Bank of England raises interest rates to 5% amid mortgage crisis

Bank of England governor Andrew Bailey warns further rises likely if inflation remains high as critics accuse him of being ‘asleep at the wheel’ in bid to curb spiralling prices

The Bank of England has hiked interest rates to 5 per cent in a further blow to homeowners struggling with spiralling mortgage costs.

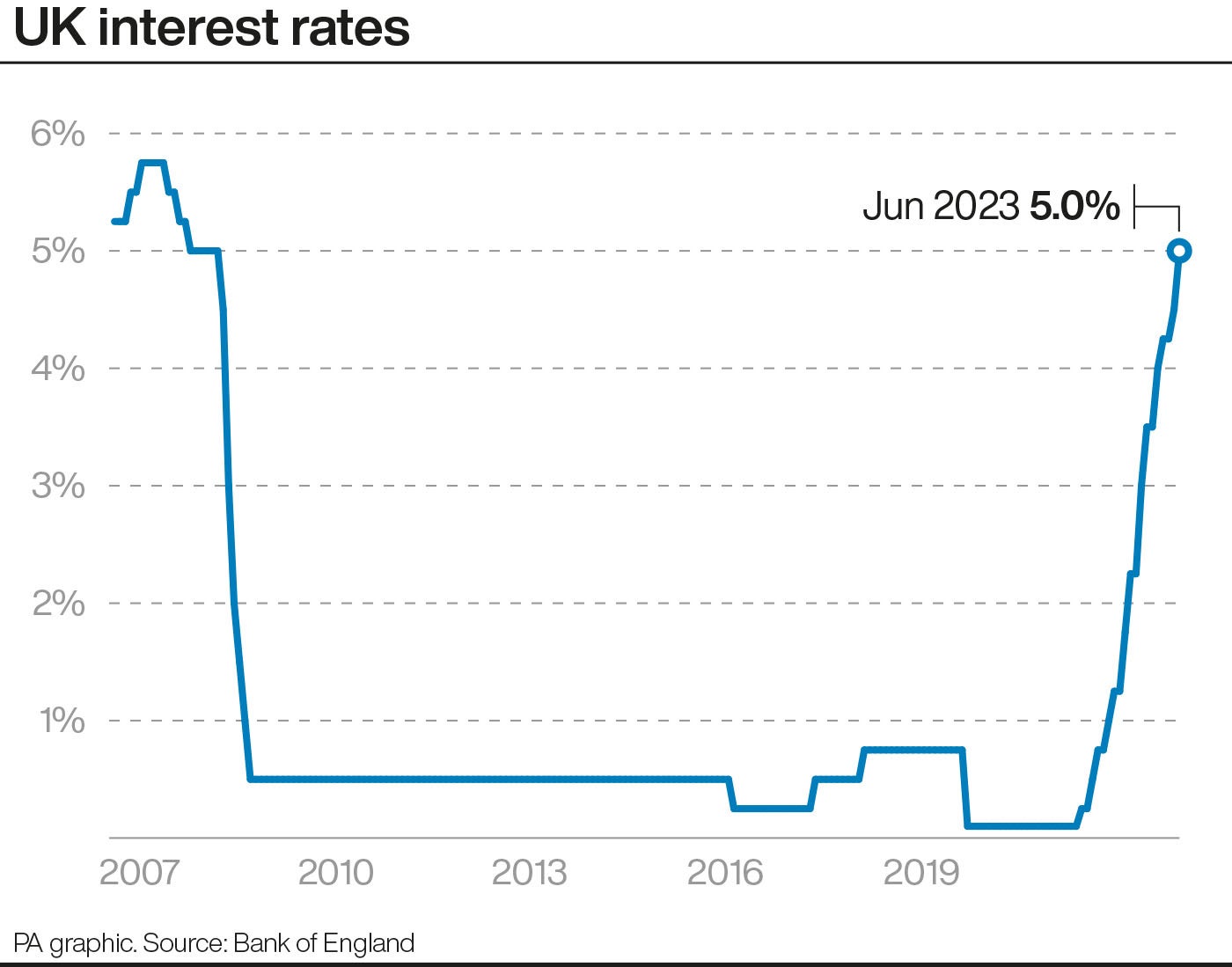

The rise, up from 4.5 per cent, is the sharpest increase since February – surprising economists who had been expecting a smaller increase of 0.25 percentage points – and sends interest rates to their highest level in 15 years.

The move is set to deepen the mortgage crisis as borrowing costs rose for the 13th time in a row in an effort to curb inflation.

And the pain may not be over yet, with Bank of England governor Andrew Bailey warning that further rate rises could be required if inflation remains stubbornly high.

Follow our live blog for the latest on interest rates here.

He said: “We’ve raised rates to 5 per cent following recent data which showed that further action was needed to get inflation back down.

“The economy is doing better than expected, but inflation is still too high and we’ve got to deal with it. We know this is hard – many people with mortgages or loans will be understandably worried about what this means for them.

“But if we don’t raise rates now, it could be worse later. We are committed to returning inflation to the 2 per cent target and will make the decisions necessary to achieve that.”

In a letter to Chancellor Jeremy Hunt setting out the Monetary Policy Committee’s (MPC) decision, he said price rises caused by the pandemic and the war in Ukraine would take longer to come down than they did to emerge.

“If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required,” he added.

Mr Hunt said the government had a “watertight’’ resolve to bring inflation down to its 2 per cent target and “if we don’t act now, it will be worse later’’.

But shadow chancellor Rachel Reeves accused the chancellor and Rishi Sunak of “burying their heads in the sand”.

“Families across Britain will be desperately worried about what today’s interest rate rise might mean for them,” she said.

“They want to know that support will be there if they need it. Instead, the chancellor and prime minister are burying their heads in the sand and failing to clean up the mess this Tory government has made.”

It comes as the rate of inflation remains unexpectedly stubborn – frozen at 8.7 per cent in May. Analysts had expected the Consumer Prices Index, which peaked at 11.1 per cent in October last year, to fall back to 8.4 per cent.

Mr Bailey has come under fire from the chancellor’s economic advisers for failing to curb inflation.

They accused Mr Bailey – who claimed there would be a sharp fall in inflation three months ago – of making the mortgage crisis worse by previously being too slow to act on persistent price rises.

Ex-Tory chairman Jake Berry told LBC: “My own personal view is that the Bank of England has been asleep at the wheel.”

It comes as the average two-year fixed residential mortgage rate surpassed six per cent, according to data from Moneyfactscompare.co.uk.

Karen Ward, a member of Mr Hunt’s economic advisory council, warned the Bank would now have to trigger a recession to finally tame the inflation problem. “There’s no other way around it.”

However, foreign secretary James Cleverley dismissed such ideas on Thursday morning, saying nobody in government would be “comfortable to subscribing” to entering a recession.

Mr Hunt said he has spoken to consumer champion Martin Lewis, who on Tuesday said that a mortgage ticking time bomb is now “exploding”, ahead of meeting with Britain’s major lenders on Friday.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments