After 19 years, Asil Nadir's day in court arrives in £150m fraud saga

Biggest trial of its kind begins for the Cypriot businessman behind the Polly Peck empire

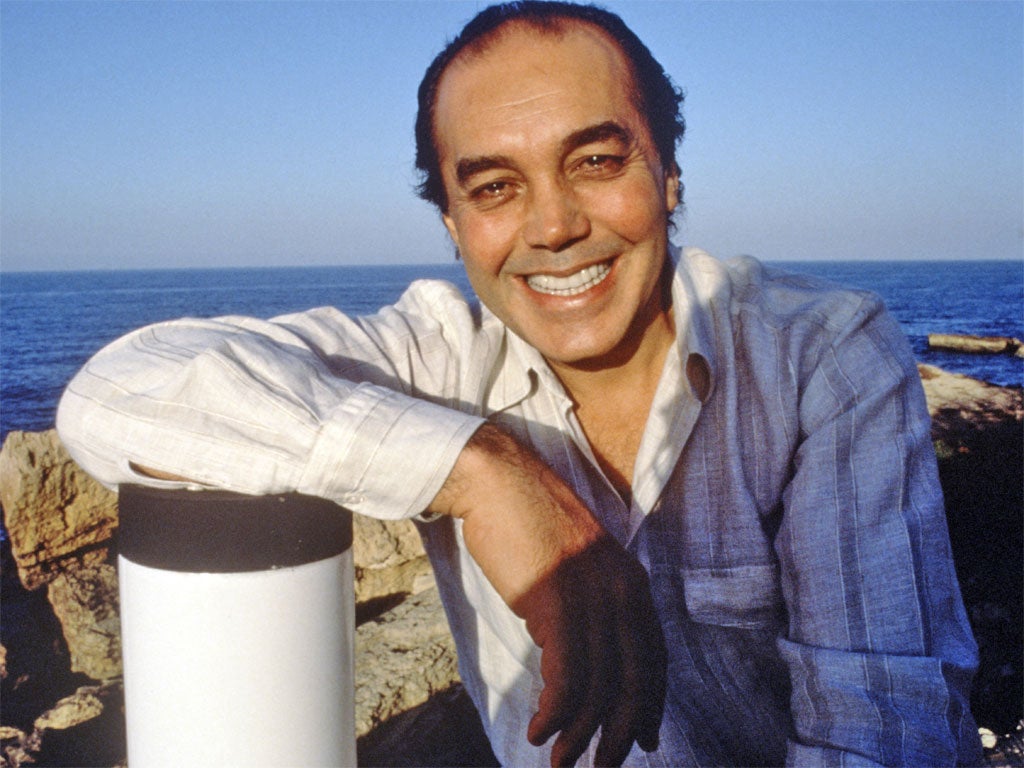

Two decades after he fled the country to evade justice, Asil Nadir appeared in the dock yesterday accused of stealing almost £150m from his own business empire to finance his lavish lifestyle.

At the start of an Old Bailey trial expected to last four months, prosecutor Philip Shears, QC, began to outline the web of intrigue and transfers used by the Cypriot business tycoon to siphon off money from Polly Peck International.

Mr Nadir was due to stand trial in 1993 but escaped back to Cyprus, evading the courts until he returned to the UK in August 2010. Yesterday, the now 70-year-old businessman appeared in court clad in a dark blue suit and floral tie, accompanied by his glamorous wife, Nur, 27.

The jury heard prosecution claims that he ran the Polly Peck empire in an autocratic manner, refusing to tolerate rivals and clashing with his own board when it tried to introduce tighter financial controls or questioned the "constant outflow" of millions of pounds to Turkish and North Cypriot subsidies.

By 1990, Mr Nadir's salary had been increased to £350,000 while he had the use of a company airplane as well as five cars including two Bentleys and a Ferrari.

The businessman denies 13 charges of theft between 1987 and 1990 relating to £34m but Mr Shears explained that these were specimen counts relating to a "much bigger picture". The prosecution estimated the total to be almost five times that amount.

In his opening remarks, the QC said: "He was chairman and chief executive of Polly Peck International. He was a man who wielded very considerable power over its operations and management and that of its subsidiaries particularly in Northern Cyprus. We say he abused that power and helped himself to tens of millions of pounds of PPI's money."

Mr Shears added: "We say he caused transfers out of sums of money from the three PPI accounts which he dishonestly routed away to benefit himself, his family or associates. A simple way of expressing what happened is that he in effect stole PPI's money."

Funds, Mr Shears said, were moved within a complex structure of offshore companies with the help, the prosecution claims, of a handful of trusted directors. One such associate, group chief accountant John Turner, the prosecution said, had helped Mr Nadir with the "covert movement of money".

"Mr Turner told a witness... that Asil Nadir would ask him to collect bags full of bank notes, often totalling £100,000, from London banks and bring them back to Asil Nadir's office," said the prosecutor.

A student who worked for the company, Mr Shears said, was dispatched to Jersey with envelopes of cash to deposit into accounts. The business tycoon used an account in the name of his mother to receive stolen money to pay off his debts. Payments went to buy his former wife a Mercedes, purchase livestock for his country estate, or expensive properties.

An employee who noted discrepancies "was told to keep his mouth shut" and one executive who tried to introduce tighter financial controls found herself on a list of people to sack.

By June 1990, £305m – more than 80 per cent of PPI's total cash balances – were held in Turkish and North Cypriot subsidiaries. Months later Polly Peck went into administration with debts in excess of £550m.

"When PPI was in difficulty leading up to it going into administration it proved impossible for PPI to get the cash back to the UK... When the administrators went to Northern Cyprus they effectively found no cash at all, just a black hole," said Mr Shears.

Mr Nadir denies all charges in the case. The trial continues

Asil Nadir: Timeline to a trial

1959 Polly Peck (Holdings) Ltd is launched, incorporating a group of East End garment trade companies.

1980 Asil Nadir acquires a controlling interest in in the firm, which became Polly Peck International five years later.

1987-1990 Asil Nadir allegedly steals tens of millions from Polly Peck International.

1990 Polly Peck International goes into administration with debts in excess of £550m.

1993 Nadir flees the country for Northern Cyprus to avoid trial later that year.

2010 Nadir returns to the UK. He is remanded on bail and in December is arrested at his Mayfair home for an alleged breach. He threatens to sue the Metropolitan Police for wrongful arrest.

2012 The trial begins