Average house prices in UK reached record high in October

House prices in the UK have surpassed the previous peak in June 2022, according to the Halifax house price index

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Average UK house prices have hit a record high of just under £300,000 in October, an index has reported.

In the fourth monthly increase in a row, house prices increased by 0.2 per cent in October, Halifax reported, with the average house price reaching £293,999.

This surpassed the previous peak of £293,507 in June 2022, according to Halifax’s head of mortgages Amanda Bryden.

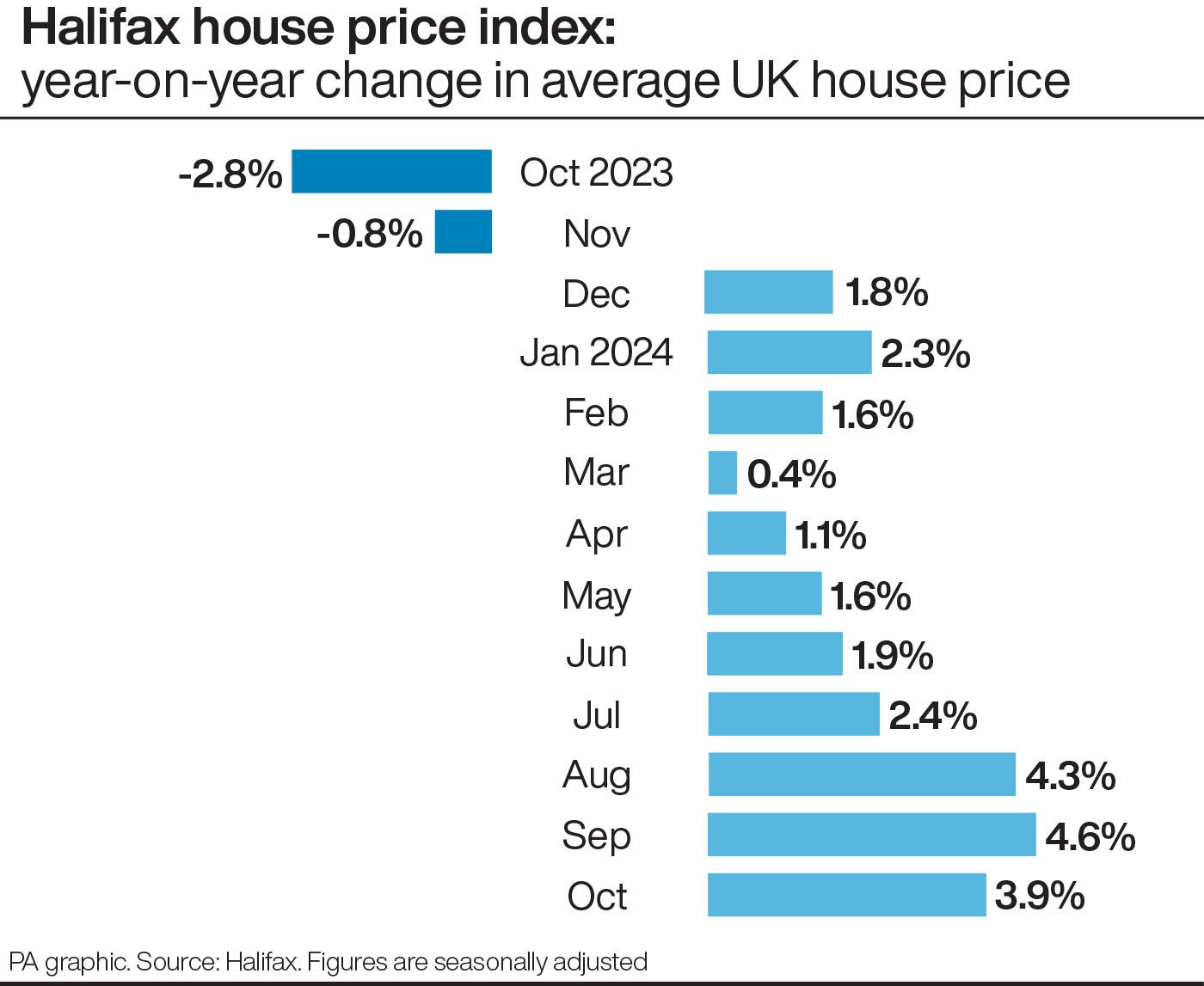

“Average UK house prices nudged up 0.2% in October, continuing the positive momentum of recent months,” Ms Bryden said. “This brought the annual growth rate to 3.9%, slightly lower than in September.

“The average property price has reached a record high of £293,999, surpassing the previous peak of £293,507 set in June 2022, towards the end of the pandemic-era ‘race for space’.”

Despite house prices falling in 2023, they didn’t fall very far, Ms Bryden added.

Prices have generally “levelled off” over the past two and a half years, she said, rising by just 0.2 per cent in that time. This was a major slowdown compared to the 21 per cent rise between January 2020 and the summer of 2022.

She explained: “Despite the affordability challenge, market activity has been improving. The number of new mortgages agreed recently reached its highest level in two years. This aligns with average mortgage rates dropping steadily since spring.”

House prices are expected to keep growing at a “modest pace” for the rest of this year and into 2025, Ms Bryden added.

Northern Ireland (£204,242, 10.2 per cent), north-west England (£235,587, 5.9 per cent), and Wales (£225,543, 5.6 per cent) saw the largest annual increases in house prices over the past year, according to the Halifax index.

Scotland (£206,480, 1.9 per cent), eastern England (£333,741, 3.1 per cent), and south-east England (£387,587, 3.2 per cent), have seen the slowest annual increase in the same period. London has an average house price of £543,308 following an increase of 3.5 per cent.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said: “The fact that property has hit a new high will mean some will struggle with affordability. To make matters worse, new mortgages are getting slightly more expensive.

“The Budget didn’t impress the bond markets, given the level of borrowing that has been factored in by the Government. It pushed bond prices down, which automatically pushes yields up, and makes mortgages pricier.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “The housing market has been significantly buoyed by lower mortgage rates, leading to more interest from prospective buyers and increased activity.”

Chief executive of estate agent Foxtons, Guy Gittins, said of the house price index: “A fourth consecutive month of positive growth demonstrates the current strength of the UK property market and now that the dust has settled on last week’s autumn Budget, the outlook continues to be very positive.”

Full list of average house prices followed by the annual increase, according to Halifax (regional annual change figures are based on the most recent three months of approved mortgage transactions):

- East Midlands, £242,189, 4.4%

- Eastern England, £333,741, 3.1%

- London, £543,308, 3.5%

- North East, £172,730, 4.0%

- North West, £235,587, 5.9%

- Northern Ireland, £204,242, 10.2%

- Scotland, £206,480, 1.9%

- South East, £387,587, 3.2%

- South West, £303,362, 3.3%

- Wales, £225,543, 5.6%

- West Midlands, £257,287, 4.7%

- Yorkshire and the Humber, £211,629, 5.3%

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments