Mortgage pain to continue after Bank of England holds interest rates at 16-year high, experts warn

Holding interests rates at 16-year peak for another month risks property market ‘stagnating’ this winter, experts warn

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Homeowners’ pain is set to continue as the mortgage market limps on in the wake of the Bank of England’s decision to keep interest rates at a 16-year high, experts have warned – despite a glimmer of light at the end of the tunnel.

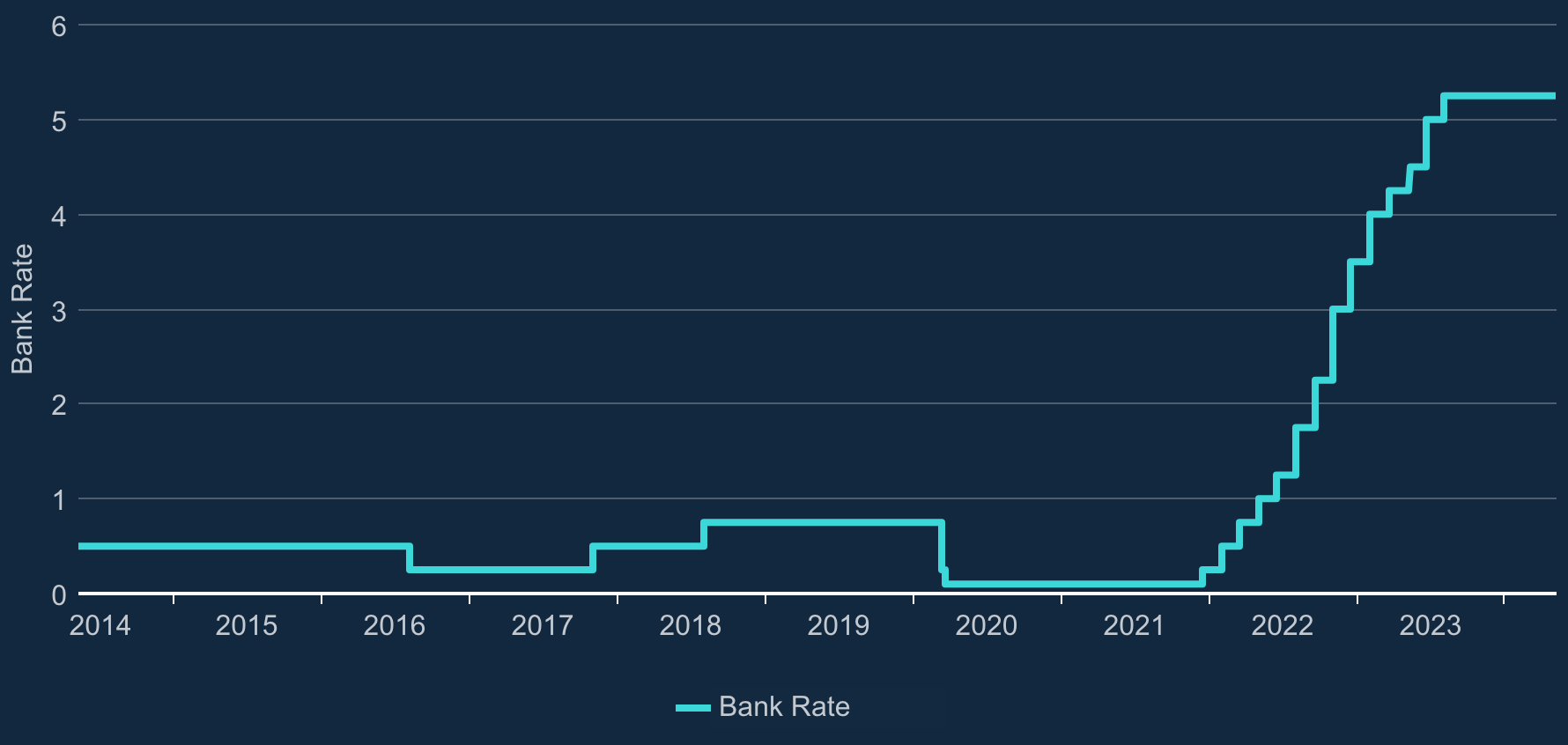

Threadneedle Street opted to hold off from its first base rate cut since 2020 to keep rates at 5.25 per cent on Thurday, as the central bank’s governor Andrew Bailey vowed he would not bow to political pressure to reduce the interest rates currently hammering mortgage-holders.

Despite the Bank sounding more optimistic in its forecasts on inflation and UK growth than earlier this year and a second member of its 12-strong Monetary Policy Committee (MPC) voting on Thursday to cut rates, experts remained divided on how soon the clamoured-for reduction would ultimately come.

While many analysts still expect the cut to fall next month, others warned June’s announcement could merely be a “dress rehearsal” for a cut in August. But experts were encouraged by Mr Bailey’s signals that Threadneedle Street could be prepared to pre-empt the US Federal Reserve.

Lewis Shaw of Shaw Financial Services told The Independent that Thursday’s announcement was likely to feel like bad news for anyone about to take out or renew a mortgage. “We’re unlikely to see any meaningful change with fixed-rate pricing, so the mortgage pain for many continues,” he said.

“However, the minutes contained some interesting points that should give us hope of a cut in the coming months. Most importantly the reference to a divergence in monetary policy between the US and other major economies. This could well be the signal that the BoE will move before the Fed.

“If I were a betting man, I think there are good odds the [European Central Bank] will cut in June, and the BoE will follow suit in August as long as they feel inflation is still going in the right direction. So, even though we’re not yet out of the tunnel, perhaps we’re starting to see the light at the end of it.”

Riz Malik of R3 Mortgages agreed that, given Thursday’s voting split, “June’s decision may be a dress rehearsal for a cut in August”.

“The first base rate will significantly boost confidence in the UK property market, no matter the scale of the reduction,” he said, adding: “In the meantime, the UK mortgage market will continue to limp on until we see that initial reduction or further economic data comes to light which suggests it is on its way.”

Interest rates are used as a tool to help bring down inflation, which has fallen sharply from the double-digit highs not seen for decades until 2022, when energy costs spiked and the cost-of-living crisis hit its peak.

The rate of Consumer Prices Index (CPI) inflation fell to 3.2 per cent in March, according to the latest official figures. And on Thursday, the Bank of England slightly improved its forecasts to suggest that inflation will fall below the Bank’s 2 per cent target between April and June, but rise again to 2.6 per cent later this year.

But the Bank indicated it is still looking for more progress on factors including services inflation and wage growth – which have remained persistently high at about 6 per cent – before cutting rates.

“Before our next meeting in June, we will have two full sets of data – for inflation, activity and the labour market – that will help us in making that judgement afresh,” Mr Bailey told reporters. “But, let me be clear, a change in bank rate in June is neither ruled out nor a fait accompli.”

But Suren Thiru, economics director at the Institute of Chartered Accountants, labelled Thursday’s announcement a “missed opportunity to provide much needed relief for those people struggling with their mortgage bills and businesses facing numerous cost pressures”.

“The Monetary Policy Committee remains unnecessarily hawkish on loosening monetary policy, given rapidly receding inflation, which risks subduing the recovery from recession by keeping borrowing costs high for too long,” he said.

Jonathan Rolande, from the National Association Of Property Buyers warned that, while Thursday’s decision to hold rates high – rather than risk overheating the property market – was understandable, the market “has been confidence-free since September 2022, when rates began their upward climb”.

“Sometimes, being on the frontline gives a better view than the generals see back at HQ. I see a fragile market with no reason to overheat since September 2022. However it needs an injection of optimism.

“Yes, prices are still high, rents too. But the signal of a rate reduction would have encouraged lenders to reduce their own recently increased lending rates and allow more first time buyers to get out of the rental trap. It would encourage developers to borrow and to build.

“Without a rate cut this month, or very soon, the market looks set to stagnate this winter. Something that isn’t good news for anyone in the property sector or the country.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments