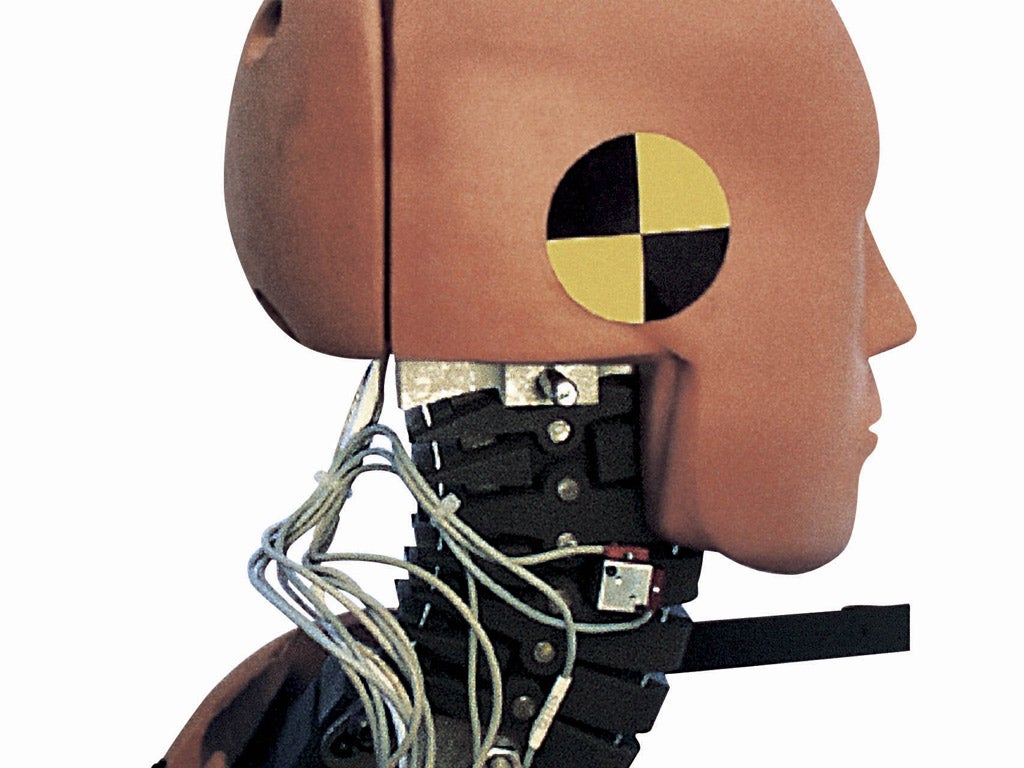

Exaggerated whiplash claims to be thrown out of court in Government crackdown

Fraudulent compensation claims are being targeted to bring insurance costs down

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Anyone exaggerating whiplash or other injuries to get compensation will be thrown out of court in a Government crackdown on dishonest claims.

Insurance premiums have been pushed up by “compensation culture” inflated by the no win, no fee industry, according to the Ministry of Justice.

Figures from the Association of British Insurers show that the number of dishonest motor claims increased by 34 per cent to a record 59,900 in 2013, with a value of £811 million.

The new measures aim to make it harder for fraudsters to profit from exaggerated injuries or contrived “accidents”, both on the road and at work or in public places.

Courts will throw out compensation applications in full where claimants have been “fundamentally dishonest” to stop people exploiting the system by making bogus claims or grossly exaggerating the extent of their injuries.

Whiplash claims are a particular target and people will have to have independent medical assessments with fixed fees to claim compensation.

Rules will also restrict the ability of lawyers to settle claims without confirmation of the claimant’s injury.

A cursory look at Google reveals the prevalence of “compensation culture”.

Searching “whiplash” throws up a clutch of compensation law firms. “Had a whiplash injury? Make a claim today,” urges one result.

Incentives used by lawyers to encourage claims like cash or iPads will be banned.

Chris Grayling, the Justice Secretary, said the average motor insurance premium has fallen by more than £100 in the past year thanks to Government measures.

He said: “The new measures are the latest stage of the government’s delivery on the commitment to deal with high insurance costs made by the Prime Minister at an insurance summit in 2012.”

Insurance firms have assured ministers they will pass any savings from the reforms to customers.

Otto Thoresen, director general of the Association of British Insurers, said: “These changes are a very positive development for the vast majority of honest insurance customers who end up paying for the fraud of the minority.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments