Martin Lewis highlights ‘important’ pension change not mentioned in Budget 2023

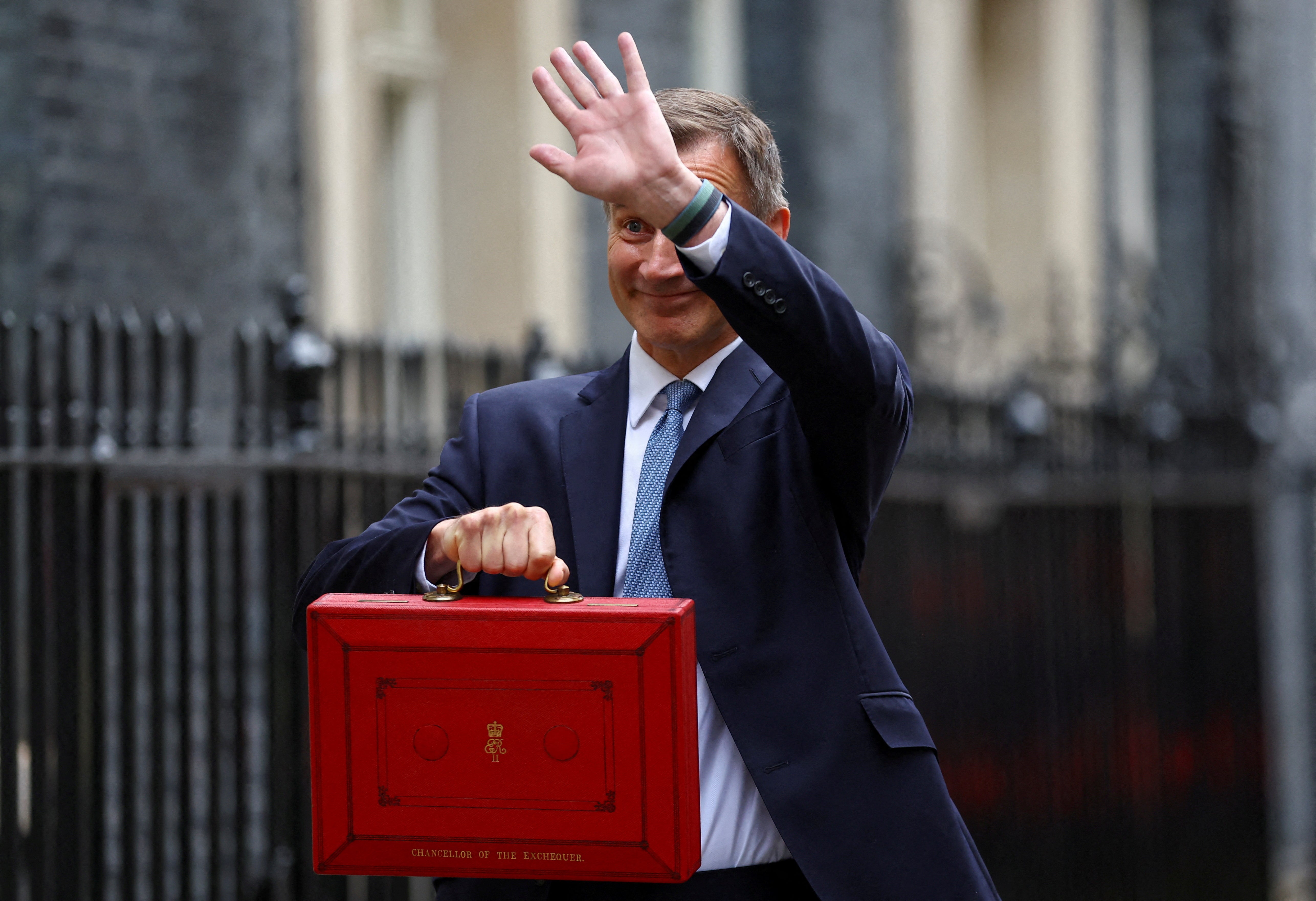

Chancellor Jeremy Hunt announced changes to pensions in the Budget on Wednesday

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Finance expert Martin Lewis has highlighted one “important” change to pensions that was not mentioned by the chancellor in the spring Budget.

Chancellor Jeremy Hunt announced changes to pensions in the Budget on Wednesday, including scrapping thewor lifetime allowance.

However, there was one change that the chancellor did not mention in his address to Parliament - which also aims to encourage older people to continue working, according to Mr Lewis.

The finance expert pointed out that people in certain circumstances will be able to put more money into their pensions.

According to the Budget paper, the government will increase the annual allowance from £40,000 to £60,000 from 6 April 2023. Individuals will continue to be able to carry forward unused annual allowances from the three previous tax years. This is the most you can save in your pension pots in a tax year (6 April to 5 April) before you have to pay tax.

The money purchase annual allowance (MPAA), which replaces your annual allowance after you’ve started to draw your pension pot, will also be increased from £4,000 to £10,000 and the minimum tapered annual allowance from £4,000 to £10,000 from 6 April 2023.

Mr Lewis said: “I think perhaps the most interest change to pensions, though, is one he didn’t mention, which is the money purchase allowance is going up from £4,000 a year to £10,000 a year. Now, what that means, that’s the amount that those people who’ve already taken some pension money are allowed to put in their pensions.

“So currently the annual allowance is £40,000 and this is £4,000. So take any money from your pension and suddenly you can only put £4,000 in it. But in future, the annual allowance is £60,000.

“Take any money from your pension, you’ll still be allowed to put £10,000 a year in, which is enough for most people.”

Mr Lewis also pointed out what he thinks is the reasoning behind the Chancellor’s changes to the allowance. He added: “And of course, he says the changes to pensions is all about helping those people who are thinking about not working - older people in their fifties and above who are thinking about not working, actually encouraging them to work.

“And I think that that money purchase allowance would be a big one in there.”

Amongst the measures announced in the Budget was a major expansion in state-funded childcare, aimed at boosting economic growth. Mr Hunt also revealed he would add £11bn to Britain’s defence budget in the next five years.

He said the Office for Budget Responsibility (OBR) now forecasts the UK will not enter a technical recession this year and that the government “will meet the Prime Minister’s priorities to halve inflation, reduce debt and get the economy growing”.

Despite “continuing global instability”, Mr Hunt said, the OBR expects inflation in the UK will fall from 10.7% in the final quarter of last year to 2.9% by the end of 2023.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments