'Bedroom tax' forces 6% of claimants to move house

Research found that 30,000 people have moved since benefit change

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

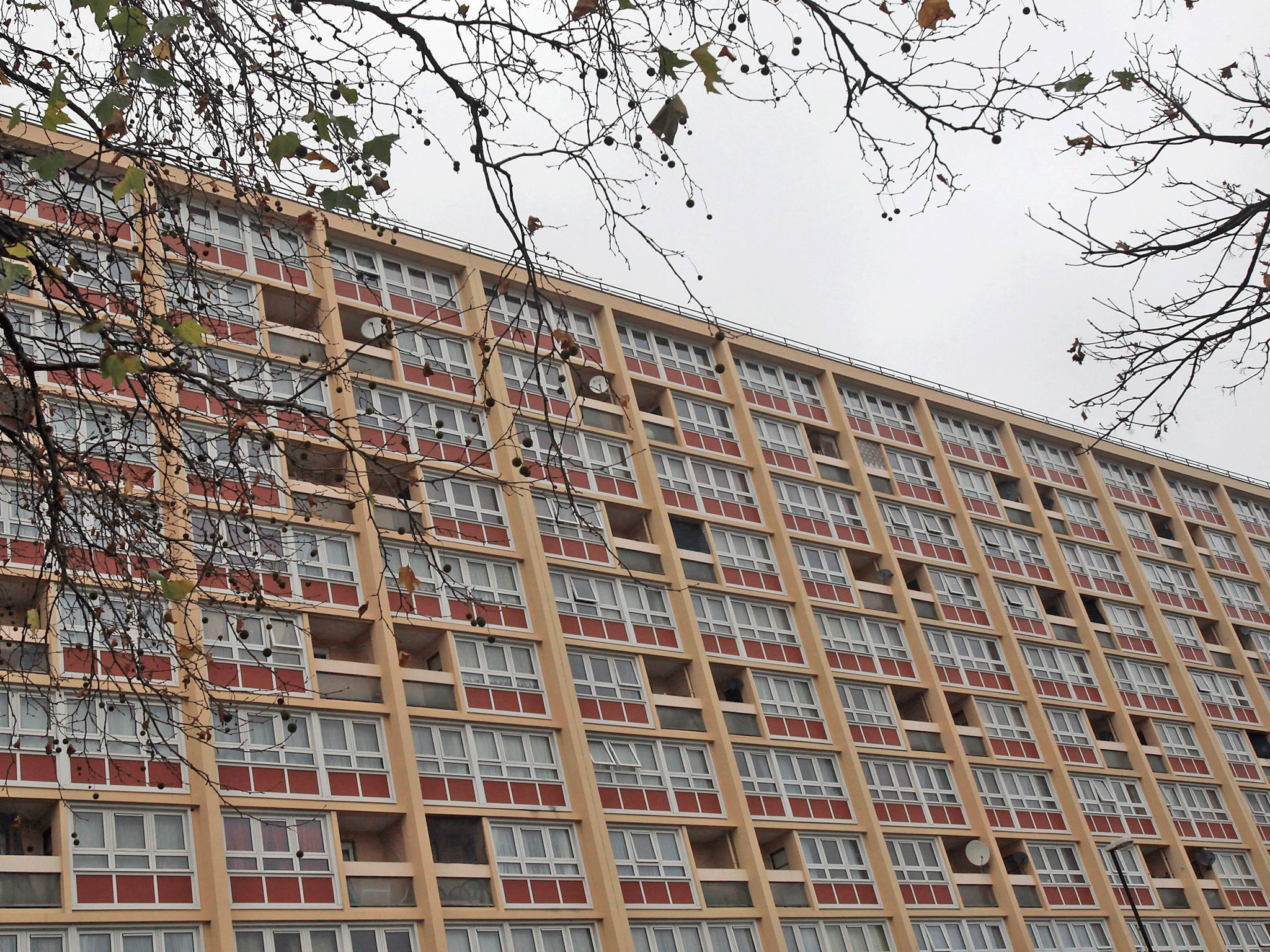

Your support makes all the difference.Benefits changes partly designed to cut under-occupancy have caused around 6 per cent of social housing tenants in Britain to move home, research suggests.

The so-called bedroom tax was introduced last year to free up large homes and save taxpayers £1 million a day.

Research by the BBC shows that 30,000 people have moved since the changes came in a year ago – a figure Employment Minister Esther McVey said was “not a failure”.

Analysis of the data from social housing also suggested 28 per cent of affected tenants were in rent arrears.

But Ms McVey disputed these figures, saying her own feedback from local authorities and the National Housing Federation found an "indiscernible number" of tenants were in arrears.

She said 50 per cent of people affected by the change were already in debt.

Among the benefits changes introduced on 1 April 2013 was the removal of what ministers called the “spare room subsidy”.

This saw social housing tenants considered to have one spare bedroom have their housing benefit reduced by 14 per cent, while those with two or more spare bedrooms had reductions of 25 per cent.

Labour criticised what it described as a "bedroom tax" and promised to scrap it if it wins the next election.

The Government had argued that the changes would reduce the benefits bill and help the 300,000 people living in overcrowded accommodation.

But the research - involving 331 social housing providers across England, Scotland and Wales with Freedom of Information requests submitted to council and surveys of housing associations - found just under 6 per cent of tenants whose benefit was cut had moved house.

It also found that 28 per cent had fallen into arrears for the first time in the last 12 months.

Prof Rebecca Tunstall, director of the centre for housing policy at the University of York, told the BBC: "There were two major aims to this policy - one was to encourage people to move, and the other was to save money for the government in housing benefit payments.

Labour's Chris Bryant, the shadow work and pensions minister, said: "Trapped with nowhere else to go, thousands of people have had no choice but to fork out an extra £14 a week.

"David Cameron's government have pretended this was all about helping people who are overcrowded, but in truth the bedroom tax is a cruel, unfair and appallingly administered policy."

But Work and Pensions Secretary Iain Duncan Smith said: "It was absolutely necessary that we fixed the broken system which just a year ago allowed the taxpayer to cover the £1m daily cost of spare rooms in social housing.

"We have taken action to help the hundreds of thousands of people living in cramped, overcrowded accommodation and to control the spiralling housing benefit bill, as part of the government's long-term economic plan.

"Our reforms ensure we can sustain a strong welfare safety net, and we are providing an extra £165m next year to support the most vulnerable claimants."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments