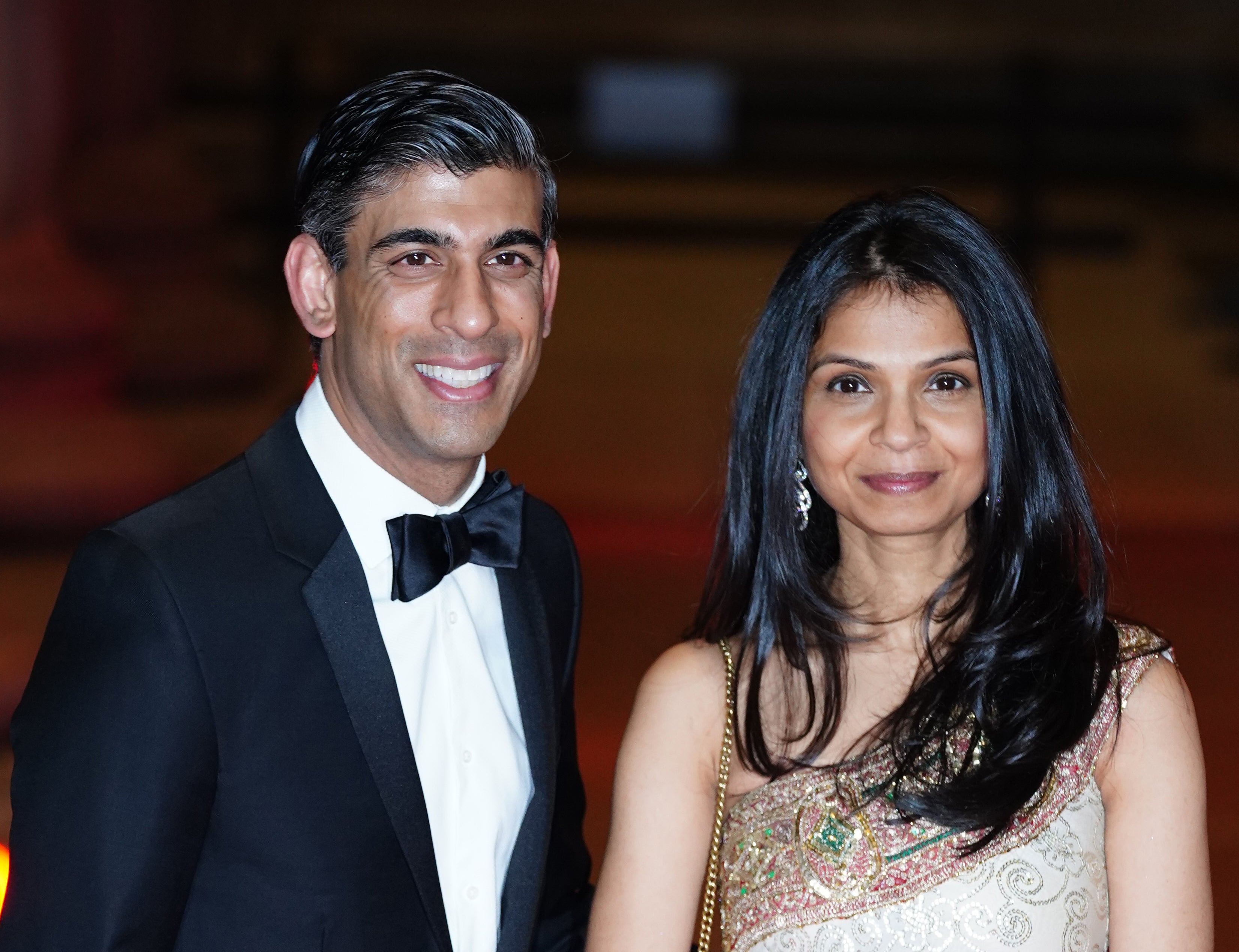

Labour piles pressure on Sunak over his family’s tax affairs

The opposition said the Chancellor’s household may have saved ‘tens of millions’ through his wife’s non-dom status.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Rishi Sunak and his family potentially saved tens of millions of pounds in taxes through his wife’s non-dom status, Labour has said as it sought to maintain pressure on the Chancellor.

Akshata Murty announced on Friday that she would pay UK taxes on all her worldwide income as she did not want her financial arrangements to be a “distraction” for her husband.

The dramatic move came after Mr Sunak had previously denounced the disclosure of his wife’s tax status as a “smear” by opponents intended to damage him politically.

Labour and the Liberal Democrats called on the millionairess Ms Murty, who remains an Indian citizen, to pay the back taxes she had saved through not having to pay UK taxes on her overseas income.

Shadow transport secretary Louise Haigh said that while the arrangement was legal, Mr Sunak had failed to be transparent about his family’s tax status at a time when he was raising taxes for millions of people.

“The Chancellor has not been transparent. He has come out on a number of occasions to try and muddy the waters around this and to obfuscate,” she told BBC Radio 4’s Today programme.

“It is clear that was legal. I think the question many people will be asking is whether it was ethical and whether it was right that the Chancellor of the Exchequer, whilst piling on 15 separate tax rises to the British public, was benefiting from a tax scheme that allowed his household to pay significantly less to the tune of potentially tens of millions of pounds less.”

In a statement Ms Murty, who is to keep India as her “place of domicile”, said she had done nothing wrong but acknowledged some people did not see her tax status as being compatible with her husband’s position.

“I understand and appreciate the British sense of fairness and I do not wish my tax status to be a distraction for my husband or to affect my family,” she said.

“I do this because I want to, not because the rules require me to.”

Her announcement came just hours after Mr Sunak admitted that he had continued to hold a US green card – granting him permanent residency in the United States – for a period while he was Chancellor.

He initially obtained the permit while he was working in the US, and a spokeswoman said he had continued to use it for travel purposes until he was advised that he should give it up when he made his first official visit to the US as Chancellor.

While the spokeswoman said “all laws and rules” had been followed, the disclosures have led some Tory MPs to question the political judgment of a man many believe harbours ambitions to enter No 10.

It comes at a time when Mr Sunak has faced intense criticism over his failure to do more to help families struggling with the soaring cost of living, while he has hiked taxes to their highest levels since the 1950s.

While the Chancellor has publicly blamed Labour for the disclosures, some around him see the hand of Downing Street amid reports of renewed tensions between Boris Johnson and the man he put in charge of the nation’s finances.

At a joint news conference on Friday with German Chancellor Olaf Scholz, the Prime Minister was forced to deny claims No 10 was responsible for briefing against Mr Sunak, insisting he was doing an “outstanding job”.

An ally of the Chancellor, Tory MP Kevin Hollinrake, rejected suggestions his leadership credentials had been damaged, pointing to his record of supporting the economy through the pandemic.

“That takes incredible skill and incredible judgment,” he told the Today programme.

Mr Hollinrake also denied that Ms Murty’s non-dom status was a “tax dodge”, saying it was a policy which had been supported by both Conservative and Labour governments.

“It is a deliberate policy to attract wealthy people from other countries around the world to the UK on the basis that they create jobs and create wealth in the UK that benefits everybody,” he said.

It has been estimated that Ms Murty, a fashion designer and the daughter of an Indian billionaire, potentially saved up to £20 million in UK tax through the arrangement.

She is reported to hold a 0.91% stake in Infosys, an IT business founded by her father, and has received £11.6 million in dividends from the Indian firm in the past year.

Non-dom status means she would not have to pay UK tax at a rate of 39.35% on dividends.

India sets the rate for non-residents at 20%, but this can fall to 10% for those who are eligible to benefit from the UK’s tax treaty with India.

Labour has also questioned whether she would use her Indian citizenship and a treaty with the UK dating back to the 1950s to avoid paying inheritance tax – a move which could reportedly save tens of millions of pounds.