UK economy set for ‘sluggish’ growth over next two years as OECD warns forecasts will be missed

The Organisation for Economic Co-operation and Development (OECD), downgraded its forecast for UK growth from 0.7 per cent to 0.4 per cent

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The UK economy is set for sluggish growth over the next two years and will fall behind its peers in the G7 in a downbeat forecast just as Britons head to the polls for the local elections. the OECD has warned.

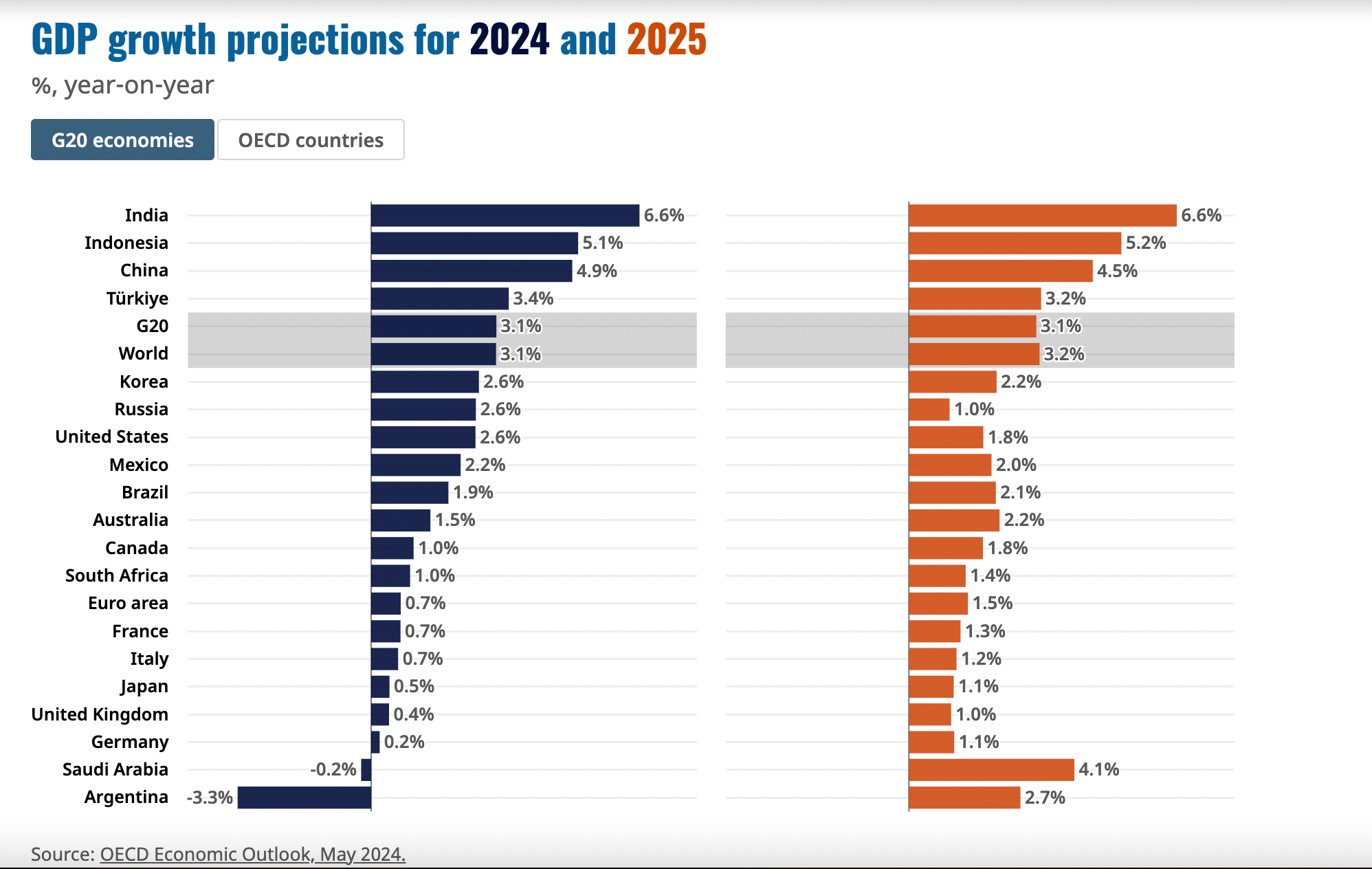

The Organisation for Economic Co-operation and Development downgraded its forecast for UK growth from 0.7 per cent to 0.4 per cent - the lowest expansion in the G7 apart from Germany - in its report released on Thursday.

The report said in 2025 GDP will rise by 1 per cent, which would but it bottom of the rest of the G7 nations, which, along with Germany, also include Canada, France, Italy, Japan and the US.

The forecasts will come as another blow to UK prime minister Rishi Sunak who promised voters he would make growing the economy a priority, as he tries to navigate Thursday’s make-or-break local elections.

The Paris-based think-tank said that higher wages in the UK could help consumer spending, but could also contribute to inflationary pressure as the Bank of England (BoE) continues with efforts to get inflation down to its 2 per cent target rate.

“Stronger real wage growth will support a modest pick-up in private consumption,” the report said.

“Headline inflation is expected to continue moderating towards target as energy and food prices have eased substantially, but persistent services price pressures will keep core inflation elevated at 3.3% in 2024 and 2.5% in 2025.”

The OECD also said it thinks the BoE will begin cutting interest rates, which are currently at a 15-year-high of 5.25 per cent. It said they are on track to drop to 3.75 per cent by the end of 2025.

It added that “fiscal prudence” was required until the BoE’s inflation target of 2 per cent is met and that government spending should be directed towards “supply-enhancing investment” such as the NHS or infrastructure.

Meanwhile, the UK’s unemployment rate is expected to rise over the period. The unemployment rate unexpectedly increased to 4.2% for the latest three-month period to February.

The OECD said this is due to continue increasing and reach as high as 4.7% in 2025 “as the labour market cools”.

Responding to the report, Mr Hunt said: “This forecast is not particularly surprising given our priority for the last year has been to tackle inflation with higher interest rates.

“But, now we are winning that war, growth matters, which is why it is significant that last month the IMF (International Monetary Fund) predicted the UK will grow faster over the next six years than any European G7 country or Japan.

“To sustain that we need to stick to our plan - competitive taxes, a flexible labour market and far-reaching welfare reform.”

Darren Jones, Labour’s shadow chief secretary to the Treasury, said: “Today’s news that growth has been downgraded again reminds the British people what they already know: after 14 years of failure, the Conservatives cannot fix the economy because they are the reason it is broken.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments