Tax on beer frozen as part of Jeremy Hunt’s ‘Brexit pubs guarantee’

Chancellor was expected to hike duty on alcohol as new tax on drink strength comes into effect

Tax on draught beer in pubs will remain frozen from 1 August this year, chancellor Jeremy Hunt has announced.

Delivering his Spring Budget on Wednesday, Mr Hunt said he would “significantly increase the generosity of draught relief” which he said he could not have been done inside the EU.

Mr Hunt told MPs: "From August 1 the duty on draught products in pubs will be up to 11p lower than the duty in supermarkets, a differential we will maintain as part of a new Brexit pubs guarantee. British ale may be warm, but the duty on a pint is frozen."

Mr Hunt said the change will apply to "every pub in Northern Ireland" due to the Windsor Framework.

Earlier the Treasury confirmed that the energy price guarantee will be extended for a further three months from April to June at its current level.

This move would see bills for the average household staying at around £2,500, instead of going up to £3,000 as had been scheduled.

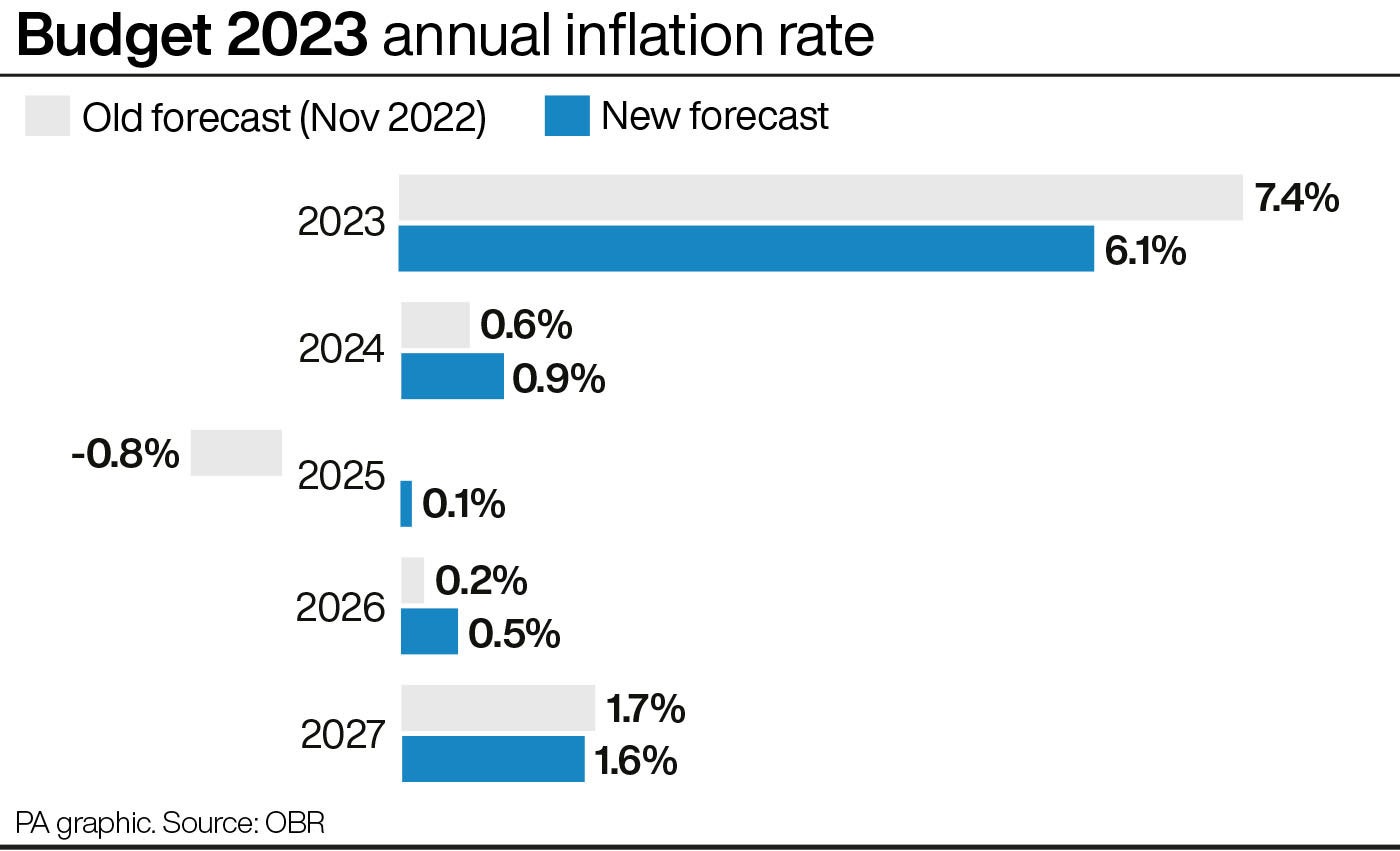

The chancellor also said that the Office for Budget Responsibility has predicted that the UK would not enter a “technical recession” this year.

Mr Hunt told MPs: "In the face of enormous challenges, I report today on a British economy which is proving the doubters wrong."

He added: "Today the Office for Budget Responsibility (OBR) forecast that because of changing international factors and the measures I take, the UK will not now enter a technical recession this year.

"They forecast we will meet the Prime Minister’s priorities to halve inflation, reduce debt and get the economy growing. We are following the plan and the plan is working."

Mr Hunt said the OBR forecasts that inflation in the UK will fall from 10.7 per cent in the final quarter of last year to 2.9 per cent by the end of 2023.

The chancellor also said the government would not rest until the UK is "Europe’s most dynamic enterprise economy".

He told MPs: "We already have lower levels of business taxation than France, Germany, Italy or Japan. But I want us to have the most pro-business, pro-enterprise tax regime anywhere.

Even after the corporation tax rise this April, we will have the lowest headline rate in the G7 - lower than at any period under the last Labour government.

"Only 10 per cent of companies will pay the full 25 per cent rate. But even at 19 per cent our corporation tax regime did not incentivise investment as effectively as countries with higher headline rates."

Mr Hunt also laid out measures the government had already taken to encourage business investment, telling the Commons: "For larger businesses we have had the super deduction, introduced by the Prime Minister, which ends this month.

"For smaller businesses we have increased the Annual Investment Allowance to £1 million, meaning 99 per cent of all businesses can deduct the full value of all their investment from that year’s taxable profits."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments