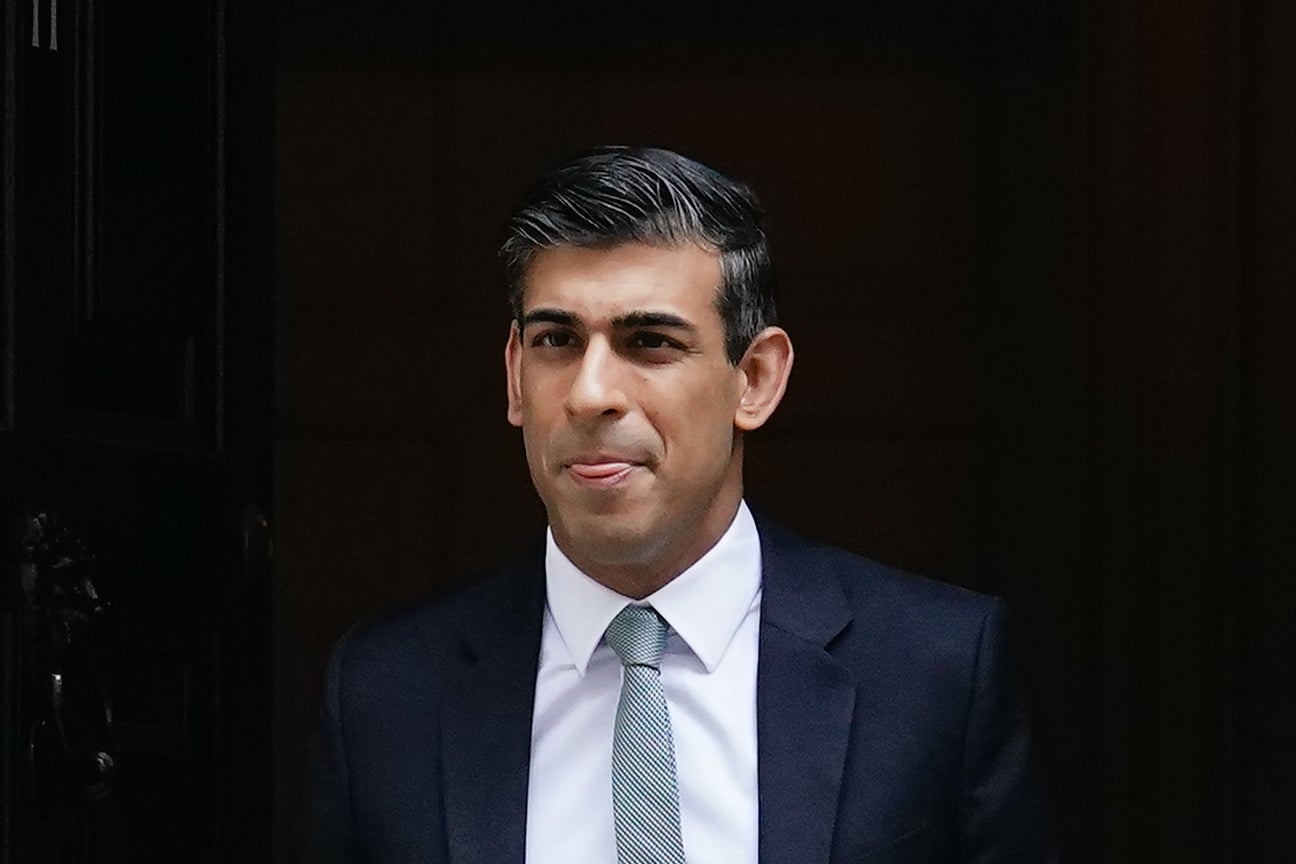

More questions for Sunak as wife says she will pay UK taxes on all income

Akshata Murty said she did not want her tax status to be a ‘distraction’ for her husband.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Chancellor Rishi Sunak continues to face questions over his financial affairs despite an announcement by his wife that she will now pay UK taxes on all her worldwide income.

Akshata Murty said she was acting as she did not to be a “distraction” for her husband after the disclosure of her non-domiciled status sparked a furious political row.

Her announcement came just hours after Mr Sunak admitted he had continued to hold a US green card – making him a “lawful permanent resident” of the United States – while he was Chancellor.

In a statement, Ms Murty, who retains her Indian citizenship, said her non-dom status – which meant she did not have to pay UK taxes on income derived from outside the UK – was “entirely legal”.

However, she said it had become clear that there were many who believed it was not compatible with her husband’s position in charge of the nation’s finances.

“I understand and appreciate the British sense of fairness and I do not wish my tax status to be a distraction for my husband or to affect my family,” she said.

“I do this because I want to, not because the rules require me to.”

Mr Sunak has faced intense scrutiny following the disclosure earlier this week that Ms Murty, who is thought to be worth hundreds of millions of pounds, held non-dom status.

If there are such briefings they are not coming from us in No 10 and heaven knows where they are coming from

Earlier, a spokeswoman for Mr Sunak released a statement confirming that he held a green card while Chancellor until seeking guidance ahead of his first US trip in a Government capacity, in October last year.

The US inland revenue says anyone who has a green card is treated as a “lawful permanent resident” and is considered a “US tax resident for US income tax purposes”.

The spokeswoman said Mr Sunak continued to file US tax returns, “but specifically as a non-resident, in full compliance with the law”, having obtained a green card when he lived and worked in the States.

Boris Johnson defended the Chancellor after coming under sustained questioning at a Downing Street press conference on Friday alongside German leader Olaf Scholz.

Allies of Mr Sunak reportedly suspect No 10 of seeking to undermine him through hostile briefings amid tensions over last month’s Spring Statement when he was accused of failing to support families struggling with the cost-of-living crisis.

However Mr Johnson said: “If there are such briefings they are not coming from us in No 10 and heaven knows where they are coming from. I think that Rishi is doing an absolutely outstanding job.”

Labour said there were still “far too many troubling questions” to be answered and called for “full transparency” from Mr Sunak regarding his financial affairs.

A party spokesman questioned whether Ms Murty would use her Indian citizenship and a treaty with the UK dating back to the 1950s to avoid paying inheritance tax – move which could reportedly save tens of millions of pounds.

“This urgently matters because the Chancellor – the person in charge of our tax system and responsible for loading working people with the highest tax burden in 70 years – will still benefit from Ms Murty’s tax arrangements,” the spokesman said.

“Any further obfuscation cannot be tolerated, and it would be beyond shameful of the Chancellor if he does attempt to do so.”

This shows that Rishi Sunak’s wife could have paid her fair share of taxes in this country all along, despite his initial claims

Liberal Democrat treasury spokeswoman Christine Jardine said the Sunak family should now backdate the payment of the taxes in the UK in full.

“This shows that Rishi Sunak’s wife could have paid her fair share of taxes in this country all along, despite his initial claims,” she said.

Ms Murty, the fashion-designer daughter of an Indian billionaire, confirmed she held non-dom status after the Independent revealed the arrangement on the day a national insurance hike hit millions of workers.

Mr Sunak said his wife was entitled to use the non-dom arrangement as she is an Indian citizen and plans to move back to her home country to care for her parents.

He insisted she was not attempting to pay less tax amid speculation she potentially avoided up to £20 million in UK tax.

Ms Murty is reported to hold a 0.91% stake in Infosys, an IT business founded by her father, and has received £11.6 million in dividends from the Indian firm in the past year.

Non-dom status means she would not have to pay UK tax at a rate of 39.35% on dividends. India sets the rate for non-residents at 20%, but this can fall to 10% for those who are eligible to benefit from the UK’s tax treaty with India.