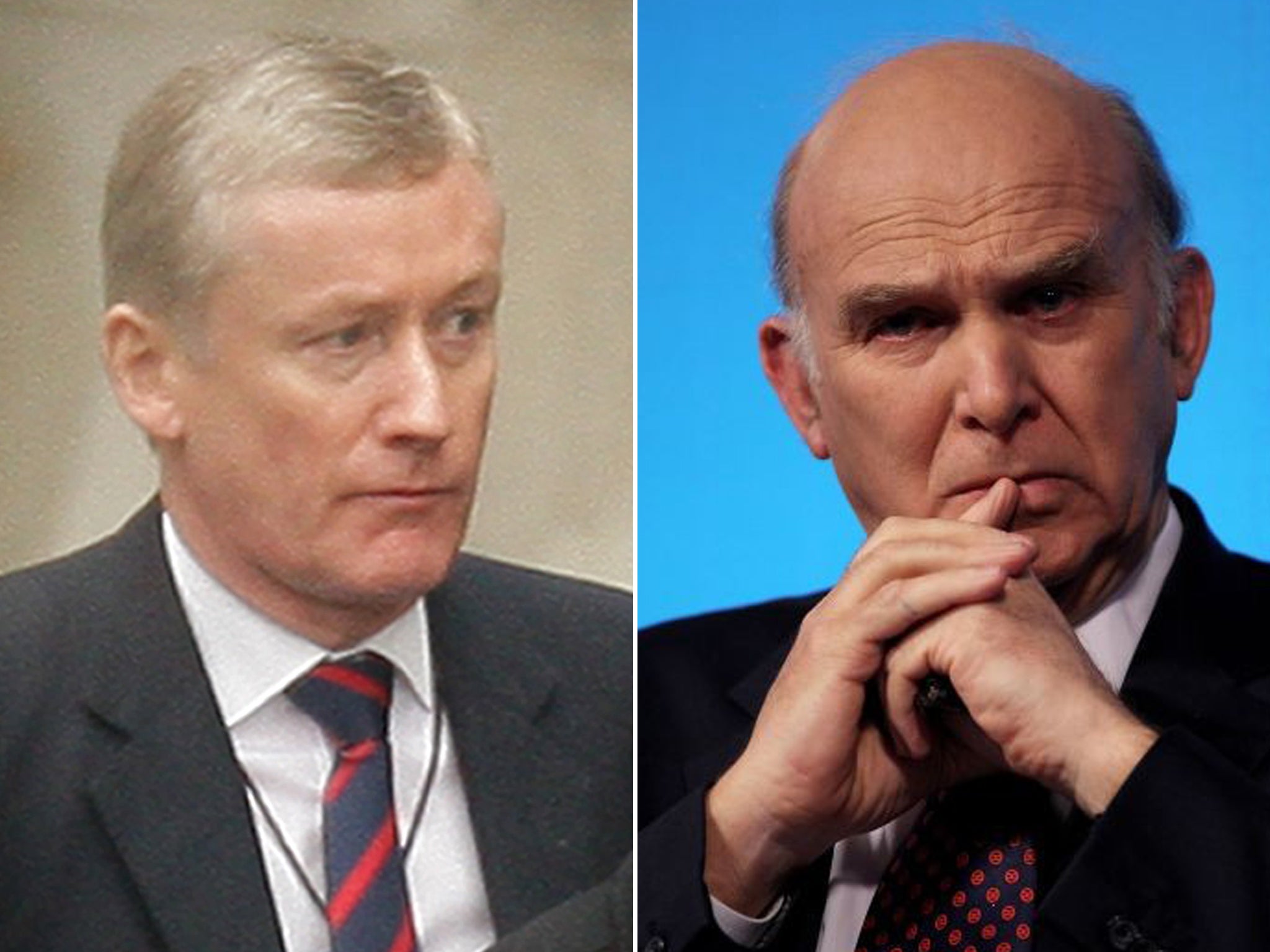

Vince Cable urges quick decision on RBS prosecution

Business secretary says there is 'serious public concern' over actions of lender's leadership before £45.5bn taxpayer bailout

Business Secretary Vince Cable has called on prosecutors to reach a decision “as quickly as possible” about possible action against the directors of Royal Bank of Scotland at the time of the financial giant's collapse.

Mr Cable said there was "considerable public concern" about the actions of the lender's leadership, which left RBS needing a £45.5 billion taxpayer-funded rescue.

The matter was referred to Scottish prosecuting authority the Crown Office and Procurator Fiscal Service in January 2012 following a damning report into the bank's failings by the Financial Services Authority (FSA).

In a letter to Advocate General Lord Wallace, Mr Cable asked for an update on the progress of the case but insisted he was "not seeking to influence the outcome" of the legal process.

The Business Secretary told his fellow Liberal Democrat: "There is, as you will know, considerable public concern about the actions of the directors of RBS prior to its insolvency.

"Following the release of the FSA's report into the failure of RBS I sought legal advice on what if any enforcement action was appropriate and was advised that the Crown Office and Procurator Fiscal Service should consider a possible prosecution.

"Given that this matter was referred to them in January 2012, I am very keen for a decision to be reached as quickly as possible in order to maintain public confidence in the efficiency of the decision-making process.

"I am fully aware that the decision whether or not to prosecute rests with the Crown Office and Procurator Fiscal Service as the relevant independent prosecuting authority.

"I want to be clear that I am not seeking to influence the outcome of this process. However, public and media interest in the banking sector and RBS have not dissipated.

"There have been numerous questions about what steps can be taken to address concerns. In particular this has focused on the prosecution and possible disqualification of former directors in appropriate cases."

The Business Secretary said he appreciated the complexities of the case but asked for an update on progress and the likely timeframes for a decision.

RBS was brought to its knees by "multiple poor decisions" and a £50 billion "gamble" on buying Dutch bank ABN Amro, the FSA report found.

The report shone a light on the poor relations between the FSA and RBS and said chief executive Fred Goodwin's "assertive and robust" management style was flagged as a potential risk as early as 2003, four years before the disastrous ABN Amro deal.

In January 2012, a month after the FSA report, Mr Goodwin was stripped of the knighthood he was awarded for services to banking.

PA