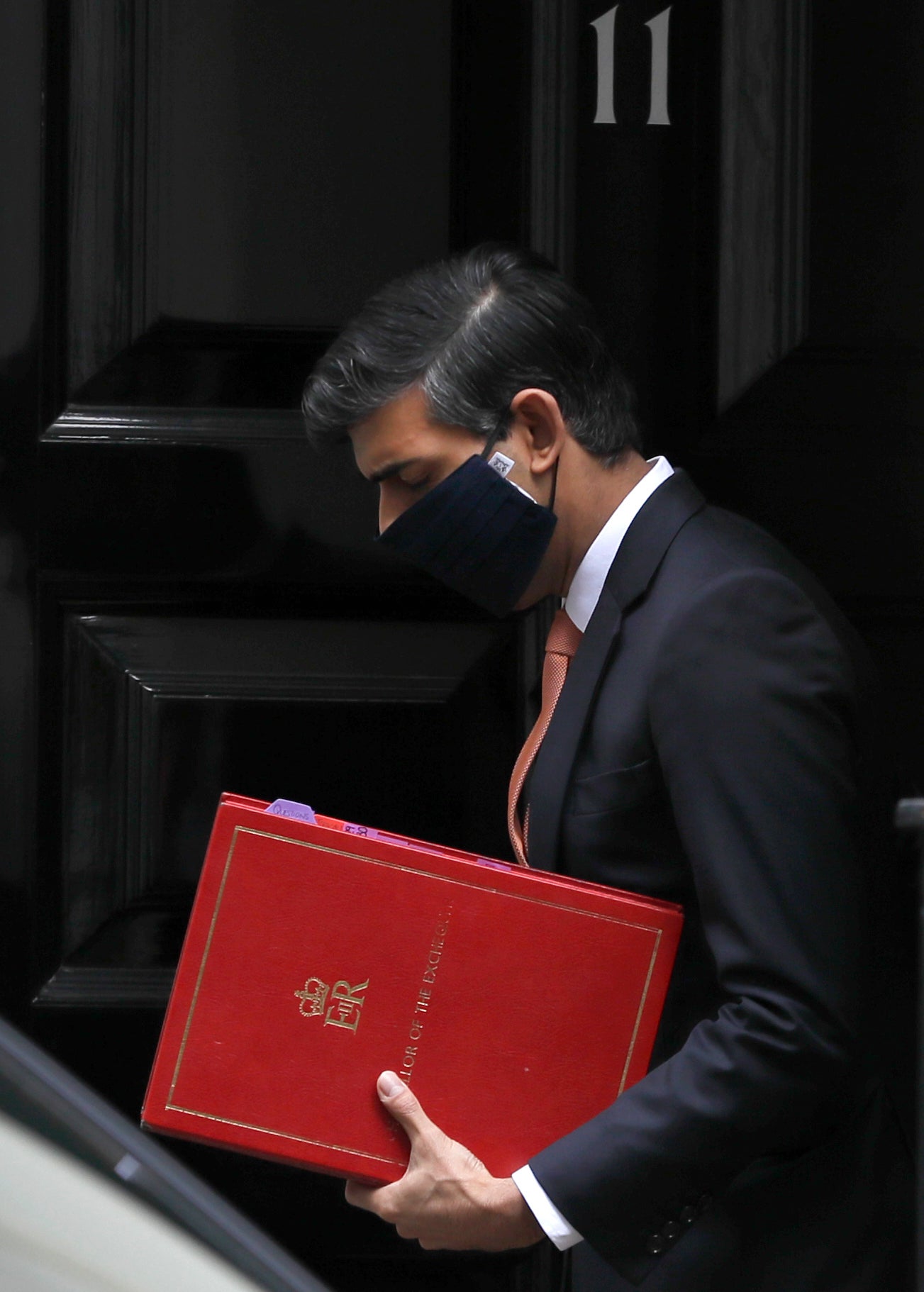

UK government borrowing rises to record due to pandemic

U.K. government borrowing rose to the highest level on record in the first half of the financial year as tax revenue fell and authorities spent billions of pounds to prop up an economy ravaged by the coronavirus pandemic

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The U.K. government's borrowing rose to the highest level on record in the first half of the financial year as tax revenue fell and authorities spent billions of pounds to prop up an economy ravaged by the coronavirus pandemic

The Office for National Statistics said Wednesday that the government borrowed a net 36.1 billion pounds ($47.1 billion) in September, pushing the total for the first six months of the year to 208.5 billion pounds. That’s the highest figure since records began in 1993.

Tax revenue dropped 11.6% from a year earlier in the six months through September. At the same time, support for individuals and businesses to get through the pandemic contributed to a 34% increase in day-to-day spending.

Public sector net debt now stands at 103.5% of the U.K.’s annual economic output, the highest level since 1960, the ONS said.