Top earners and entrepreneurs ‘choosing to leave UK’ over feared capital gains tax raid

Wealthy people are said to be leaving the country or selling up over fears Chancellor Rachel Reeves will hike capital gains tax in the autumn budget

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Entrepreneurs and top earners are selling up or leaving the UK due to fears the Labour government will announce an increase in capital gains tax (CGT) in the autumn Budget, experts have warned.

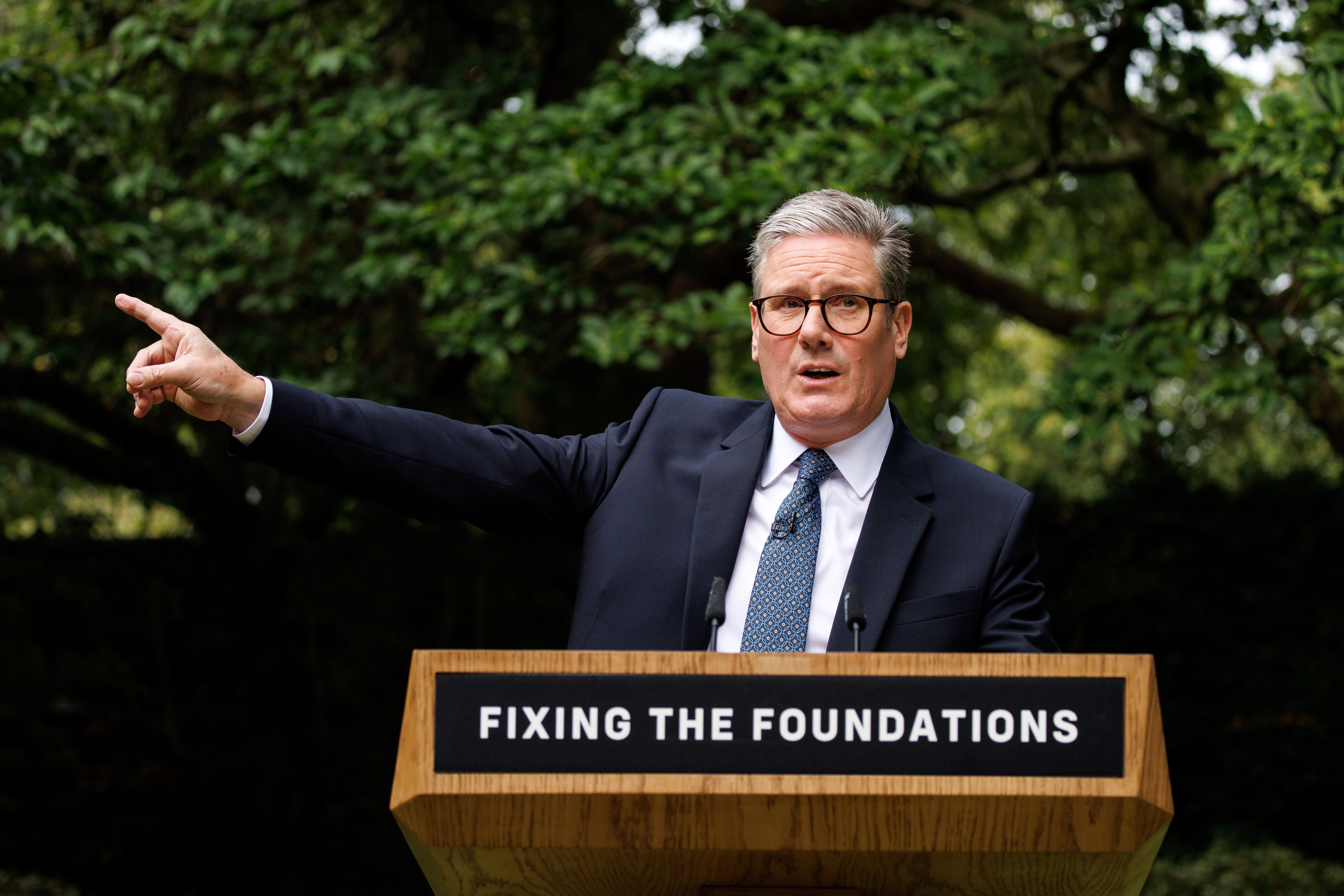

Speculation on the Budget’s content has continued after Prime Minister Sir Keir Starmer said that “those with the broadest shoulders should bear the heavier burden” during a speech last week.

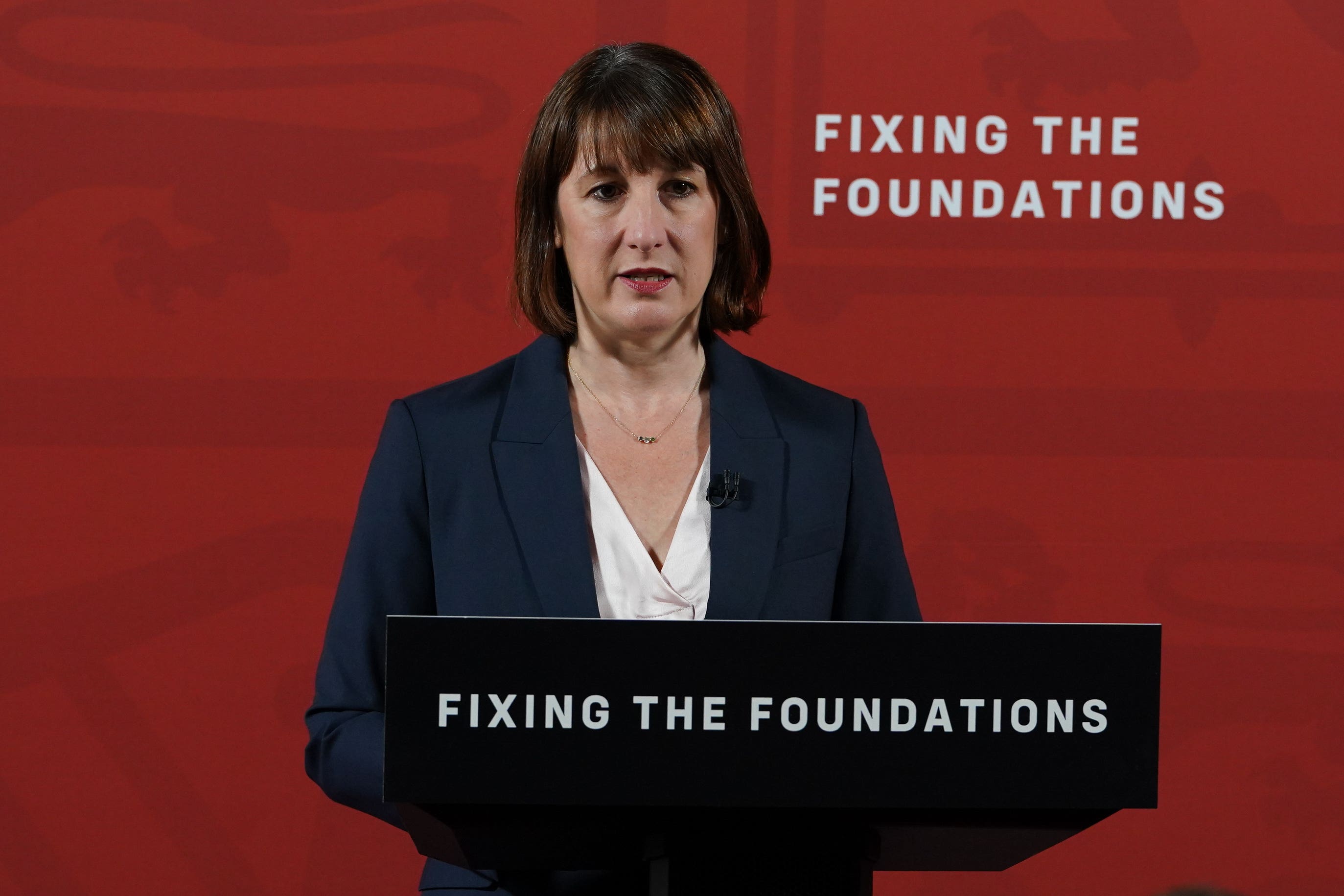

And with Labour vowing to avoid rises in income tax, national insurance and VAT, many believe Chancellor Rachel Reeves will look to raise much-needed cash from hikes in inheritance tax and CGT on 30 October.

Capital gains tax is a levy on any profit made on the sale of an asset, such as shares or buy-to-let properties. It is currently set at between 10 and 28 per cent.

Ms Reeves has declined to rule out a potential increase in the tax, saying she will “write a Budget two months ahead of delivering it”.

But Tom Adcock, a former HMRC tax inspector and tax partner at Gravita, toldThe Independent a number of entrepreneurs, high earners and wealth generators are already choosing to leave the UK.

“Just the prospect of CGT rising significantly from 30 October is driving behaviour,” he said.

“Clients are rushing through transactions, such as third party sales to liquidations of businesses, to avoid the spectre of potential tax rises.

“It is particularly concerning as some of these businesses could have continued generating wealth and having a positive effect on the UK economy. Instead, they are being shut down so that the entrepreneur benefits from the pierced lower tax rates of today.”

He added it is not just non-doms – a UK resident whose permanent home for tax purposes is outside the UK – choosing to leave the UK over fears of a rise in CGT.

“They are UK resident and domiciled people who have had enough and can afford to leave, so they are doing so,” Mr Adcock said.

Countries such as Spain and Ireland are among the more tax-attractive territories. Under “Beckham’s Law” in Spain, which was named after the famous footballer, gains on non-Spanish assets are not taxed. There are similar laws in Ireland.

Tim Stovold, head of tax at Moore Kingston Smith, told The Independent: “Business owners are canny enough to expect a tax increase in the autumn statement and to know that they are very unlikely to be able to sell up before the Chancellor announces the new CGT rates.

“They are left with two choices. They can simply pay tax at whatever rate is applicable or explore leaving the UK. The latter choice would mean they fall outside the scope of UK capital gains tax at the point they sell their business.

“There are many countries with rates of tax that may appear attractive to business owners if the UK dramatically increases CGT. As the UK becomes a less attractive place to live for those with gains to make, these other jurisdictions will grow in popularity.”

Capital gains on assets including businesses, second homes and shares are currently taxed between 10 and 28 per cent – lower than the 20 to 45 per cent levied on income.

Some investors are concerned that Labour will increase CGT rates to match income tax. This means many business owners who sell up after the tax changes would lose an increased amount in taxes.

Stefan Fielding, tax director at the contracting and accountancy firm Sapphire, told The Independent he has had several discussions with “concerned clients” who are considering leaving the UK.

“The consensus amongst the business community is that a rise in capital gains tax may well encourage people to consider moving away from the UK,” he said.

“Since Keir Starmer’s announcement last Tuesday, I have had half a dozen discussions with concerned clients who are currently considering their options in view of the proposed changes.

“I am in no doubt that a significant increase to the headline rate of CGT will result in some wealthy individuals leaving the UK and setting up residence abroad.”

A Treasury spokesperson said: “Following the spending audit, the chancellor has been clear that difficult decisions lie ahead on spending, welfare and tax to fix the foundations of our economy and address the £22bn hole in the public finances left by the last government.

“Decisions on how to do that will be taken at the Budget in the round.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments