Brits in favour of higher income tax on country's wealthiest, poll finds

A return to the 50p income-tax rate for those earning over £150,000 is supported by 77 per cent

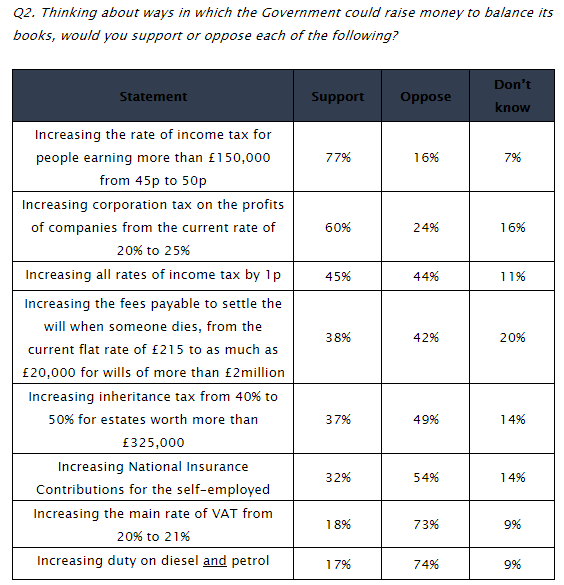

Increased taxes on wealthy individuals and businesses in order to balance the country’s books have the overwhelming support of the British public, a new poll reveals.

According to a survey by ComRes for The Independent, restoring the income tax rate for those earning more than £150,000 a year from 45p to 50p has the support of 77 per cent of the public, including 76 per cent of Conservative respondents.

George Osborne, the former Chancellor, introduced the cut in April 2013, and later said the tax revenues from the UK’s highest earners had increased by £8bn despite the reduction – a claim disputed by the Shadow Chancellor John McDonnell.

Increased rates of corporation tax on the profits of firms from the current rate of 20 per cent to 25 per cent are also supported by 60 per cent of those surveyed. Just 26 per cent disagreed while 16 per cent registered “don’t know”.

Despite this, from 2020, Britain will have one of the lowest rates of corporation taxes in the G20 as the Government intends to cut the tax rate to 17 per cent.

But voters are far less keen on taxes on expenditure outside income. Around 74 per cent of voters are opposed to increasing duty on diesel and petrol while increasing the main rate of VAT by one per cent is also opposed by 73 per cent.

The results come after a torrid week for Philip Hammond, the Chancellor, who was forced into a humiliating U-turn over increases to National Insurance Contributions – a centrepiece policy in his Budget just 10 days ago. The abrupt change came following a backbench revolt by Conservative MPs after it was pointed out the policy would directly contradict the party’s general election manifesto promise not to hike National Insurance Contributions.

John McDonnell, the Shadow Chancellor, said the poll “shows that the public are against the unfair giveaways to big businesses and a wealthy few that Tories have prioritised over funding for our NHS and schools”.

He continued: “Labour wants a fairer tax system, easing the burden on low and middle earners, instead of the £70bn Tory tax giveaway to those at the top. We need to see a change in direction from the Government with an end to austerity, with increased investment in our people and public services to rebuild and transform Britain, so no one and no community is left behind.”

According to the poll, 54 per cent of the public disagreed with this hike in contributions from the self-employed while 32 per cent agreed.

Overall, the announcements made at Mr Hammond’s first Budget at the helm of the Treasury were judged to be unfair by 40 per cent of respondents and fair by 34 per cent.

ComRes interviewed 2,026 GB adults online between the 15 and 17 March 2017. Data were weighted to be representative of all adults. Data were also weighted by past vote recall. ComRes is a member of the British Polling Council and abides by its rules. Full tables on the ComRes website

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments