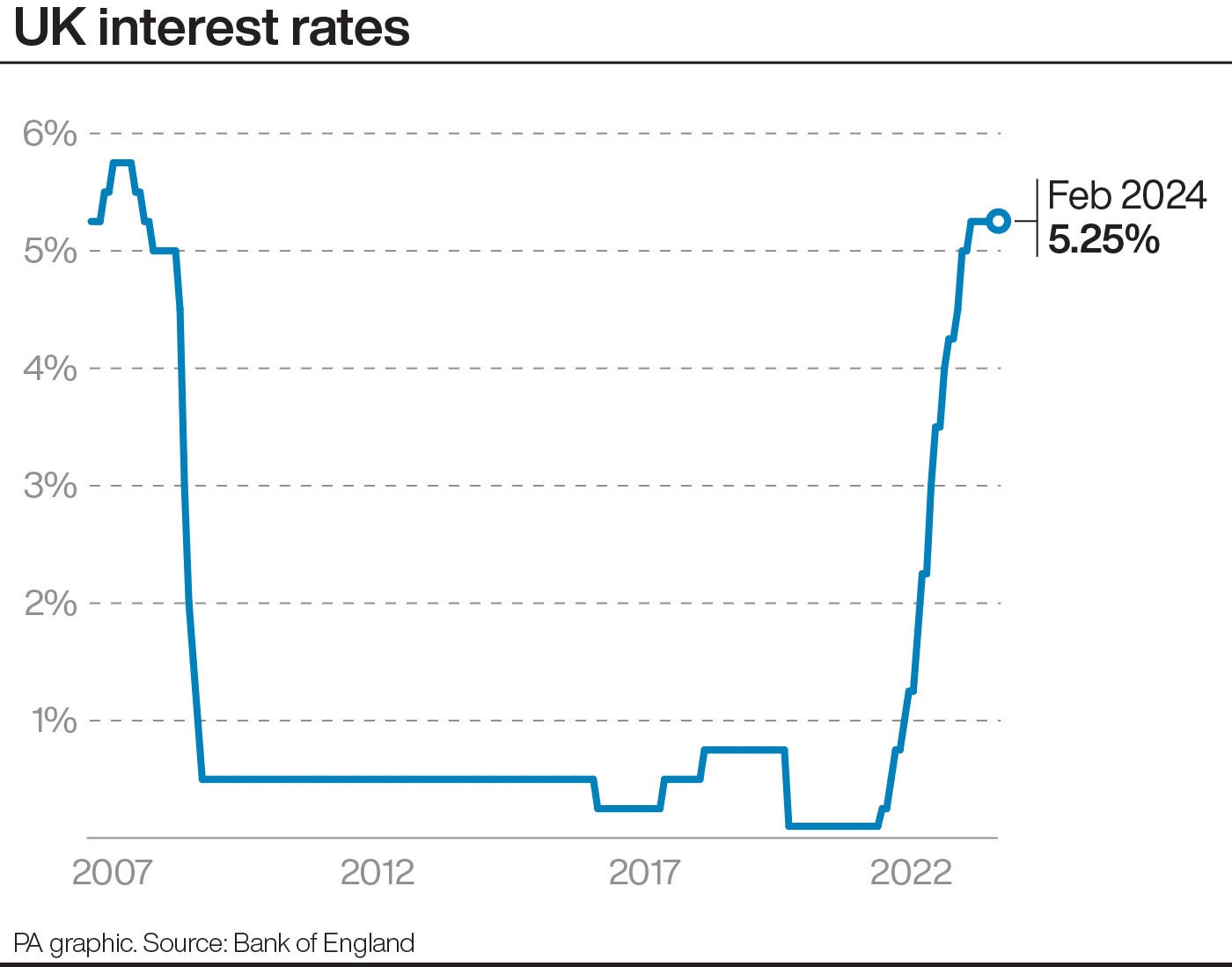

Bank of England keeps interest rates frozen at 15-year high - but inflation to hit 2% target ‘in months’

Bank of England policy chiefs vote to keep base rate unchanged for the fourth consecutive time

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Bank of England has opted to freeze interest rates at a 15-year high, but forecast that inflation is set to fall to its target of 2 per cent within months.

Policymakers at the central bank voted to keep interest rates at 5.25 per cent for the fourth consecutive time on Thursday in a bid to flush rising prices out of the economy.

Officials at the Bank were accused by some of acting too slowly to tackle inflation when it spiralled into double-digit figures in 2022 and so will be keen to ensure the danger has passed before cutting rates.

Interest rates determine how high the cost of borrowing money is, or how high the rewards of saving are. They can also impact the cost of mortgages, which have begun to come down recently after soaring in response to the hike in interest rates, with city analysts expecting cuts to the base rate later this year.

The Bank’s latest decision on interest rates comes after inflation unexpectedly ticked up slightly to 4 per cent in December, from 3.9 per cent in November, driven by rising tobacco and alcohol prices.

Although inflation increased slightly it has been trending downwards for months and remains well below the 11.1 per cent peak recorded in October 2022.

Investment banking giant Goldman Sachs previously said it expects the Bank to start cutting the base rate from 5.25 per cent from May – meaning a quicker-than-expected fall in borrowing costs.

Some economists predict the rate could fall as low as 3 per cent by the end of 2024, driving optimism in the market.

In more positive news, the Bank also said it expects inflation to hit 2 per cent in the second quarter of this year as energy prices put downward pressure on the figure.

But it warned the victory against its inflation target would only be temporary and inflation was actually likely to rise again in the following months. After that it will take until the fourth quarter of 2026 for inflation to consistently return to the 2 per cent target, the Bank said. That is a year later than it had previously forecast.

It means that while inflation appears to be falling faster than previously thought, it will also stick around for longer than the Bank anticipated in its forecast in November.

It was the fourth consecutive time that the Bank opted to keep interest rates unchanged but one member of its monetary policy committee did vote for a cut.

Swati Dhingra argued that inflation is already on “a firm downward trajectory” and the Bank risked slashing rates too quickly later if it did not start cutting now.

It was the first time in almost four years that anyone on the committee has voted for a cut, although as a whole it voted to keep rates unchanged.

But two members of the committee also voted to increase rates, from 5.25 per cent to 5.5 per cent saying that wages are still increasing faster than previously expected.

The remaining six members voted to keep rates unchanged. The pound was lower against the US dollar and the euro after the rates decision, but pared back declines seen earlier in the session.

Sterling stood 0.1 per cent lower at 1.27 US dollars and was 0.1 per cent down at 1.17 euros.

Carsten Jung, senior economist at the IPPR think tank, warned that the fight against inflation was not over yet.

“The fight against inflation is not yet over, but the end is in sight,” he said. “This is largely due to global supply chains recovering and energy costs falling and not due to rising unemployment, as the Bank and most economists initially expected.”

He added: “Even though inflation is coming down people’s incomes have still not caught up with the increased prices of the last years, with hundreds of thousands having newly fallen into destitution. More support is needed to support them.

“And we need more creative policy action to bring prices down, including on food and energy.”

Responding to calls for rates to be cut Andrew Bailey, the Bank’s governor, said he and his colleagues “need to see more evidence” that inflation is going to stay around 2 per cent and refused to speculate on when the base rate might be decreased.

The frozen rate could be a blow to some mortgage holders, although the new inflation forecast may bring some light relief for families struggling with the cost of living crisis.

The rate of Consumer Prices Index (CPI) inflation is set to fall to 2 per cent between April and June this year, about 18 months earlier than previous forecasts, according to the latest Monetary Policy Report.

However, it will only stay at the target level temporarily before increasing during the second half of the year, and could rise to 2.8 per cent by the first three months of 2025.

Energy prices are expected to be a key driver of the level of inflation throughout the year.

Lindsay James, investment strategist at Quilter Investors, said the current geopolitical climate and potential shocks in the energy market meant that inflation could remain volatile.

“The Bank’s view that inflation may not be sustained at 2 per cent reflects the ongoing risks to energy supply, which at the margin depends not only on shifting US export policy for gas but also on the ability of shipping companies to ensure deliveries, particularly via the Red Sea,” he told The Independent.

With energy prices creeping higher in recent weeks and manufacturing companies beginning to see disruption to supply chains, the risk of this being a factor in volatile inflation readings in the second half of 2024 remains high.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments