House prices: Three charts that prove only the rich can afford to buy property in Britain

An average couple applying for joint mortgage would only just hit the £50,000 threshold

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Upmarket property agent Savills has come up with the data to back up an anecdotal supposition that many in Britain have — that the property market "only really works for income rich (and typically equity rich) households."

In a note published by Savills Research this week, associate director Neal Hudson found that price growth in the UK became dislocated from growth in average incomes, loan-to-income multiples, and average loan-to-value ratio around 2003.

That means price growth is bring driven by above average incomes and Hudson says as much as 40% of property price growth comes from the rich, who can afford to bid up prices. In short, the influence of the rich in the market is now disproportionate, or as Hudson puts it: "The average buyer no longer has an average income."

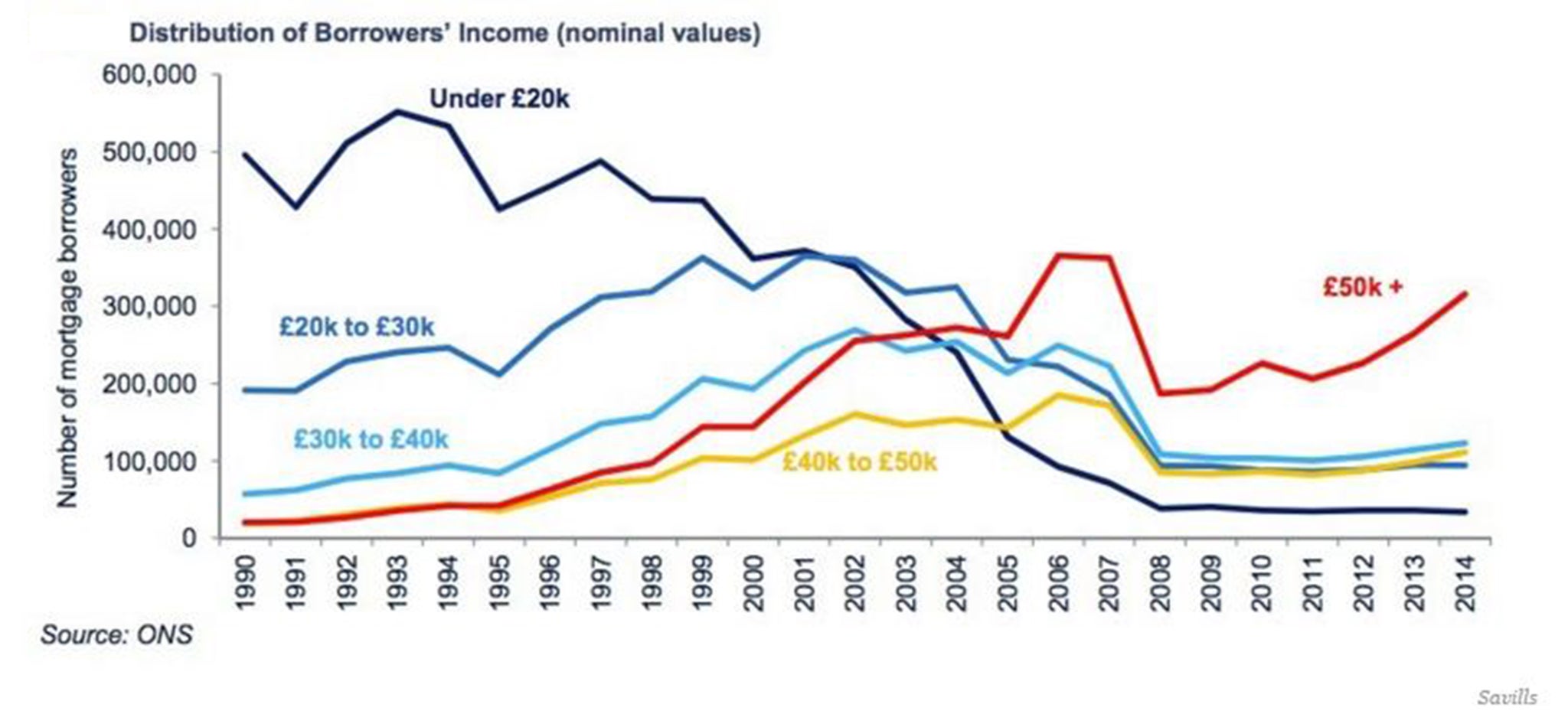

The increasing influence of rich buyers corresponds to a rise in the number of top end mortgage borrower — those with a household income above £50,000 ($76,000) — and a fall in mortgages for those earning below that level, shown in the chart below.

The average income in the UK is around £25,000 ($38,000), which means an average couple applying for joint mortgage would only just hit the £50,000 threshold.

Hudson writes:

Home ownership is in general now limited to those who are both income and equity rich. It is for this reason that the average age of first time buyers has barely changed in recent years (despite some commentary to the opposite). You can either afford to buy and do so at similar ages to previous first time buyers, or you can’t afford to and so don’t buy.

Increasingly you have to have rich parents and/or a good job to get on the housing ladder. And not just to get on early, but to get on at all.

The average age of first-time buyers is in the early 30s and has stayed around that level pretty steadily since 1990. If you can't afford to buy by then, the likelihood is you never will be able to and will be trapped renting your whole life.

This is backed up by the below graph that shows the household income for first time buyers and home movers has jumped relative to the national average incomes over the last 40 years, with a particularly pronounced leap after 1993.

First-time buyers in Britain are now typically in the 7th richest 10% of the country, while those moving house are typically in the top 9th decile.

All of this corresponds to home-ownership levels in Britain falling to their lowest level in almost 30 years — you have to be in the top 70% or above of earners to even get on the housing ladder.

In response, the government is making home ownership one of its biggest priorities, introducing a pledge to build 200,000 new homes across Britain every year for this Parliament.

The Tories have also: extended Right to Buy; are pushing the Help to Buy scheme that allows first-time buyers to get a mortgage with a lower deposit; and have launched a "Starter Home" programme that allows first-time buyers to snap up new builds with at least a 20% discount to market price.

But Hudson warns (emphasis ours):

With increasing home ownership firmly in the Government’s sights, the challenge for them will be in how to take a tenure that currently only really works for income rich (and typically equity rich) households and make it accessible for those currently living in the rented sectors and sitting at the bottom of the income distribution.

Many of the currently proposed solutions (e.g. Right to Buy and Starter Homes) will still be unaffordable to households on the lowest incomes and that could potentially lead to tensions between the Government and market regulators. Some parts of Government are now touting shared ownership as a possible solution to this issue and I’ll look at whether that could work for lower income households in a future note.

Not only are the government's housing policies not helping the poorest in society, they're actually hurting them according to a separate report from Savills published on Monday.

Developers are being allowed to sidestep quotas on building affordable housing if they are building "Starter Homes", meaning supply is being constrained. Right to Buy is being extended to let housing association residents buy their property at a discount, thereby reducing the number of affordable rental properties. And housing benefits are being tapered to bring people to pay market rate rents, putting a further squeeze on low earners.

Savills estimates that 70,000 households a year will be priced out of Britain's property market, or 350,000 across the parliament.

That's a huge number of people who will either need government support, be forced to move in with family, or, in the worst cases, face homelessness.

Meanwhile, government policies look likely to do little to extend the bracket of people who can benefit from Britain's property market. Savills says in Monday's report: "The combination of Starter Homes, shared ownership and Help to Buy all help households with £45,000 to £90,000 annual income." So pretty much all the rich then.

Read more:

• Nations with highest ratio of women in higher education

• China dragging luxury brand business into recession

• The 18 weirdest, best-paid jobs in Britain

Read the original article on Business Insider UK. © 2015. Follow Business Insider UK on Twitter.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments