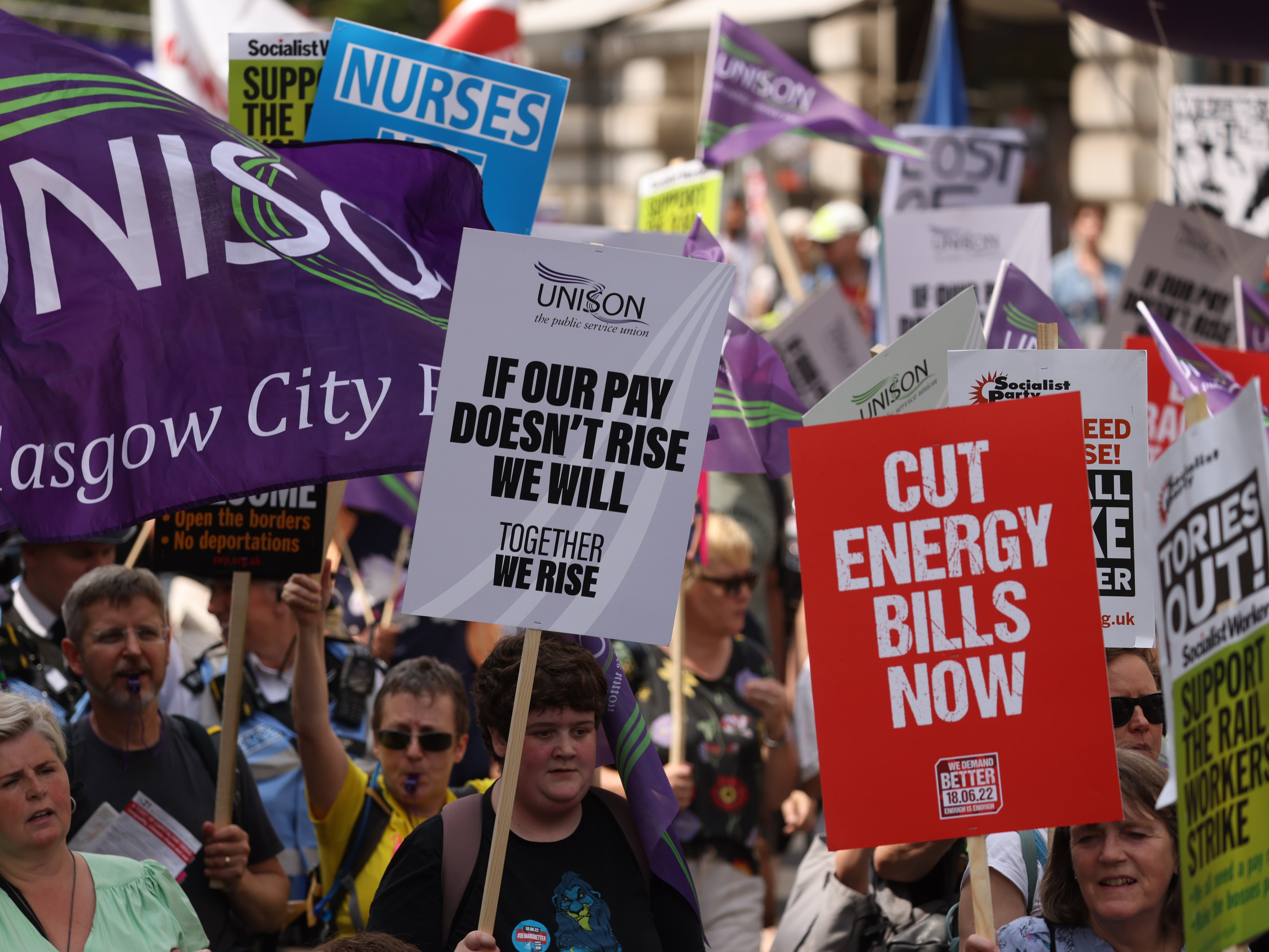

Millions falling behind on bill payments as cost of living crisis mounts

Year has been ‘frightening’ so far for poorest families, charity says

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Millions are believed to be behind on household bills as the rising cost of living crisis puts pressure on budgets.

The UK is grappling with soaring energy bills, four-decade high inflation and incomes failing to keep pace with prices.

Low-income families have been experiencing a “year of financial fear” so far in the current cost of living crisis, a charity has now warned.

The Joseph Rowntree Foundation, whose work aims to solve poverty, warned this group was being forced to make grim choices such as falling behind on bills, going without essentials or taking on expensive debt.

It polled around 4,000 low-income families, which is defined as in the bottom 40 per cent with an income of under £25,000 for a couple without children, in May and June.

Just over one in five were going without enough food or heating for their homes, working out at around 2.3 million families in the UK, the charity found.

Around 40 per cent - or around 4.6 million - were behind on at least one bill, according to the survey. This was up by 20 per cent since October.

Earlier this year, other research suggested a similar percentage were struggling to afford their rising energy bills.

Katie Schmuecker from the Joseph Rowntree Foundation said the survey highlighted the “frightening” year so far for low-income families.

“Families up and down the country have been faced with options that are simple but grim – fall behind on bills, go without essentials like enough food, or take on expensive debt at high interest. In some cases they had to do all three,” she said.

“No one should be put in this precarious position. The hardship families are facing now builds on the foundations of a decade of cuts and freezes to social security.”

Ms Schmuecker added: “The chancellor’s cost of living support package will offer some temporary relief, but rather than lurching from emergency to emergency government must get ahead of this problem.”

She suggested stopping deducting debt repayments from benefits “at unaffordable rates”.

A government spokesperson said it was providing targeted help of at least £1,2000 to 8 million low-income families in light of rising prices, which has been welcomed by the Joseph Rowntree Foundation.

They said it was also “supporting people to earn more”, including a £300 a year tax cut in July and allowing Universal Credit claimants to keep £1,000 more of what they earn.

“We have both reduced the amount that can be taken through deductions twice in recent years to no more than 25 per cent, and doubled the time period over which they can be repaid,” they added.

Additional reporting by Press Association

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments