before payments become too expensive.

The Money Saving Expert hosted a one off special show on ITV last night to advise Britons on how better manage their finances amid rising food, fuel and energy bills.

He issued a specific warning about fixed rate mortgages, saying some people could struggle to afford the payments if they fail to secure a better deal when their current rate expires.

Mr Lewis said: "If you're coming to the end of your rate, you need to prepare in advance."

His comments come just weeks after Andrew Bailey, the Bank of England governor, announced that base interest rates would rise by 0.25 percentage points to 1 per cent in a bid to tackle soaring inflation.

Rising interest rates increase the cost of borrowing. Homeowners on fixed-rate deals which follow the Bank's interest rates could face having to make bigger payments.

Mr Lewis said he had some "real concerns about mortgages right now".

He advised homeowners: "You might even want to pay a booking fee to lock in a cheap mortgage in case things get more expensive and if it doesn't you can get a cheaper one elsewhere, so it's like an insurance policy so you lose a few hundred quid having locked in a cheap mortgage."

He added: "Now if you look at the impact on mortgages, six months ago you could get mortgage deals below one per cent, mortgage fixes below one per cent, the cheapest fixes are now double that at 2.1 per cent.

"So the cost of getting a mortgage is going up. And if I'm honest I have some real concerns about mortgages right now. This is the concern, we're seeing rates go up, but you also have to remember to get a mortgage, to be accepted, you have to pass a credit check and an affordability check.

"Now we are clearly in the midst of a cost of living crisis. So everybody has less room than they did before because other costs have gone up.

"So my great fear is we're seeing interest rates go up and fewer people are going to be accepted when they apply for a mortgage because more are going to fail affordability checks.

"And that leaves us with a ticking timebomb because most people are on cheap fixes and they're going to expect to fix again on the cheap rate and it's going to be a lot higher and they may not be able to get them and that is a real problem coming forward."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments